MN DoR M1 2013 free printable template

Show details

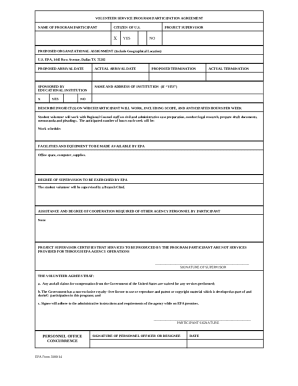

23 24 Minnesota estimated tax and extension Form M13 payments made for 2013. 25 Child and Dependent Care Credit enclose Schedule M1CD. Last name Your first name and initial If joint return spouse s first name initial Place an X If a Foreign Address Current home address street apartment number route Your Social Security number Spouse s Social Security number City 2013 Federal Filing Status place an X in one oval box State 1 Single 4 Head of household State Elections Campaign Fund If you want 5 to...go to help candidates for state offices pay campaign expenses you may each enter the code number for the party of your choice. This will not increase your tax or reduce your refund. 2 Married filing joint 5 Qualifying widow er Zip code filing separate Enter spouse s name and Social Security number here From Your Federal Return for line references see instructions enter the amount of A Wages salaries tips etc. B IRA Pensions and annuities C Unemployment Your Code Spouse s Code D Federal adjusted...gross income If negative number use a minus sign - 1 Federal taxable income from line 43 of federal Form 1040 line 27 of Form 1040A or line 6 of Form 1040EZ. 1 Do not send W-2s. Enclose Schedule M1W to claim Minnesota withholding. Spouse s date of birth Political Party and Code Number Republican. M1 2013 Individual Income Tax 201311 Leave unused boxes blank. Do not use staples on anything you submit. Last name Your first name and initial If joint return spouse s first name initial Place an X If...a Foreign Address Current home address street apartment number route Your Social Security number Spouse s Social Security number City 2013 Federal Filing Status place an X in one oval box State 1 Single 4 Head of household State Elections Campaign Fund If you want 5 to go to help candidates for state offices pay campaign expenses you may each enter the code number for the party of your choice. This will not increase your tax or reduce your refund. 2 Married filing joint 5 Qualifying widow er Zip...code filing separate Enter spouse s name and Social Security number here From Your Federal Return for line references see instructions enter the amount of A Wages salaries tips etc* B IRA Pensions and annuities C Unemployment Your Code Spouse s Code D Federal adjusted gross income If negative number use a minus sign - 1 Federal taxable income from line 43 of federal Form 1040 line 27 of Form 1040A or line 6 of Form 1040EZ. 1 Do not send W-2s. Enclose Schedule M1W to claim Minnesota withholding....Spouse s date of birth Political Party and Code Number Republican. 11 Grassroots. 14 Democratic Farmer-Labor 12 Libertarian. 16 Independent. 13 General Campaign Fund. 99 Your date of birth mmddyyyy Place an X if a new address t 2 State income tax or sales tax addition* If you itemized deductions on federal Form 1040 complete the worksheet in the instructions. 2 3 Other additions to income including disallowed standard deduction for married/ widowed taxpayers itemized deductions personal...exemptions and non-Minnesota bond interest see instructions enclose Schedule M1M.

pdfFiller is not affiliated with any government organization

Instructions and Help about MN DoR M1

How to edit MN DoR M1

How to fill out MN DoR M1

Instructions and Help about MN DoR M1

How to edit MN DoR M1

To edit the MN DoR M1 form, first obtain a digital copy of the form in PDF format. You can use pdfFiller to import the file and utilize its features to add or modify text fields. After making necessary changes, ensure to save the updated document for your records.

How to fill out MN DoR M1

Filling out the MN DoR M1 requires accurate detail about your tax situation. Begin by gathering financial documents, such as income statements and receipts. Use pdfFiller to enter the required information directly into each section of the form. Double-check for accuracy before submission.

About MN DoR M1 2013 previous version

What is MN DoR M1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MN DoR M1 2013 previous version

What is MN DoR M1?

MN DoR M1 is a tax form used by residents of Minnesota to report their individual income tax liability. This form acts as a summary of income and deductions for the tax year reported. It is essential for compliance with state tax laws.

What is the purpose of this form?

The purpose of the MN DoR M1 form is to calculate the amount of state income tax owed by individuals. It helps taxpayers summarize their income, claim deductions, and determine tax credits applicable to their situation. Proper completion is crucial for accurate tax assessment.

Who needs the form?

Individuals residing in Minnesota who have earned income during the tax year must file the MN DoR M1. This includes employees, self-employed individuals, and those receiving income from various sources. Meeting the filing requirement is essential for all eligible taxpayers.

When am I exempt from filling out this form?

You may be exempt from filing the MN DoR M1 if you meet specific criteria, such as having minimal income below the filing threshold or if you are claimed as a dependent on someone else’s tax return. Additionally, certain governmental or qualified tax-exempt income sources may not require filing.

Components of the form

The MN DoR M1 form consists of several key components, including personal identification information, income sections, deductions, and tax credits. Each part must be completed accurately to ensure the correct calculation of tax owed or refunds due. Pay attention to specific sections that pertain to your financial situation.

What are the penalties for not issuing the form?

Failure to file the MN DoR M1 can result in penalties such as fines, interest on unpaid taxes, and potential legal actions. The state of Minnesota imposes these penalties to encourage compliance and timely submission of tax forms. It's crucial to adhere to filing deadlines to avoid these consequences.

What information do you need when you file the form?

When filing the MN DoR M1, you need detailed information about your income, including W-2 forms, 1099 forms for self-employed income, and other documentation of earnings. Additionally, information about deductions, such as student loan interest or property taxes, is required to accurately complete the form.

Is the form accompanied by other forms?

Typically, the MN DoR M1 is accompanied by additional forms, depending on your specific tax situation. For instance, if you are claiming certain deductions or credits, you may need to file additional schedules or forms. Ensure that you review the requirements based on your tax circumstances.

Where do I send the form?

The completed MN DoR M1 form should be sent to the Minnesota Department of Revenue. The specific mailing address may depend on your location or whether you are filing electronically. Check the Minnesota Department of Revenue’s official website for the latest submission guidelines and addresses.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

The whole process has worked out really well. PDFfiller was relatively easy to use. I'd like to attend a session but can't say now when I can do it.

excellent, but we need the form last update

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.