Get the free MetLife Retirement Income Selector Questionnaire

Show details

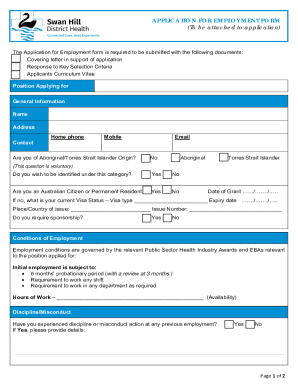

This document is a questionnaire designed to help individuals assess their preferences for retirement income strategies, enabling them to develop a personalized income plan with insights about flexibility,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign metlife retirement income selector

Edit your metlife retirement income selector form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your metlife retirement income selector form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit metlife retirement income selector online

Follow the guidelines below to benefit from a competent PDF editor:

1

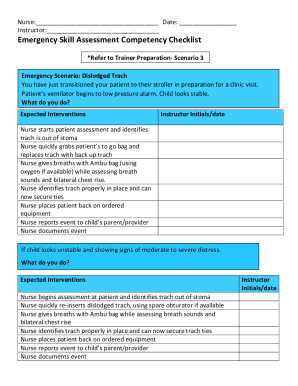

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit metlife retirement income selector. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out metlife retirement income selector

How to fill out MetLife Retirement Income Selector Questionnaire

01

Begin by visiting the MetLife website and locating the Retirement Income Selector Questionnaire.

02

Read the instructions carefully to understand the purpose of the questionnaire.

03

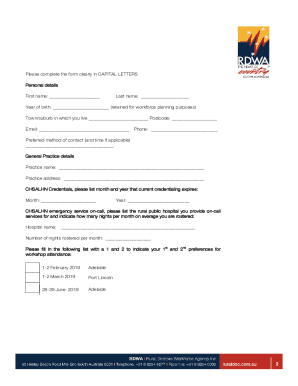

Start filling in your personal information such as name, age, and contact details.

04

Provide your current financial status, including savings, investments, and any existing retirement accounts.

05

Specify your retirement goals, including desired retirement age and lifestyle preferences.

06

Answer questions regarding your desired income sources, such as Social Security or pensions.

07

Review your answers to ensure accuracy and completeness.

08

Submit the questionnaire as per the website instructions, typically by clicking the 'Submit' button.

Who needs MetLife Retirement Income Selector Questionnaire?

01

Individuals planning for retirement who want to assess their income needs.

02

People looking to evaluate different income sources for their retirement.

03

Those unsure about how much money they will need during retirement.

04

Individuals aiming to optimize their retirement savings and investment strategies.

Fill

form

: Try Risk Free

People Also Ask about

Is MetLife a reliable company?

MetLife's long-established presence in the insurance industry makes it a reliable source of coverage for many people. High third-party ratings for customer satisfaction and financial strength further back MetLife's reputation in the sector.

What is the best company for retirement?

Top Retirement Investment Companies Fidelity. Vanguard. Charles Schwab. Tastytrade. Public. Empower. Betterment.

Do MetLife employees get a pension?

Eligible MetLife employees have the opportunity to participate in two significant Retirement Benefit programs: the Retirement Plan and the 401(k) Plan.

What is the secure income option for MetLife?

The Secure Income Option provides a guaranteed level of income for life, even if the underlying fund value runs out of money, along with a guaranteed death benefit.

What is MetLife weakness?

Weaknesses. Competitive Pressures and Market Saturation: Despite its strong market position, MetLife faces intense competition from a multitude of insurance and financial services companies.

Is MetLife a good retirement company?

For 150 years, clients have turned to MetLife to navigate through constantly shifting market conditions. With innovative thinking, an expert-to-expert approach and high financial strength ratings, we can help you create investment opportunities and protection strategies for the future.

How do I plan my retirement income?

For those who choose Level, rates begin at 3.75% and reach 4.75%, whereas Expedite rates range from 5% to 6. There are separate rates for lifetime income, though.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MetLife Retirement Income Selector Questionnaire?

The MetLife Retirement Income Selector Questionnaire is a tool designed to help individuals assess their retirement income needs and preferences.

Who is required to file MetLife Retirement Income Selector Questionnaire?

Individuals who are seeking to plan their retirement income and need to evaluate their options are typically required to fill out the questionnaire.

How to fill out MetLife Retirement Income Selector Questionnaire?

To fill out the questionnaire, individuals should follow the prompts provided, providing accurate information regarding their financial situation, retirement goals, and income preferences.

What is the purpose of MetLife Retirement Income Selector Questionnaire?

The purpose of the questionnaire is to help individuals identify their retirement income needs and match them with suitable MetLife products and solutions.

What information must be reported on MetLife Retirement Income Selector Questionnaire?

The questionnaire typically requires information on current income, expected expenses in retirement, assets, liabilities, and preferred retirement lifestyle.

Fill out your metlife retirement income selector online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Metlife Retirement Income Selector is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.