Get the free You got this - TaxACT

Show details

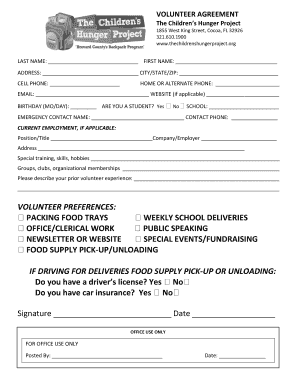

Easy fast free you got this 2013 Tax Year Media Guide Tax ACT Overview Tax ACT Free Federal Edition the most complete free 33? Prepare, print and e-file your federal return free no restrictions! 33?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign you got this

Edit your you got this form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your you got this form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing you got this online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit you got this. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out you got this

How to fill out "You Got This":

01

Start by identifying the purpose of filling out "You Got This." Is it for personal motivation, goal setting, or self-reflection?

02

Begin by writing down your current goals and objectives. This could include career aspirations, personal development goals, or fitness targets.

03

Use positive and empowering language in "You Got This" to reinforce a can-do attitude. For example, instead of saying "I will try to achieve X," phrase it as "I am confident that I can achieve X."

04

Divide your goals into smaller, manageable tasks. This will make them more attainable and help you track your progress along the way.

05

Create a timeline or schedule for each task, outlining when you aim to complete them. This will provide a sense of structure and help you stay organized.

06

Reflect on your strengths and weaknesses. Identify areas where you may need additional support or resources to accomplish your goals.

07

Seek encouragement and support from friends, family, or mentors. Share your "You Got This" document with them, and ask for their input or advice if needed.

08

Regularly review and update your "You Got This" document. Adjust your goals, tasks, or timelines as necessary to adapt to changing circumstances or priorities.

Who needs "You Got This":

01

Individuals facing challenging situations or moments of self-doubt can benefit from "You Got This." It serves as a source of motivation and encouragement.

02

Students and professionals striving to achieve personal or career goals can use "You Got This" as a tool for planning and staying focused.

03

Anyone seeking a positive mindset shift can utilize "You Got This" to boost confidence and belief in their abilities.

04

People in need of self-reflection and self-improvement can use "You Got This" as a guide to set and track their progress towards personal development goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is you got this?

You Got This is a form used to report certain information to the relevant authority.

Who is required to file you got this?

Individuals or entities who meet specific criteria are required to file You Got This.

How to fill out you got this?

You can fill out You Got This by providing the requested information in the designated fields on the form.

What is the purpose of you got this?

The purpose of You Got This is to report necessary information to ensure compliance with certain regulations.

What information must be reported on you got this?

You must report specific details as required by the relevant authority on You Got This.

How can I manage my you got this directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign you got this and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the you got this in Gmail?

Create your eSignature using pdfFiller and then eSign your you got this immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete you got this on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your you got this. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your you got this online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

You Got This is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.