Get the free 2012 Partnership Income Tax Return D-403 Web 11-12 North Carolina Department of Reve...

Show details

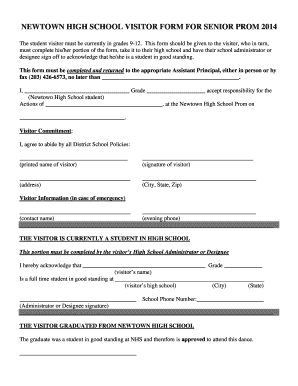

2012 Partnership Income Tax Return D-403 Web 11-12 North Carolina Department of Revenue 12 For calendar year 2012, or fiscal year beginning (MM-DD) and ending (MM-DD-YY) Legal Name (USE CAPITAL LETTERS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 partnership income tax

Edit your 2012 partnership income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 partnership income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 partnership income tax online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2012 partnership income tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 partnership income tax

How to fill out 2012 partnership income tax:

01

Obtain Form 1065: The first step in filling out the 2012 partnership income tax is to obtain and familiarize yourself with Form 1065, also known as the U.S. Return of Partnership Income. You can find this form on the official website of the Internal Revenue Service (IRS).

02

Gather necessary information: Collect all the necessary information and documentation required to fill out the form accurately. This may include partnership records, financial statements, profit and loss statements, and any other relevant documents.

03

Enter partnership information: On Form 1065, you will be required to provide general information about the partnership, such as the name, address, Employer Identification Number (EIN), and the date the partnership started or ended during the tax year.

04

Report income and expenses: Next, you will need to report the partnership's income and expenses for the tax year. This entails providing details about the different types of income earned by the partnership and deducting allowable expenses. Carefully follow the instructions on the form to accurately report this information.

05

Distribute income, deductions, and credits: If the partnership distributes its income, deductions, or credits among its partners, these allocations must be properly reported. This is typically done using Schedule K-1, which details each partner's share of the partnership's income, losses, and credits.

06

Complete additional schedules: Depending on the partnership's activities and specific circumstances, you may need to complete additional schedules and forms. Some common schedules include Schedule B (Other Information), Schedule L (Balance Sheets per Books), and Schedule M-2 (Analysis of Unappropriated Retained Earnings per Books).

07

Review and double-check: Before submitting your 2012 partnership income tax, carefully review all the information you have entered to ensure accuracy. Mistakes or omissions could lead to penalties or unnecessary delays.

08

File the form: Once you are confident that the information provided is correct, you can file Form 1065. The deadline to file the 2012 partnership income tax was typically April 15, 2013. However, if you require an extension, you can file for an extension using Form 7004.

Who needs 2012 partnership income tax?

Partnerships operating in the United States during the tax year 2012 are required to file the partnership income tax return using Form 1065. A partnership is defined as a business entity formed by two or more individuals or entities to carry on a trade or business. Therefore, if you were a partner in a partnership during 2012, you need to file the 2012 partnership income tax return. It is essential to comply with the IRS regulations to ensure accurate reporting and fulfillment of tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2012 partnership income tax for eSignature?

When you're ready to share your 2012 partnership income tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find 2012 partnership income tax?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 2012 partnership income tax and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit 2012 partnership income tax on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 2012 partnership income tax from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is partnership income tax return?

A partnership income tax return is a form filed by a partnership to report its income, deductions, and other tax-related information.

Who is required to file partnership income tax return?

Partnerships are required to file a partnership income tax return.

How to fill out partnership income tax return?

Partners can fill out a partnership income tax return by providing information about the partnership's income, deductions, credits, and other tax-related details.

What is the purpose of partnership income tax return?

The purpose of partnership income tax return is to report the partnership's income and expenses to calculate the partnership's tax liability.

What information must be reported on partnership income tax return?

Information such as income, deductions, credits, and other tax-related details of the partnership must be reported on the partnership income tax return.

Fill out your 2012 partnership income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Partnership Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.