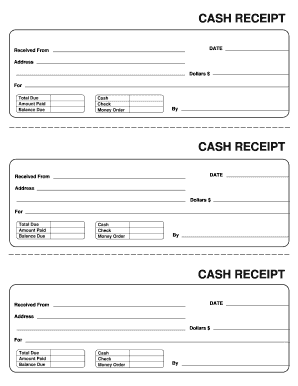

NY Donation Receipt free printable template

Show details

Donation Receipt Any donation valued over $250 must be brought into a Housing Works Thrift Shops to be validated. Item/Description Fair Market Value Donation Total Value This receipt is only for donations

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign housing works donation receipt form

Edit your blank donation receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable printable donation receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donation receipt form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit savers donation receipt form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NY Donation Receipt

How to fill out NY Donation Receipt

01

Start with the name and address of the organization receiving the donation at the top of the receipt.

02

Include the donor's name and address below the organization's details.

03

Specify the date of the donation.

04

Describe the donated items or services, including details like quantity and condition for non-cash donations.

05

State the fair market value of the donated items, if applicable.

06

Include a statement confirming that no goods or services were provided in exchange for the donation, if this is the case.

07

Provide the signature of an authorized representative from the organization.

Who needs NY Donation Receipt?

01

Individuals or organizations who make charitable donations and require documentation for tax purposes.

02

Non-profit organizations that must provide receipts to their donors.

Fill

form

: Try Risk Free

People Also Ask about

How do I prove my donations to my taxes?

Written acknowledgement from the charity is required and must be obtained from the charity on or before the earlier of the date when the tax return is filed or the due date of the tax return (including extensions). The written acknowledgement must contain: Charity name. Amount of cash contribution.

Do I need a donation receipt for tax deduction?

1. Legal requirements: The IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty of $10 per contribution, up to $5,000 for each specific campaign.

How much should I put on a donation receipt?

Donors are responsible for obtaining a written acknowledgment from a charity for any single contribution of $250 or more before the donors can claim a charitable contribution on their federal income tax returns.

What is a safe amount to claim for charitable donations?

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply.

What is a common donation amount?

What is the Average Donation for Each Income Range? Income Range (Adjusted Gross Income)Average Charitable Donation$50,000 to $99,999$3,296$100,000 to $199,999$4,245$200,000 to $249,999$5,472$250,000 or more$21,2643 more rows • Feb 10, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY Donation Receipt for eSignature?

To distribute your NY Donation Receipt, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get NY Donation Receipt?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific NY Donation Receipt and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the NY Donation Receipt in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NY Donation Receipt and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is NY Donation Receipt?

The NY Donation Receipt is a document given to donors in New York State that acknowledges the receipt of donations made to charitable organizations.

Who is required to file NY Donation Receipt?

Nonprofit organizations that receive donations and want to provide donors with proof for tax purposes are required to issue NY Donation Receipts.

How to fill out NY Donation Receipt?

To fill out the NY Donation Receipt, include the organization's name, address, and Tax ID number, the donor's name and address, the date of the donation, a description of the donated property, and the amount donated.

What is the purpose of NY Donation Receipt?

The purpose of the NY Donation Receipt is to provide donors with evidence of their contributions for tax deduction purposes and to ensure transparency in charitable donations.

What information must be reported on NY Donation Receipt?

The NY Donation Receipt must report the date of the donation, the donor's name and address, a detailed description of the donated property, the fair market value of the donation, and whether any goods or services were provided in exchange for the contribution.

Fill out your NY Donation Receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Donation Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.