Get the free Liquidation of assets form

Show details

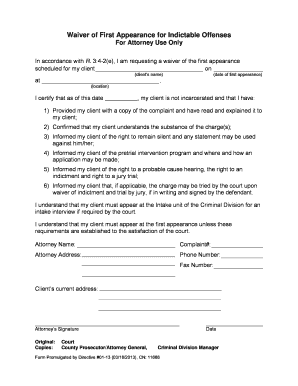

This document facilitates the liquidation of participant accounts and the transfer of assets to Lincoln Financial Group as part of the Lincoln American Legacy Retirement program.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign liquidation of assets form

Edit your liquidation of assets form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liquidation of assets form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit liquidation of assets form online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit liquidation of assets form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out liquidation of assets form

How to fill out Liquidation of assets form

01

Gather all necessary documents related to the assets that are to be liquidated.

02

Obtain the Liquidation of assets form from the relevant authority or website.

03

Fill out the personal information section including your name, contact details, and any identification numbers.

04

List each asset to be liquidated in the designated section, including descriptions and valuations.

05

Specify the reason for liquidation for each asset.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the appropriate office or agency as instructed.

Who needs Liquidation of assets form?

01

Individuals or businesses seeking to sell off their assets in order to pay debts or downsize.

02

Executors of estates managing the liquidation of a deceased person’s assets.

03

Companies undergoing bankruptcy or restructuring that need to liquidate assets.

04

Organizations that need to dispose of surplus or obsolete equipment.

Fill

form

: Try Risk Free

People Also Ask about

Does an LLC need to file form 966?

Limited liability companies (LLCs): By default, LLCs are not required to file Form 966 when they dissolve or liquidate.

Who must file form 7217?

There is no direct Form 966 penalty for non-filing or late filing, but by not properly notifying the IRS of a dissolution or liquidation, it may result in collateral damage and other penalties.

Who is exempt from filing form 966?

Foreign corporations that are not required to file Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, or any other U.S. tax return are generally not required to file Form 966. U.S. shareholders of foreign corporations may be required to report information regarding a corporate dissolution or liquidation.

Does my LLC need to file form 720?

Any entity, whether a sole proprietorship, partnership, corporation, or a limited liability company, dealing in goods or services subject to federal excise taxes must file Form 720. This includes businesses involved in the sale of luxury goods, certain types of equipment, or specific services.

How do I close an LLC with the IRS?

Steps to take to close your business File a final return and related forms. Take care of your employees. Pay the tax you owe. Report payments to contract workers. Cancel your EIN and close your IRS business account. Keep your records.

What is Liquidation of assets?

For tax years beginning in 2024 or later, any partner receiving property subject to Internal Revenue Code (IRC) § 732 from a partnership in both a liquidating and non-liquidating transaction must prepare Form 7217.

Does an LLC need to file a 1099?

LLCs taxed as corporations: If the LLC has elected to be taxed as a corporation, you are not required to file a 1099 form. Payments to LLCs treated as corporations are not reportable since the IRS does not require this information for their corporate tax filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Liquidation of assets form?

The Liquidation of assets form is a document used to formally report the sale or disposal of assets, typically during the winding down of a business or organization.

Who is required to file Liquidation of assets form?

Generally, businesses or organizations that are liquidating their assets or going out of business are required to file a Liquidation of assets form.

How to fill out Liquidation of assets form?

To fill out the Liquidation of assets form, provide detailed information about each asset being liquidated, including descriptions, values, dates of liquidation, and the method of sale or disposal.

What is the purpose of Liquidation of assets form?

The purpose of the Liquidation of assets form is to maintain official records of the assets being liquidated, ensure compliance with legal and financial obligations, and provide transparency to stakeholders.

What information must be reported on Liquidation of assets form?

The information reported on the Liquidation of assets form typically includes asset descriptions, asset values, dates of liquidation, method of disposal, and any associated financial transactions.

Fill out your liquidation of assets form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liquidation Of Assets Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.