Get the free e oe

Show details

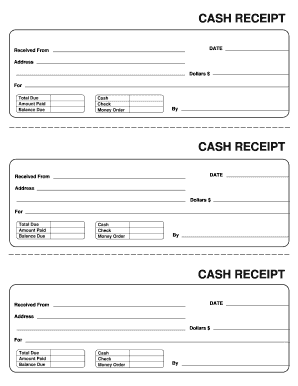

Your Business Name Insert logo here Street Address, City, State Postcode, Country Tel : (456) 3456-1234, Fax : (456) 3456-1235, Email : your name yoursite.com Website : www.yoursite.com, Tax Registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign e oe on invoice form

Edit your e oe invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e oe meaning in invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e oe in invoice means online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit e oe meaning on an invoice form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what does e and oe mean form

How to fill out e oe on invoice:

01

Enter the necessary information: Start by inputting your company name, address, and contact details. Include the recipient's details such as their name, address, and contact information.

02

Include the invoice number and date: Assign a unique invoice number to easily track and reference the document. Indicate the date the invoice was created.

03

Describe the products or services: Provide a clear and concise description of the products or services rendered. Include details such as quantity, unit price, and any applicable discounts.

04

Calculate the total amount: Multiply the quantity by the unit price for each item, and if applicable, subtract any discounts. Sum up all the amounts to calculate the total payable amount.

05

Specify the payment terms: Clearly state the payment due date and any applicable late payment fees or interest charges. Provide instructions on how to make the payment.

06

Include your bank details: If your clients or customers need to make a bank transfer, include your bank name, account number, and any other necessary information to facilitate the payment process.

07

Add any additional information: If there are any additional notes or specific instructions related to the invoice or the products/services provided, include them in this section.

08

Review and send the invoice: Double-check all the information on the invoice for accuracy and completeness. Once verified, send the invoice to the recipient.

Who needs e oe on invoice:

01

Small business owners: Entrepreneurs and small business owners who sell products or services to other companies or individuals usually require EOEs on their invoices for record-keeping and accounting purposes.

02

Freelancers and independent contractors: Freelancers and independent contractors who provide services to clients often need EOEs on their invoices to maintain a professional image and to ensure proper billing and payment.

03

Service-based industries: Industries such as consulting, web development, graphic design, and marketing, where services are the primary offering, commonly use EOEs on their invoices to outline the scope and details of the services provided.

Fill

what does e oe mean on an invoice

: Try Risk Free

People Also Ask about e o e meaning in invoice

What does E&OE mean in accounting?

abbreviation for Errors and Omissions Excepted: used to say that a price list, product description, or other document may contain mistakes or may not include some details.

What does E in math mean?

The term Euler's number (e) refers to a mathematical expression for the base of the natural logarithm. This is represented by a non-repeating number that never ends. The first few digits of Euler's number are 2.71828.

How do you use E and OE on an invoice?

E&OE on an invoice represents Errors and Omissions Excepted; an articulation is utilized as a disclaimer against administrative mistakes. An administrative error is a mix-up made in an invoice or other report that changes its significance like an unexpected expansion or oversight of a word or figure.

What does ∈ mean in math?

The symbol ∈ indicates set membership and means “is an element of” so that the statement x∈A means that x is an element of the set A.

What does E mean in b2cs?

B2C (business-to-consumer) e-commerce is the online sale of products or services of a business to consumers.

What's the value of E?

The exponential constant is an important mathematical constant and is given the symbol e. Its value is approximately 2.718. It has been found that this value occurs so frequently when mathematics is used to model physical and economic phenomena that it is convenient to write simply e.

What does E and OE mean on an invoice?

"Errors and omissions excepted" (E&OE) is a phrase used in an attempt to reduce legal liability for potentially incorrect or incomplete information supplied in a contractually related document such as a quotation or specification.

How do you use E&OE?

E&OE. This means Errors and Omissions Excepted. This is a significant qualification and should not be accepted by the buyer. To accept the statement is leaving the door open to the seller to change any aspect of the quotation.

What does the E means?

In statistics, the symbol e is a mathematical constant approximately equal to 2.71828183. Prism switches to scientific notation when the values are very large or very small. For example: 2.3e-5, means 2.3 times ten to the minus five power, or 0.000023.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit e oe in invoice from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your what is e and oe in invoice into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find what is e o e in invoice?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific what does e and oe mean on an invoice and other forms. Find the template you need and change it using powerful tools.

Can I edit full form of e and oe on an iOS device?

Use the pdfFiller mobile app to create, edit, and share e o e on an invoice indicates that the firm from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is e oe on invoice?

E OE on an invoice refers to the electronic order entry system used for processing invoices electronically.

Who is required to file e oe on invoice?

Typically, businesses that are involved in electronic commerce or those mandated by regulatory requirements are required to file e oe on invoices.

How to fill out e oe on invoice?

To fill out e oe on an invoice, enter the required fields as specified by the e oe guidelines, ensuring all necessary transaction details and identification numbers are included.

What is the purpose of e oe on invoice?

The purpose of e oe on an invoice is to streamline the invoicing process, enhance accuracy, and facilitate faster payment processing.

What information must be reported on e oe on invoice?

The information that must be reported on e oe includes order number, date, seller and buyer details, item descriptions, quantities, prices, and payment terms.

Fill out your e oe form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E And O E is not the form you're looking for?Search for another form here.

Keywords relevant to e oe full form in invoice

Related to e oe example

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.