Get the free Rental income & expenses worksheet 2011 - Beggin Tipp Lamm LLC

Show details

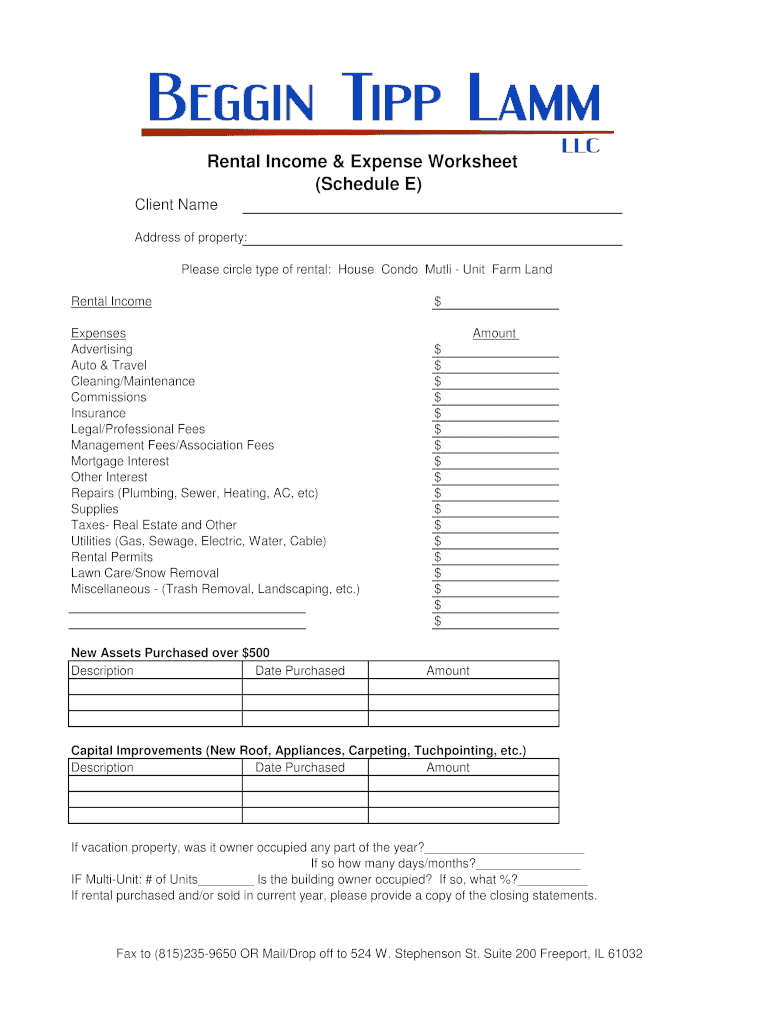

Rental Income & Expense Worksheet (Schedule E) Schedule E) (Client Name Address of property: Please circle type of rental: House Condo Multi — Unit Farm Land Rental Income Expenses Advertising Auto

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental income amp expenses

Edit your rental income amp expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental income amp expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental income amp expenses online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rental income amp expenses. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental income amp expenses

How to fill out rental income & expenses:

01

Gather all necessary documents and information: Before starting to fill out the rental income and expenses, gather your rental property income statements, rental expense receipts, and any other relevant financial documents.

02

Determine the rental income: Calculate the total income generated from your rental property. This may include rental payments, late fees, security deposits, or any other income sources related to your rental property.

03

Record rental expenses: Identify and record all expenses associated with maintaining and managing your rental property. This can include mortgage payments, property taxes, insurance premiums, repairs and maintenance costs, property management fees, advertising expenses, and utilities, among others.

04

Separate personal and rental expenses: Make sure to separate your personal expenses from the rental expenses. Include only the costs directly related to your rental property.

05

Keep track of depreciation: If applicable, calculate and record the depreciation of your rental property. This can be a significant deduction that offsets your taxable rental income.

06

Determine net rental income: Subtract the total rental expenses from the rental income to calculate the net rental income. This will give you an idea of the profitability of your rental property.

07

Report income and expenses on appropriate forms: Depending on your local tax regulations, report your rental income and expenses on the appropriate tax forms such as Schedule E (Form 1040) in the United States.

Who needs rental income & expenses?

01

Landlords: Landlords who own and manage rental properties need to keep track of their rental income and expenses to accurately report their financial data and comply with tax regulations.

02

Property owners: Owners of multiple rental properties or real estate investments also need to maintain accurate records of their rental income and expenses for both financial and tax purposes.

03

Accountants and tax professionals: Accountants and tax professionals rely on rental income and expense documentation provided by landlords and property owners to prepare accurate financial statements and tax returns.

04

Potential investors: Individuals considering investing in rental properties need to gather information about rental income and expenses to analyze the potential profitability and returns of a specific property or real estate market.

05

Financial institutions: Lenders and financial institutions often require rental income and expense documentation to assess the financial health and feasibility of a rental property when considering loan applications.

Overall, anyone involved in the rental property industry, including landlords, property owners, accountants, tax professionals, and potential investors, needs rental income and expense information to make informed financial decisions and comply with legal and tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rental income amp expenses to be eSigned by others?

rental income amp expenses is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in rental income amp expenses?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your rental income amp expenses to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the rental income amp expenses in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your rental income amp expenses and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is rental income amp expenses?

Rental income amp expenses refer to the revenue and costs associated with renting out a property.

Who is required to file rental income amp expenses?

Individuals who earn rental income from properties they own are required to report rental income amp expenses.

How to fill out rental income amp expenses?

To report rental income amp expenses, individuals can use tax forms such as Schedule E (Form 1040).

What is the purpose of rental income amp expenses?

The purpose of reporting rental income amp expenses is to accurately calculate taxable income related to renting out a property.

What information must be reported on rental income amp expenses?

Information such as rental income, expenses related to maintaining the property, and depreciation must be reported on rental income amp expenses.

Fill out your rental income amp expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Income Amp Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.