Get the free 2013 mi cf 1065 form - cityofjackson

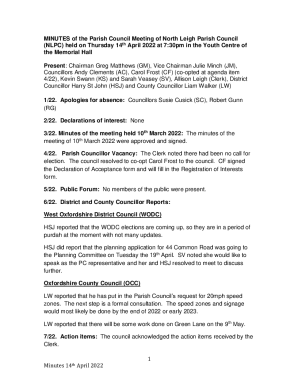

Show details

2013 CF-1065 PARTNERSHIP COMMON FORM FINAL VERSION FORM CF-1065 PARTNERSHIP COMMON FORM AND SPECIFICATIONS PACKET FINAL VERSION November 12 2013 This document contains the final version of the forms and specifications authorized by the Michigan cities of Albion Battle Creek Big Rapids Flint Grand Rapids Grayling Hamtramck Highland Park Ionia Jackson Lansing Lapeer Muskegon Muskegon Heights Pontiac Portland Port Huron Saginaw Springfield and Walker levying a city income tax and accepting city...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 mi cf 1065

Edit your 2013 mi cf 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 mi cf 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 mi cf 1065 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2013 mi cf 1065. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 mi cf 1065

How to fill out 2013 MI CF 1065:

01

Gather all relevant financial information for the year 2013, including income, deductions, and credits.

02

Start by completing the general information section of the form, including the partnership's name, address, Employer Identification Number (EIN), and accounting method.

03

Proceed to Part I - Income, where you'll report the partnership's total income and deductions. Follow the instructions provided to accurately report each item and ensure that all necessary schedules are attached.

04

Move on to Part II - Balance Sheets, where you'll provide details on the partnership's assets, liabilities, and capital accounts. Fill in the required information for each item based on the partnership's financial records.

05

Next, complete Part III - Analysis of Net Income (Loss) if the partnership has multiple activities or foreign transactions. It may require additional schedules or forms to be attached, depending on the complexity of the partnership's activities.

06

If applicable, fill out Part IV - Supplemental Information, providing details on any additional information or disclosures that should be included with the return.

07

Review the completed form for accuracy, ensuring that all required fields have been filled and all necessary schedules have been attached.

Who needs 2013 MI CF 1065:

01

Any partnership that operated during the year 2013 in the state of Michigan needs to file the 2013 MI CF 1065. A partnership is generally defined as an association of two or more individuals or entities engaged in a trade or business together, sharing profits and losses.

02

This form is required to report the partnership's income, deductions, and credits to the Michigan Department of Treasury. It helps determine the partnership's tax liability and allows for the proper allocation of income and expenses among partners.

03

Partnerships subject to Michigan income tax, regardless of whether they had any taxable income, must file the 2013 MI CF 1065. Failing to file or filing an incomplete or incorrect form can result in penalties and interest imposed by the state.

04

It is important to consult with a tax professional or refer to the instructions provided by the Michigan Department of Treasury for specific guidance on who needs to file the 2013 MI CF 1065 form and any associated requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2013 mi cf 1065 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2013 mi cf 1065. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find 2013 mi cf 1065?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 2013 mi cf 1065 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit 2013 mi cf 1065 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2013 mi cf 1065.

What is mi cf 1065 form?

MI CF 1065 form is a Michigan Partnership Income Tax Return form.

Who is required to file mi cf 1065 form?

Partnerships with business activities in Michigan are required to file MI CF 1065 form.

How to fill out mi cf 1065 form?

MI CF 1065 form can be filled out online or through mail by providing relevant business and financial information.

What is the purpose of mi cf 1065 form?

The purpose of MI CF 1065 form is to report partnership income, deductions, credits, and taxes.

What information must be reported on mi cf 1065 form?

Partnership income, deductions, credits, tax payments, and other relevant financial information must be reported on MI CF 1065 form.

Fill out your 2013 mi cf 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Mi Cf 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.