Get the free DR-501A STATEMENT OF GROSS INCOME

Show details

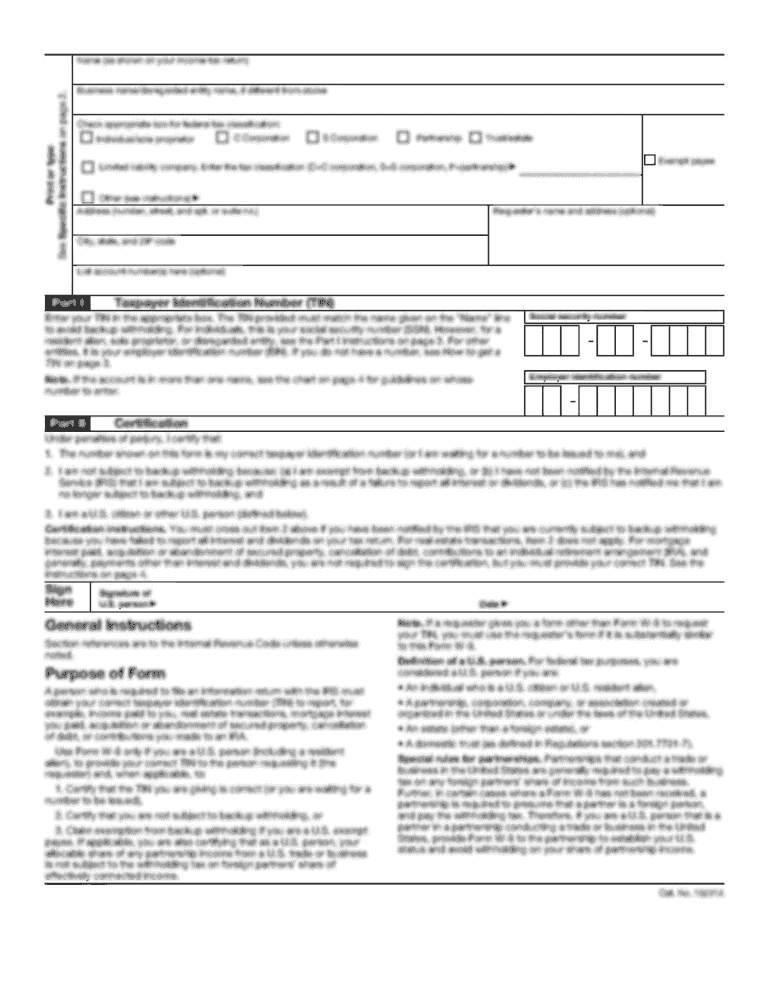

DR-501A R. 11/12 STATEMENT OF GROSS INCOME Rule 12D-16.002 Florida Administrative Code Effective 11/12 Section 196.101(4)(c), Florida Statutes Date Applicants for the Exemption for Totally and Permanently

We are not affiliated with any brand or entity on this form

Instructions and Help about dr-501a statement of gross

How to edit dr-501a statement of gross

How to fill out dr-501a statement of gross

Instructions and Help about dr-501a statement of gross

How to edit dr-501a statement of gross

You can edit the dr-501a statement of gross using pdfFiller's powerful editing tools. Start by uploading your form to the platform, then use the editing features to modify text or fields as needed. Save any changes to your document securely for further submission or record-keeping.

How to fill out dr-501a statement of gross

To fill out the dr-501a statement of gross accurately, first gather all required information regarding your income and applicable deductions. Follow these steps:

01

Obtain a copy of the dr-501a statement of gross from the IRS website or your tax preparation software.

02

Enter your personal information accurately in the designated fields.

03

Report your total gross income and any deductions you are eligible for.

04

Review your entries for accuracy before submission.

Latest updates to dr-501a statement of gross

Latest updates to dr-501a statement of gross

The most recent updates to the dr-501a statement of gross involve changes in reporting thresholds and the inclusion of newly defined categories for income sources. Always check the IRS website for the latest information before completing the form.

All You Need to Know About dr-501a statement of gross

What is dr-501a statement of gross?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About dr-501a statement of gross

What is dr-501a statement of gross?

The dr-501a statement of gross is an IRS form used to report the total gross income received by an individual or entity during a tax year. This data is crucial for the IRS to assess and verify the amount of income reported on tax returns.

What is the purpose of this form?

The purpose of the dr-501a statement of gross is to provide a detailed account of all income received from various sources, ensuring compliance with federal tax regulations. This form plays a critical role in determining tax liability and ensuring accurate tax reporting.

Who needs the form?

Individuals or businesses that have received income from self-employment, rental property, interest, dividends, or other taxable sources may need to file the dr-501a statement of gross. It helps the IRS properly assess the individual's or entity's overall tax obligation.

When am I exempt from filling out this form?

You may be exempt from filling out the dr-501a statement of gross if your total income falls below the minimum reporting threshold set by the IRS or if you are in a category of income that is not taxable. Always verify your eligibility by consulting with a tax professional.

Components of the form

The dr-501a statement of gross includes several key components, such as your personal information, total gross income from various sources, and any allowable deductions. Each section must be completed accurately to ensure compliance and prevent any potential penalties.

Due date

The dr-501a statement of gross is generally due on April 15 of the tax year following the year in which the income was earned. If the due date falls on a weekend or holiday, it may be extended to the next business day. Ensure timely submission to avoid penalties.

What payments and purchases are reported?

The dr-501a statement of gross requires reporting of all forms of income received, such as wages, tips, interest, dividends, and self-employment earnings. It does not typically require the reporting of non-taxable income like certain gifts or inheritances.

How many copies of the form should I complete?

You typically need to complete one copy of the dr-501a statement of gross for your records. However, if you are required to submit copies to multiple agencies or parties, ensure you prepare additional copies as needed to meet compliance requirements.

What are the penalties for not issuing the form?

Failing to issue the dr-501a statement of gross when required can result in penalties imposed by the IRS. These can include fines or interest charges on unpaid taxes. It is essential to comply to avoid unnecessary financial repercussions.

What information do you need when you file the form?

When filing the dr-501a statement of gross, you need to provide your personal identification information, such as your Social Security number, as well as details regarding all income sources, including any documentation supporting your reported income and deductions.

Is the form accompanied by other forms?

In some instances, the dr-501a statement of gross may need to be filed alongside other tax forms. This could include schedules that detail specific income types or deductions. Consult IRS guidelines for necessary accompanying forms.

Where do I send the form?

The completed dr-501a statement of gross should be sent to the address specified by the IRS based on your location and filing situation. Check the IRS website or the instructions included with the form for the correct submission address.

See what our users say