Get the free Direct Deposit (ACH Credit) Authorization Form* - cityoftulsa

Show details

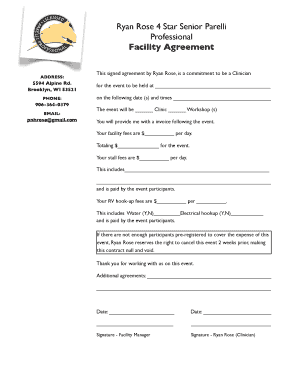

AUTHORIZATION AGREEMENT

FOR ACH CREDIT TRANSACTIONS

Authorization is hereby granted to the City of Tulsa, Oklahoma, hereinafter called City of Tulsa,

by

(Company/Individual Name) to initiate ACH

credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct deposit ach credit

Edit your direct deposit ach credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct deposit ach credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit direct deposit ach credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit direct deposit ach credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct deposit ach credit

How to fill out direct deposit ach credit:

01

Gather necessary information: Before filling out the direct deposit ach credit form, you will need certain details such as your bank's routing number, your account number, and any other required information provided by your employer or the entity issuing the payment.

02

Obtain the direct deposit ach credit form: Typically, this form can be obtained from your employer's human resources department or directly from your bank. If you are unsure where to find it, reach out to your employer or contact your bank for assistance.

03

Provide personal information: Fill out the required personal information section of the form, including your full name, address, and contact details. Ensure that the information you provide is accurate and matches your bank account information.

04

Add bank account details: Enter your bank's routing number and your account number in the designated sections of the form. These numbers are crucial for directing the funds to the correct account and bank.

05

Specify the type of account: Indicate whether your bank account is a checking or savings account. Typically, this information is required to ensure the funds are deposited into the appropriate account type.

06

Attach any necessary documents: If your employer or the entity issuing the payment requires any supporting documents, such as a voided check, attach them with the completed form. This helps to verify the accuracy of the provided bank account details.

07

Sign and date the form: Read through the form carefully, ensuring that all the provided information is accurate. Sign and date the form to indicate your consent for direct deposit ach credit.

Who needs direct deposit ach credit?

01

Employees: Many employees opt for direct deposit ach credit as it offers a convenient and secure way to receive their wages. It eliminates the need for physical checks and enables faster access to funds.

02

Independent contractors: Freelancers or individuals who work independently often choose direct deposit ach credit to receive payments from their clients or customers. It simplifies the payment process and reduces the risk of lost or delayed payments.

03

Benefit recipients: Individuals receiving various benefits, such as Social Security or unemployment benefits, can choose direct deposit ach credit to receive their payments directly into their bank accounts. This method ensures timely and reliable payment delivery.

04

Businesses: Companies utilize direct deposit ach credit to efficiently disburse payments to their vendors, suppliers, and employees. It streamlines their payment processes, improves cash flow management, and reduces administrative costs.

05

Government agencies: Government entities often utilize direct deposit ach credit to transfer funds to individuals, such as tax refunds or other government benefits. This method ensures secure and reliable fund delivery, reducing the risk of fraud or loss.

Overall, direct deposit ach credit is beneficial for individuals and organizations aiming to streamline payment processes, enhance security, and expedite fund availability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is direct deposit ach credit?

Direct deposit ach credit is a payment method where funds are electronically deposited into a recipient's bank account.

Who is required to file direct deposit ach credit?

Employers or organizations that need to pay employees or vendors through direct deposit are required to file direct deposit ach credit.

How to fill out direct deposit ach credit?

To fill out direct deposit ach credit, you need to provide the recipient's bank account information, including routing number and account number, as well as the payment amount.

What is the purpose of direct deposit ach credit?

The purpose of direct deposit ach credit is to provide a convenient and secure way to transfer funds electronically to recipients' bank accounts.

What information must be reported on direct deposit ach credit?

The information reported on direct deposit ach credit includes the recipient's bank account information, payment amount, and any additional details related to the payment.

How can I send direct deposit ach credit for eSignature?

Once you are ready to share your direct deposit ach credit, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my direct deposit ach credit in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your direct deposit ach credit and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit direct deposit ach credit on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign direct deposit ach credit right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your direct deposit ach credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Deposit Ach Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.