Goodwill E201 2011 free printable template

Show details

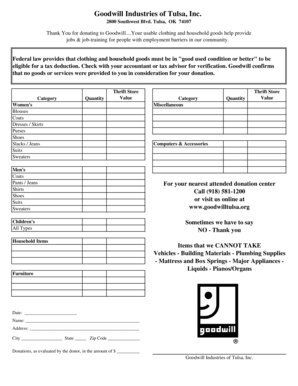

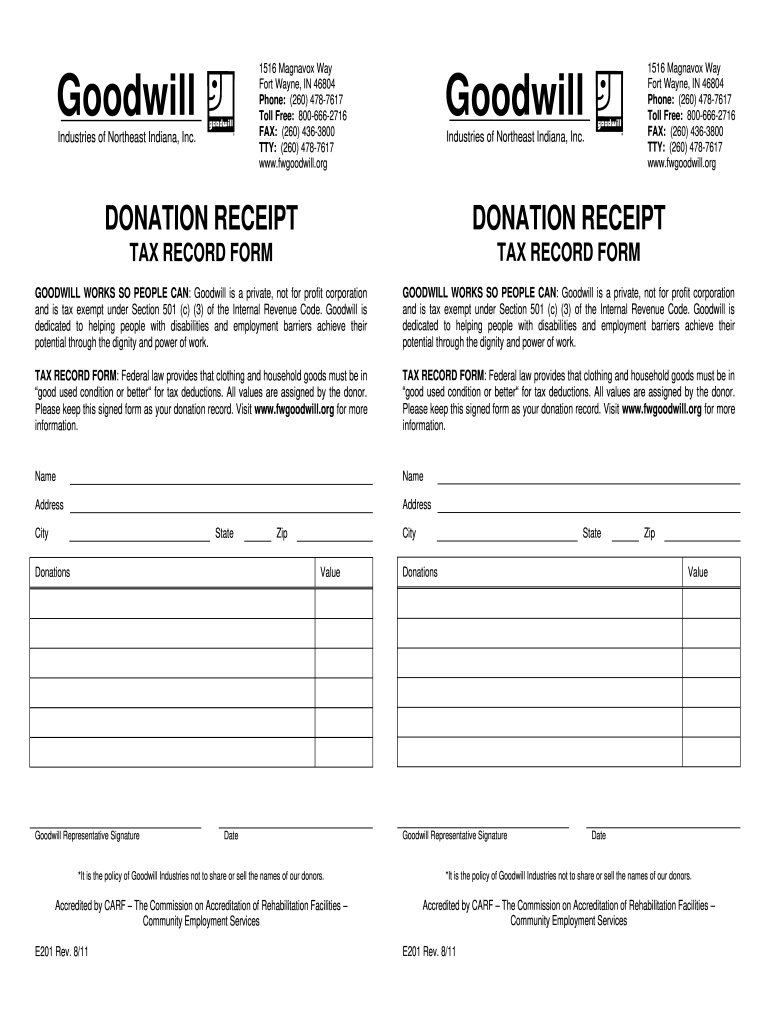

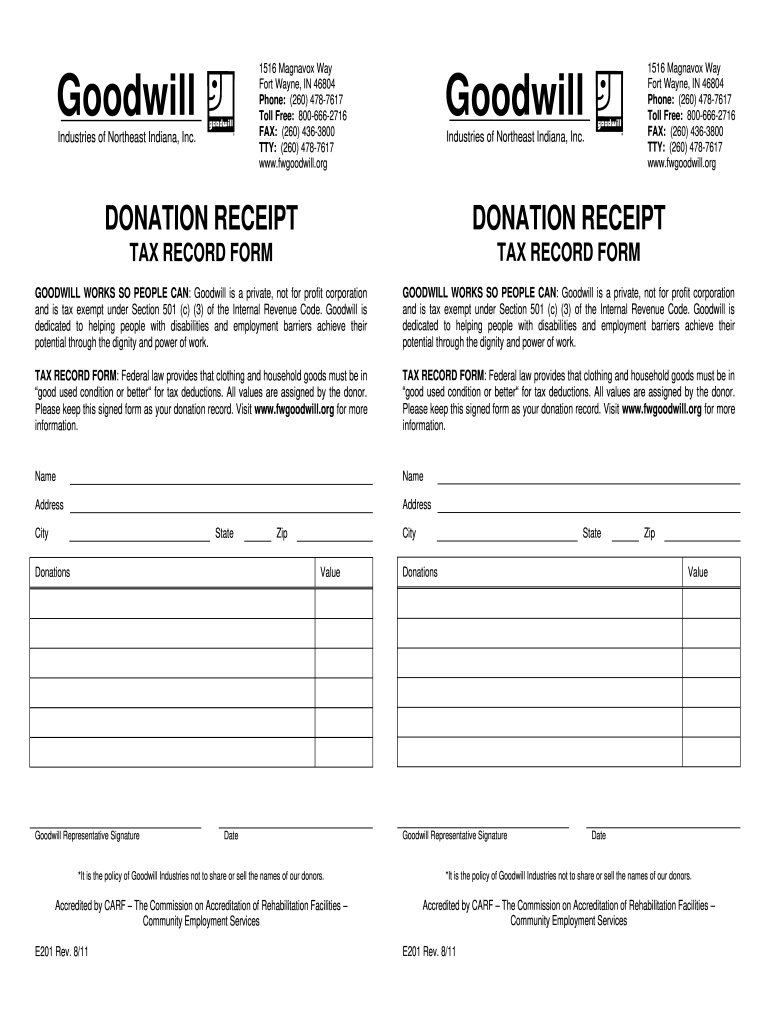

Fwgoodwill.org Goodwill Industries of Northeast Indiana Inc. DONATION RECEIPT TAX RECORD FORM GOODWILL WORKS SO PEOPLE CAN Goodwill is a private not for profit corporation and is tax exempt under Section 501 c 3 of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work. good used condition or better for tax deductions. All values are assigned by the donor. Please keep this...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Goodwill E201

Edit your Goodwill E201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Goodwill E201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Goodwill E201 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Goodwill E201. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Goodwill E201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Goodwill E201

How to fill out Goodwill E201

01

Gather all necessary information related to the goods and services being donated.

02

Clearly list each item being donated in the designated section of the form.

03

Provide accurate descriptions for each item to assist with valuation.

04

Include the date of the donation.

05

Review the form for completeness and ensure all required signatures are obtained.

06

Submit the Goodwill E201 form to the appropriate Goodwill organization.

Who needs Goodwill E201?

01

Individuals or organizations looking to donate items to Goodwill for tax purposes.

02

Businesses that wish to provide donations for community support and receive a receipt.

03

Anyone seeking assistance from Goodwill's services and requiring documentation of their donations.

Fill

form

: Try Risk Free

People Also Ask about

How do I record goodwill donations on my taxes?

Record your donations on the Schedule A of IRS Form 1040. This form is used for itemized deductions and includes all charitable donations throughout the year.

How do I show donations on my taxes?

To claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing Schedule A of IRS Form 1040.

How do you write an in-kind donation receipt?

In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received. Cash donation receipt. A cash donation receipt provides written documentation of a cash gift.

How much can you write off in donated goods?

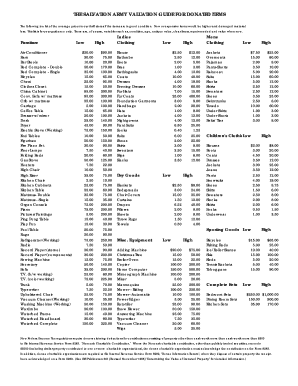

How to claim tax deductible donations on your tax return Filing statusStandard deduction 2022Standard deduction 2023Single$12,950.$13,850.Married, filing jointly$25,900.$27,700.Married, filing separately$12,950.$13,850.Head of household$19,400.$20,800. Apr 6, 2023

Why do people get receipts from Goodwill?

The Goodwill donation receipt is used to claim tax deductions for clothing and household property itemized on your taxes. You can use your tax deduction from giving charity to get money back on: Sales taxes. You have the option of deducting sales taxes or state income taxes from your federal income tax.

How much can you write off goodwill?

ing to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them. Value usually depends on the condition of the item.

What does the IRS allow for clothing donations?

You can't take an income tax charitable contribution deduction for an item of clothing unless it is in good used condition or better.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Goodwill E201 online?

Filling out and eSigning Goodwill E201 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in Goodwill E201 without leaving Chrome?

Goodwill E201 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the Goodwill E201 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Goodwill E201 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is Goodwill E201?

Goodwill E201 is a form used to report goodwill and other intangible assets that a business has acquired during mergers, acquisitions, or other transactions.

Who is required to file Goodwill E201?

Businesses involved in mergers or acquisitions that result in the recognition of goodwill and intangible assets are required to file Goodwill E201.

How to fill out Goodwill E201?

To fill out Goodwill E201, businesses must provide details about the goodwill recognized, the acquisition date, and any relevant financial data related to the assets acquired.

What is the purpose of Goodwill E201?

The purpose of Goodwill E201 is to ensure that businesses properly disclose and account for goodwill and intangible assets on their financial statements to maintain transparency.

What information must be reported on Goodwill E201?

Goodwill E201 must report information such as the amount of goodwill recognized, the acquisition's nature, the date of acquisition, and any relevant adjustments made to the reported goodwill.

Fill out your Goodwill E201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Goodwill e201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.