Get the free dor mo gov

Show details

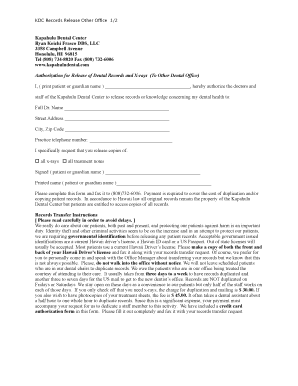

The Employers Withholding Tax Return

Correction (Form MO941C) is no longer available.

If you wish to amend your employer withholding

tax return, please use the Employers Return of

Income Taxes Withheld

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dor mo gov

Edit your dor mo gov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dor mo gov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dor mo gov online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dor mo gov. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dor mo gov

How to fill out dor mo gov:

01

Visit the official website of the Missouri Department of Revenue (DOR) by typing "dor mo gov" in your web browser's address bar.

02

Once on the website, navigate to the appropriate section or page that relates to the service or task you need to complete. The website is designed to provide information and forms for various services offered by the DOR.

03

Read the instructions carefully to ensure you understand the requirements and gather any necessary documents or information that may be needed to complete the process.

04

Fill out the required forms or online applications accurately and completely. Double-check the information to avoid any mistakes or errors.

05

If applicable, submit any supporting documents or additional information as requested by the DOR.

06

Review the completed form or application to ensure all details are correct and nothing is missing. Make any necessary corrections before submission.

07

Once you are confident that everything is in order, submit the form or application as instructed on the website. This process may involve clicking on a button to submit it electronically or printing and mailing the form to the designated address.

08

After submission, it is advisable to keep a copy of the completed form or application for your records.

09

If required, make any necessary payments for the services requested, following the provided instructions on the website.

Who needs dor mo gov?

01

Missouri residents who need to renew their driver's license or obtain a new driver's license.

02

Individuals or businesses in Missouri responsible for paying taxes, including income tax, sales tax, or business taxes.

03

Anyone who needs to register their vehicles or obtain vehicle-related services such as title transfers or obtaining license plates.

04

Missouri residents who need to apply for various permits, such as fishing or hunting licenses.

05

Individuals or businesses in Missouri who require professional licenses or certifications.

06

Those seeking information or assistance regarding state taxes, refunds, or tax-related issues in Missouri.

07

Employers in Missouri who need to enroll in the state's withholding tax program or report wages for their employees.

08

Individuals or businesses involved in the process of purchasing or selling real estate in Missouri may require services from the DOR.

09

Missouri residents looking for resources or information related to motor vehicle inspections, emissions testing, or vehicle safety programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get dor mo gov?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the dor mo gov in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I edit dor mo gov on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing dor mo gov, you need to install and log in to the app.

Can I edit dor mo gov on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as dor mo gov. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your dor mo gov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dor Mo Gov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.