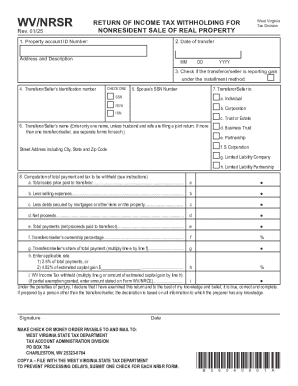

WV DoR NRSR 2012 free printable template

Show details

He income tax withheld and reported on line 8 of form wV/nrsr must be claimed as a withholding Income tax payment. When to file unless the transaction is otherwise exempt from the income tax withholding requirement the person responsible for closing must complete form wV/nrsr for each nonresident transferor/seller at closing of sale. WV/nrsr must be claimed as a withholding tax payment. i copy b For transFeror/seller records copy copy c For issuer. He income tax withheld his tax and any...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wv nrsr form

Edit your wv form nrsr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wv nrsr form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit west virginia withholding nonresident sale online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wv nrsr return tax withholding form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV DoR NRSR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wv dor form

How to fill out WV DoR NRSR

01

Obtain the WV DoR NRSR form from the official West Virginia Department of Revenue website or your local DMV.

02

Fill in personal information, including your name, address, and contact details.

03

Provide the vehicle information, such as the make, model, and vehicle identification number (VIN).

04

Indicate the reason for completing the NRSR, such as a title issue or transaction.

05

Review the completed form for accuracy and completeness.

06

Submit the form as instructed, either online or in person at the designated office.

Who needs WV DoR NRSR?

01

Individuals who have lost their vehicle title or require a new title due to various circumstances.

02

Vehicle owners who are applying for a title for a previously unregistered vehicle.

03

Anyone involved in a vehicle transaction that requires the submission of a new title application.

Fill

wv withholding form 2025

: Try Risk Free

People Also Ask about wv tax exempt form

Is West Virginia a no tax state?

West Virginia has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.55 percent. West Virginia's tax system ranks 20th overall on our 2023 State Business Tax Climate Index.

Who pays transfer and recordation taxes in West Virginia?

(a) Every person who delivers, accepts, or presents for recording any document, or in whose behalf any document is delivered, accepted, or presented for recording, is subject to pay for, and in respect to the transaction or any part thereof, a state excise tax upon the privilege of transferring title to real estate at

What is WV Realty Transfer Tax?

West Virginia levies a deed transfer tax (often referred to as an excise tax) on real property. The tax is $1.10 per $1,000. Each county has the authority to establish its own excise tax rate, which the majority do.

What is exempt from transfer tax in WV?

The followings are exempt from the transfer tax: (1) wills; (2) testamentary or inter vivos trusts; (3) deeds of partition; (4) deeds made pursuant to mergers of corporations, limited liability companies, partnerships, and limited partnerships; (5) deeds made pursuant to conversions to limited liability companies; (6)

What is WV sales tax?

Municipal sales and use taxes are reported on the municipal schedules of the return. * The combined rate is the state sales tax rate of 6% plus the municipality's rate of tax.

What is West Virginia real property tax rate?

The median property tax in West Virginia is $464.00 per year for a home worth the median value of $94,500.00. Counties in West Virginia collect an average of 0.49% of a property's assesed fair market value as property tax per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my wv nrw 4 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your west virginia real estate transfer tax and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit west virginia tax forms online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your west virginia non resident income tax filing requirements and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out income tax return on an Android device?

Use the pdfFiller Android app to finish your bugger site pdffiller com site blog pdffiller com and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is WV DoR NRSR?

WV DoR NRSR stands for West Virginia Department of Revenue Nonresident Sales and Use Tax Return. It is a form used by nonresidents to report and pay sales tax on goods purchased in West Virginia.

Who is required to file WV DoR NRSR?

Nonresident individuals, businesses, or entities that purchase items in West Virginia but do not have a permanent residence or physical presence in the state are required to file WV DoR NRSR.

How to fill out WV DoR NRSR?

To fill out the WV DoR NRSR, individuals must provide their personal information, details of the purchases made in West Virginia, the total amount of tax owed, and any relevant exemptions that may apply.

What is the purpose of WV DoR NRSR?

The purpose of WV DoR NRSR is to ensure nonresidents comply with the sales tax regulations of West Virginia by reporting and remitting any applicable taxes on purchases made within the state.

What information must be reported on WV DoR NRSR?

The information that must be reported on WV DoR NRSR includes the buyer's name and address, the seller's details, a description of the purchased items, the sales tax rate applied, and the total amount of sales tax due.

Fill out your WV DoR NRSR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV DoR NRSR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.