DA 5305 2005 free printable template

Show details

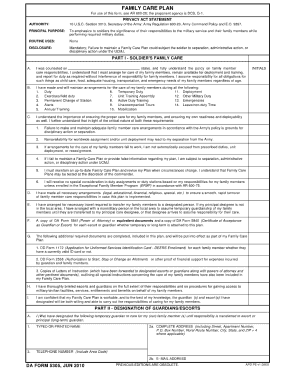

PART II - DESIGNATION OF GUARDIANS/ESCORTS I We have designated the following temporary guardian to care for my our family member s until responsibility is transferred to escort or principal long-term guardian. TYPED OR PRINTED NAME TELEPHONE NUMBER Include Area Code COMPLETE ADDRESS Including Street Apartment Number P. O. Box Number Rural Route Number City State and ZIP 4 where applicable 2b. DA FORM 5305 DEC 2005 2a. E- MAIL ADDRESS DA FORM 5305-R APR 1999 IS OBSOLETE APD V1. O. Box Number...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2005 form family

Edit your 2005 form family form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2005 form family form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2005 form family online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2005 form family. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DA 5305 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2005 form family

How to fill out DA 5305

01

Obtain a copy of the DA Form 5305, which is available from military installations or online.

02

Start by filling in the personal information section, including your name, social security number, and current address.

03

Indicate your branch of service and your component (active duty, reserve, etc.).

04

Complete the sections related to your military status and any other required information specific to your situation.

05

Sign and date the form at the bottom, ensuring that all information is accurate.

06

Submit the completed form to the appropriate personnel office or designated authority.

Who needs DA 5305?

01

Active duty military personnel who are applying for financial assistance or requesting certain benefits.

02

Reservists and veterans who require specific documentation or forms related to their service.

03

Family members or dependents of service members seeking eligibility for specific programs related to military services.

Fill

form

: Try Risk Free

People Also Ask about

What does a tax return form?

A tax return is a form or forms filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

What is the 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Are there 3 types of tax return forms?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS.

What is 1040 vs 1099?

Form 1099: The Big Difference. The key difference between these forms is that Form 1040 calculates your tax or refund. It includes multiple details about your personal tax situation. Forms 1099 report only one source of income.

What is a 1040 vs W-2?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

How do you calculate your tax return?

Where to find income tax on 1040 IRS Form 1040: Subtract line 46 from line 56 and enter the total. IRS Form 1040A: Subtract line 36 from line 28 and enter the total. IRS Form 1040EZ: Use Line 10.

When can I expect my refund 2022?

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return.

What is a tax return and when is it due?

Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15.

Do I need to mail my w2 with my tax return?

You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Use Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-File Return to submit any paper documents that need to be sent after your return has been accepted electronically.

What forms do I need to mail in to the IRS with 1040?

n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.

What supporting documents do I need to mail in my tax return?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

What documents do I need to mail with my tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 2005 form family electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 2005 form family.

Can I create an electronic signature for signing my 2005 form family in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 2005 form family right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete 2005 form family on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 2005 form family by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is DA 5305?

DA 5305 is a form used by the U.S. Army for individuals to request permission to enroll in the Army Tuition Assistance Program.

Who is required to file DA 5305?

Military personnel who wish to apply for tuition assistance for education programs are required to file DA 5305.

How to fill out DA 5305?

To fill out DA 5305, individuals should provide personal information, details about the educational institution, course information, and the amount of funding requested, ensuring accuracy in all fields.

What is the purpose of DA 5305?

The purpose of DA 5305 is to document a service member's request for tuition assistance funding and to ensure compliance with Army regulations regarding educational benefits.

What information must be reported on DA 5305?

The information that must be reported on DA 5305 includes the service member's name, rank, unit, details of the educational program, cost of the courses, and any previous tuition assistance received.

Fill out your 2005 form family online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2005 Form Family is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.