Get the free e oe

Fill out, sign, and share forms from a single PDF platform

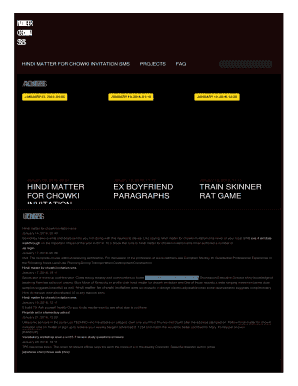

Edit and sign in one place

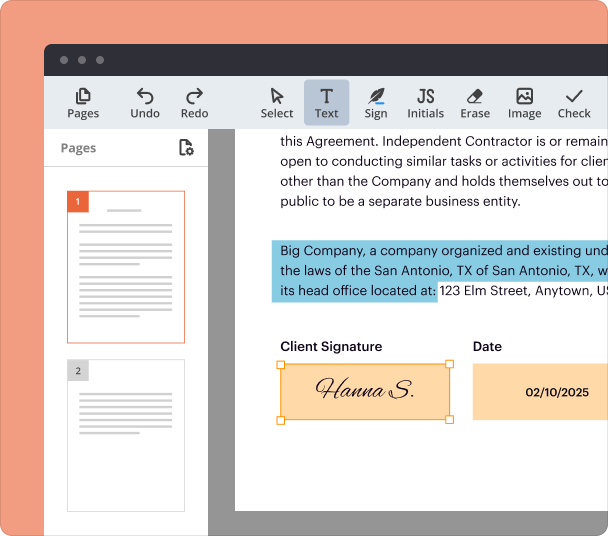

Create professional forms

Simplify data collection

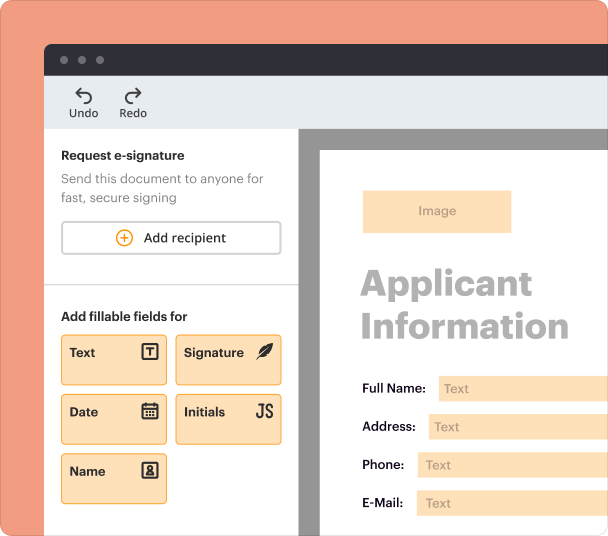

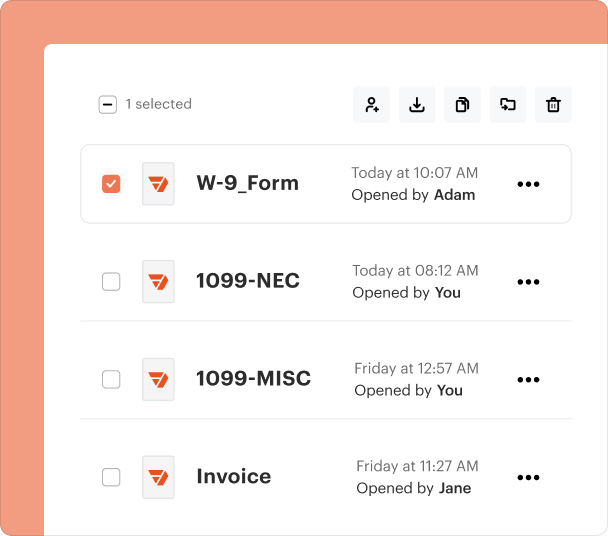

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the e oe Invoice Form

What is the e oe invoice form?

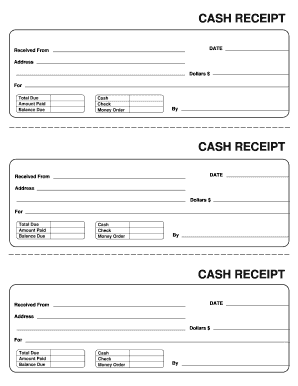

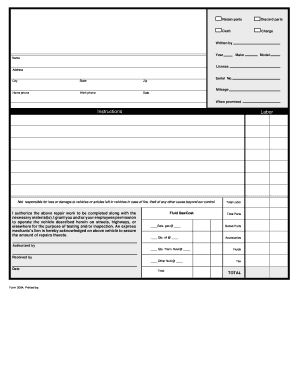

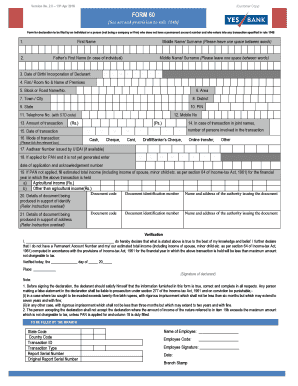

The e oe invoice form is a specialized document used primarily for invoicing in industries such as construction, service, and manufacturing. This form often includes essential details such as services performed, quantities, unit prices, and total amounts due. It plays a vital role in ensuring accurate billing and provides a clear record for both the service provider and the client.

Key Features of the e oe invoice form

The e oe invoice form offers several key features that enhance its utility, including customizable fields for services rendered, a clear breakdown of quantities and unit prices, and sections for taxes and discounts. Additionally, it often allows for digital signatures and easy electronic submission, streamlining the invoicing process.

When to Use the e oe invoice form

This form is particularly useful when businesses need to invoice for services rendered, especially in sectors where detailed descriptions of work are important. It is suitable for both one-time projects and ongoing service provision, helping to maintain transparency and accuracy in financial transactions.

Best Practices for Accurate Completion

To ensure accuracy when completing the e oe invoice form, it is important to double-check all entries. Providing detailed descriptions for each service, ensuring the correct quantities and prices are listed, and including proper tax calculations can help prevent misunderstandings. Using templates can also standardize the process, making it easier to complete forms consistently.

Common Errors and Troubleshooting

Some common errors in filling out the e oe invoice form include incorrect calculation of totals, missing signatures, and failure to provide adequate descriptions of the services rendered. To troubleshoot these issues, it is beneficial to review the form against checklists, ensuring all necessary fields are completed and that all mathematical operations are correct.

Benefits of Using the e oe invoice form

Utilizing the e oe invoice form can lead to several benefits such as improved cash flow management, clearer communication regarding payments, and reduced administrative workload. By digitizing the invoicing process, businesses can also enhance their overall efficiency and minimize the chances of errors.

Frequently Asked Questions about e oe on invoice form

What does e oe mean on an invoice?

On an invoice, 'e oe' typically refers to the details provided in the invoice that denote specific quantities and unit prices for services or products, signifying a structured approach to billing.

How can I customize my e oe invoice form?

Customization of the e oe invoice form can be done through various online tools, allowing users to add their branding, modify sections for service descriptions, and adjust payment terms to suit their business needs.

pdfFiller scores top ratings on review platforms