Get the free KANSAS PARTNERSHIP or S CORPORATION INCOME - ksrevenue

Show details

K-120S 2013 155013 KANSAS PARTNERSHIP or S CORPORATION INCOME (Rev. 7/13) DO NOT STAPLE For the taxable year beginning 2 0 1 3 ; ending Name C. Business Activity Code (NAILS) Employer's Identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kansas partnership or s

Edit your kansas partnership or s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas partnership or s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas partnership or s online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit kansas partnership or s. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kansas partnership or s

How to Fill Out Kansas Partnership or S?

01

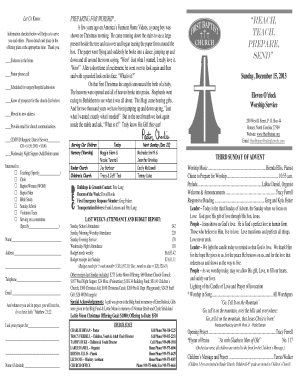

Obtain the necessary forms: To fill out a Kansas Partnership or S Corporation, start by obtaining the appropriate forms. You can download the forms from the Kansas Department of Revenue website or request them by mail.

02

Provide general information: Begin by entering the general information requested on the form, such as the entity name, business address, federal employer identification number (EIN), and the date the entity was formed.

03

Determine the type of entity: Indicate whether you are filling out the form for a Kansas Partnership or an S Corporation. This will vary depending on how you have structured your business.

04

Complete the ownership details: Provide the names, addresses, and social security numbers or EINs of all partners or shareholders involved in the entity. Indicate their ownership percentages or shares.

05

Report income, deductions, and credits: Fill in the appropriate sections to report the income, deductions, and credits of the partnership or S Corporation. This includes details about revenues, expenses, assets, liabilities, and other relevant financial information.

06

Attach additional schedules: If necessary, attach any additional schedules or forms required to provide a complete picture of the financial activities of the entity. This may include schedules for rental income, capital gains, or foreign income, among others.

07

Double-check the information: Before submitting your form, carefully review all the information you provided to ensure accuracy and completeness. Errors or omissions can lead to delays or penalties.

08

Sign and submit the form: Once you are satisfied with the information provided, make sure to sign the form, either as a responsible person or on behalf of the entity. Submit the completed form and any required supporting documentation to the Kansas Department of Revenue by the specified deadline.

Who needs Kansas Partnership or S?

01

Small business owners: Kansas Partnership or S Corporation forms are needed by small business owners who have chosen to organize their business as a partnership or an S Corporation. This includes businesses with multiple owners or shareholders.

02

Businesses looking for pass-through taxation: Partnerships and S Corporations are both pass-through entities, meaning the business itself does not pay taxes, but the income or losses flow through to the owners' personal tax returns. Therefore, those seeking pass-through taxation may choose to use the Kansas Partnership or S Corporation forms.

03

Entities operating in Kansas: The Kansas Partnership or S Corporation forms are specifically required for entities operating in the state of Kansas. If your business is located in Kansas or conducts business activities within the state, you will need to fill out these forms to comply with state tax regulations.

Remember, it is always advisable to consult with a qualified tax professional or seek guidance from the Kansas Department of Revenue for any specific questions or concerns related to filling out the Kansas Partnership or S Corporation forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kansas partnership or s?

Kansas partnership or S refers to the tax form used by partnerships and S corporations in Kansas to report their income, deductions, and credits to the state.

Who is required to file kansas partnership or s?

Partnerships and S corporations in Kansas are required to file the Kansas partnership or S form.

How to fill out kansas partnership or s?

To fill out the Kansas partnership or S form, businesses must provide information about their income, expenses, deductions, and credits for the tax year.

What is the purpose of kansas partnership or s?

The purpose of the Kansas partnership or S form is to report the income, deductions, and credits of partnerships and S corporations operating in Kansas.

What information must be reported on kansas partnership or s?

Partnerships and S corporations must report their income, deductions, credits, and any other relevant financial information on the Kansas partnership or S form.

How can I edit kansas partnership or s on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing kansas partnership or s, you can start right away.

Can I edit kansas partnership or s on an iOS device?

You certainly can. You can quickly edit, distribute, and sign kansas partnership or s on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete kansas partnership or s on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your kansas partnership or s. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your kansas partnership or s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Partnership Or S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.