NY Publication 145 2013-2025 free printable template

Show details

Note: The NOT addition

modification code has been

changed for tax years after

2013; click to see page 12. Publication 145Net Operating Losses (Vols)

For New York State

Resident Individuals, Estates,

And

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nys publication 145

Edit your nys publication 145 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nys publication 145 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nys publication 145 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nys publication 145. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

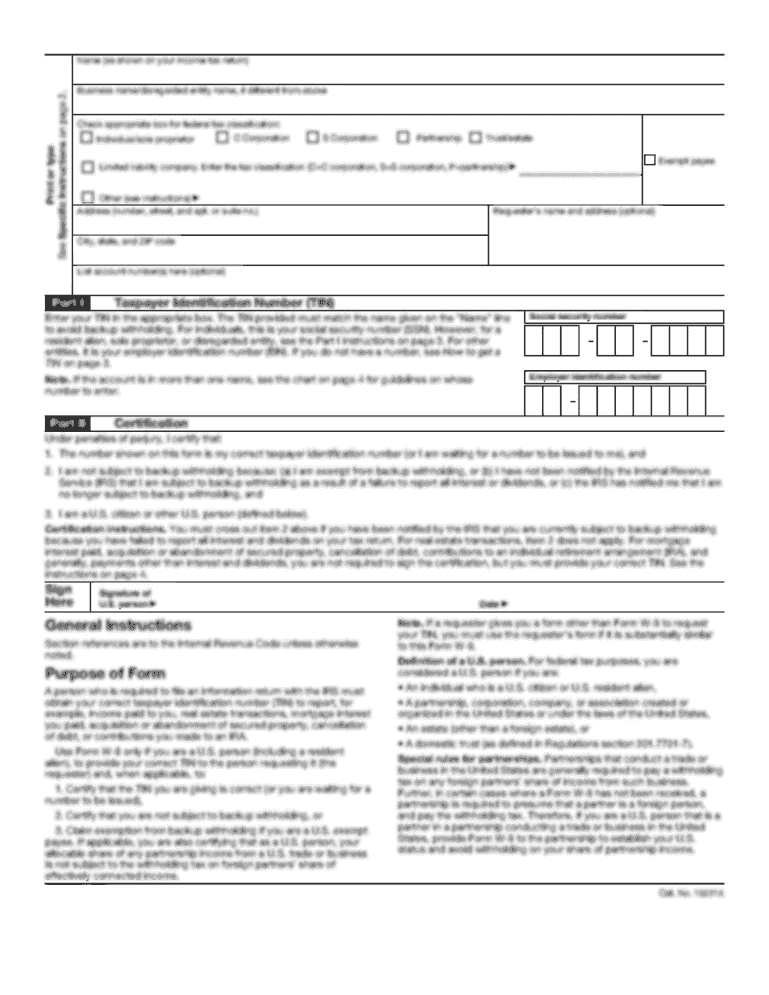

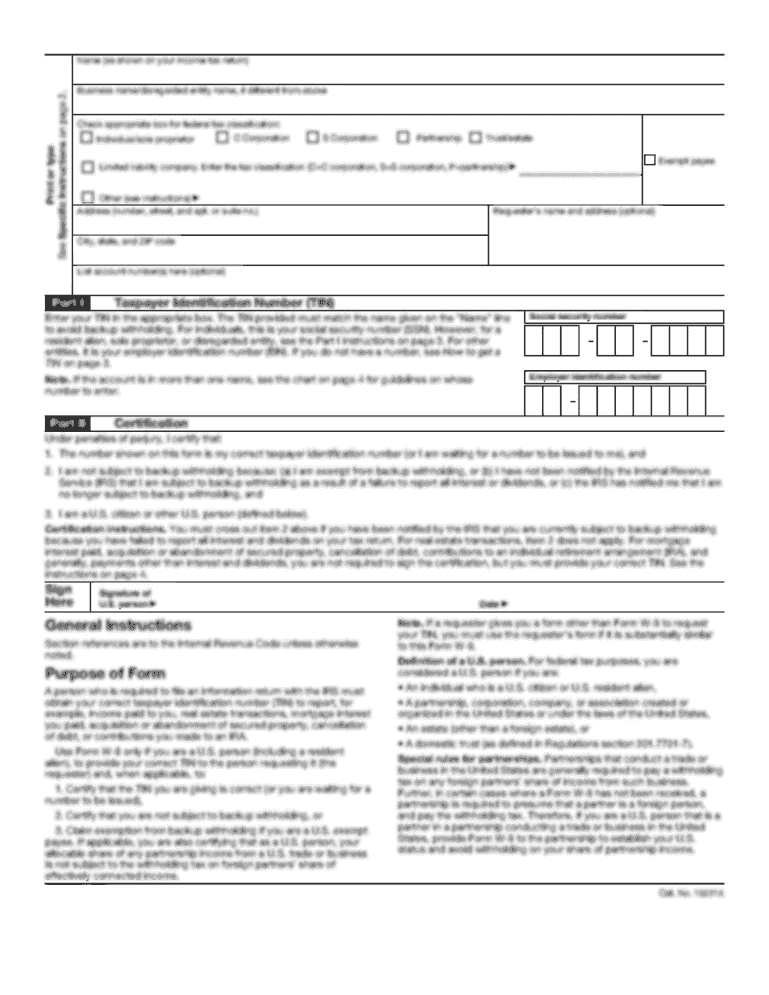

How to fill out nys publication 145

How to fill out NY Publication 145

01

Obtain a copy of NY Publication 145 from the New York State Department of Taxation and Finance website.

02

Review the publication to understand the purpose and requirements.

03

Gather all necessary documentation, including income statements and tax forms.

04

Carefully follow the instructions outlined in the publication for each applicable section.

05

Fill out the required sections clearly and accurately, ensuring all information is current.

06

Double-check the entries for errors before submission.

07

Submit the completed form as instructed, either electronically or via mail.

Who needs NY Publication 145?

01

Taxpayers who are required to report specific business income or sales tax information in New York.

02

Businesses operating in New York that need to comply with state tax regulations.

03

Accountants or tax professionals assisting clients with New York tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a NY non resident return?

Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an 1127 return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

Do I have to file New York non resident tax return?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

How do I get a NY state tax form?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

Is a non resident required to file income tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Do I qualify for NYS household credit?

New York State household credit full- or part-year resident. married or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate)

Do I have to file NY state tax return for nonresident?

If I'm not domiciled in New York and I'm not a resident, do I owe New York income tax? If you do not meet the requirements to be a resident, you may still owe New York tax as a nonresident if you have income from New York sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nys publication 145 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your nys publication 145 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send nys publication 145 for eSignature?

Once your nys publication 145 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in nys publication 145?

With pdfFiller, the editing process is straightforward. Open your nys publication 145 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is NY Publication 145?

NY Publication 145 is a document issued by the New York State Department of Taxation and Finance that provides guidance on certain tax matters, specifically for individuals and businesses in New York.

Who is required to file NY Publication 145?

Those who engage in specific taxable activities in New York, including businesses that meet certain criteria outlined by the New York State Department of Taxation and Finance, are required to file NY Publication 145.

How to fill out NY Publication 145?

To fill out NY Publication 145, individuals and businesses must follow the instructions provided in the publication, which includes sections for entering personal and business information, tax calculations, and relevant deductions.

What is the purpose of NY Publication 145?

The purpose of NY Publication 145 is to provide clear instructions and guidelines for taxpayers regarding their tax obligations and ensuring compliance with New York tax laws.

What information must be reported on NY Publication 145?

The information that must be reported on NY Publication 145 includes taxpayer identification, income details, applicable tax credits, and any deductions claimed, as well as other tax-related information required by the state.

Fill out your nys publication 145 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nys Publication 145 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.