Get the free The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request

Show details

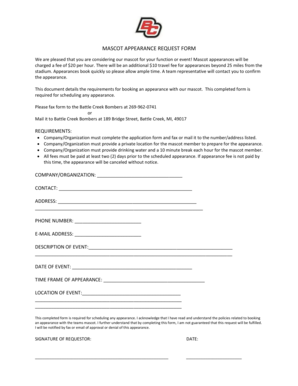

A form used to request a transfer of assets from a 457(b) Deferred Compensation Plan, including personal and former plan information, investment allocations, and participant signature.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form university of georgia

Edit your form university of georgia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form university of georgia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form university of georgia online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form university of georgia. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form university of georgia

How to fill out The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request

01

Obtain the 457(b) Transfer Request form from The University of Georgia's human resources or website.

02

Fill out your personal information in the designated fields, including your full name, Social Security number, and contact information.

03

Indicate the type of transfer you are requesting (e.g., direct transfer, rollover).

04

Provide details of your current 457(b) plan or any other retirement plan from which you are transferring funds.

05

Complete the section regarding the source of funds and any amount to be transferred.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the designated office or individual as specified in the instructions.

Who needs The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request?

01

Employees of The University of Georgia who have a 457(b) deferred compensation plan and wish to transfer their funds to another qualified plan or account.

02

Individuals looking to consolidate their retirement accounts for better management and potential growth.

03

Those who are changing employers and want to move their retirement savings to a new plan.

Fill

form

: Try Risk Free

People Also Ask about

What is a 457 B deferred compensation plan?

An eligible deferred compensation plan under IRC Section 457(b) is an agreement or arrangement (which may be an individual employment agreement) under which the payment of compensation is deferred (whether by salary reduction or by nonelective employer contribution).

How do I transfer my 403b to a 457b?

Steps include: reviewing details of both the 403(b) and 457(b) plans, consulting a financial advisor, initiating the rollover (confirming the 457(b) plan accepts rollovers), executing the transfer (either direct or indirect), and confirming the successful transfer.

What are the disadvantages of a 457 B plan?

Cons of 457(b) plans: Fewer investing options than 401(k)s (Not as common today) Only available to certain employees employed by state or local governments or qualifying nonprofits. Employer contributions count toward the annual limit. Non-governmental 457(b) plans are riskier.

What are the rules for withdrawing from a 457 B?

Flexible withdrawals: Unlike 403(b) and 401(k)s, you can withdraw funds from your 457(b) before age 59½ penalty-free if you're no longer employed by the plan sponsor. But you'll still owe income tax on any withdrawals.

What is the difference between a 401k and a 457 B?

401k is available retirement plan for most companies, including some government, but mostly in private sectors; however, 457b (and 403b) are retirement plans geared towards governmental entities or public sectors (schools, law enforcement, fire/police, city, state, and county, etc.).

What are the disadvantages of a 457 B plan?

Cons of 457(b) plans: Fewer investing options than 401(k)s (Not as common today) Only available to certain employees employed by state or local governments or qualifying nonprofits. Employer contributions count toward the annual limit. Non-governmental 457(b) plans are riskier.

Can I keep my 457b after leaving my job?

You can withdraw all of the traditional 457 balance including investment gains after separation from employment at ANY age. (Still have to pay taxes but no penalty).

How does a 457 deferred compensation plan work?

What Is a 457(b) Plan? A 457(b) plan is a tax-deferred retirement savings plan. Funds are withdrawn from an employee's income without being taxed and are only taxed upon withdrawal, which is typically at retirement, after the funds have had several years to grow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request?

The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request is a formal request submitted by participants to transfer their retirement savings from one eligible 457(b) plan to another. This allows employees to manage their retirement funds effectively when they change employers or wish to consolidate their retirement savings.

Who is required to file The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request?

Any participant of The University of Georgia 457(b) Deferred Compensation Plan who wishes to transfer their funds to another 457(b) plan is required to file the Transfer Request. This includes employees who are leaving the university or those who want to consolidate their retirement accounts.

How to fill out The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request?

To fill out the Transfer Request, participants should provide their personal information including name, contact details, and account number, as well as the information of the receiving plan. They must also specify the amount to be transferred and sign the form to authorize the transaction.

What is the purpose of The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request?

The purpose of the Transfer Request is to facilitate the seamless movement of retirement savings between different 457(b) plans. This ensures that participants can continue to save for retirement without incurring penalties or taxes that may arise from premature withdrawals.

What information must be reported on The University of Georgia 457(b) Deferred Compensation Plan 457(b) Transfer Request?

The information that must be reported includes the participant's name, Social Security number, contact information, details of the current plan, details of the receiving 457(b) plan, the amount to be transferred, and any necessary signatures to authorize the transfer.

Fill out your form university of georgia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form University Of Georgia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.