CA CW 8A 2013 free printable template

Show details

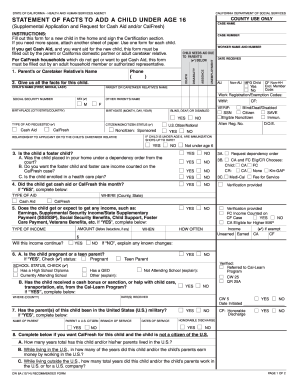

STATE OF CALIFORNIA HEALTH AND HUMAN SERVICES AGENCY CALIFORNIA DEPARTMENT OF SOCIAL SERVICES COUNTY USE ONLY STATEMENT OF FACTS TO ADD A CHILD UNDER AGE 16 CASE NAME (Supplemental Application and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CW 8A

Edit your CA CW 8A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CW 8A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CW 8A online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CW 8A. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CW 8A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CW 8A

How to fill out CA CW 8A

01

Gather necessary personal information such as your name, address, and Social Security number.

02

Prepare your California tax information including income, deductions, and credits.

03

Locate the CA CW 8A form, which is available online or at tax preparation offices.

04

Begin filling out the form by entering your personal information in the designated fields.

05

Follow the instructions for reporting any income or adjustments as required on the form.

06

Review your information for accuracy to ensure there are no mistakes.

07

Sign and date the form once completed, then submit it to the appropriate state agency.

Who needs CA CW 8A?

01

Individuals who are required to report their California tax information.

02

Taxpayers applying for California tax credits or refunds.

03

Residents who need to declare income and deductions for state tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How much can you make and still get CalWORKs?

Your family can only get CalWORKs if it has $10,888 or less in resources ($16,333 if the family includes someone with a disability or someone 60 or over). CalWORKs does not count some things as resources: Your home. Household goods (like furniture or appliances)

How much does welfare pay per child in California?

In California the average amount of benefits per person is approximately $70 per month. The average amount of benefits per household is approximately $189 per month.

What is a CW8 form?

(Supplemental Application for CalFresh and Request for Cash Aid) INSTRUCTIONS: Fill out this form to tell us about a new person in the home. If you need more space to answer the questions, attach another sheet of paper. Fill in the answers for all the questions about the benefits you are asking for.

How long does it take to get approved for CalWORKs?

How long does it take to get CalWORKs benefits? CalWORKs applications must be approved or denied within 45 days of submission, and the county must set up an intake appointment within seven days of receiving your application.

Can you work and still get CalWORKs?

You can work and still get CalWORKs cash aid as long as you are low income and remain eligible. When you add your earnings to your cash aid, you will have more $$$ for your family. Work also: Develops your job skills, and helps you get a better job.

How is income calculated for CalWORKs?

CalWORKs regulations provide for a gross income limit which is determined by subtracting $450 from the earned income of each employed person, then adding all remaining earned and unearned income to determine the gross income for family.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA CW 8A in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your CA CW 8A along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit CA CW 8A from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CA CW 8A, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit CA CW 8A on an Android device?

The pdfFiller app for Android allows you to edit PDF files like CA CW 8A. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is CA CW 8A?

CA CW 8A is a form used by individuals and businesses in California to report specific tax-related information to the state.

Who is required to file CA CW 8A?

Individuals or entities that have engaged in certain activities that necessitate the reporting of California withholding credits are required to file CA CW 8A.

How to fill out CA CW 8A?

To fill out CA CW 8A, provide personal identification information, report the total California income tax withheld, and include any relevant credits or adjustments as required by the form instructions.

What is the purpose of CA CW 8A?

The purpose of CA CW 8A is to ensure accurate reporting of withholding credits and to assist in the administration of California tax laws.

What information must be reported on CA CW 8A?

Information that must be reported on CA CW 8A includes the taxpayer's identification details, total California withholding amounts, and any applicable credits or deductions.

Fill out your CA CW 8A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CW 8a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.