TX LL-1 2014 free printable template

Show details

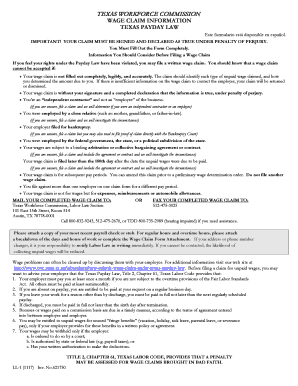

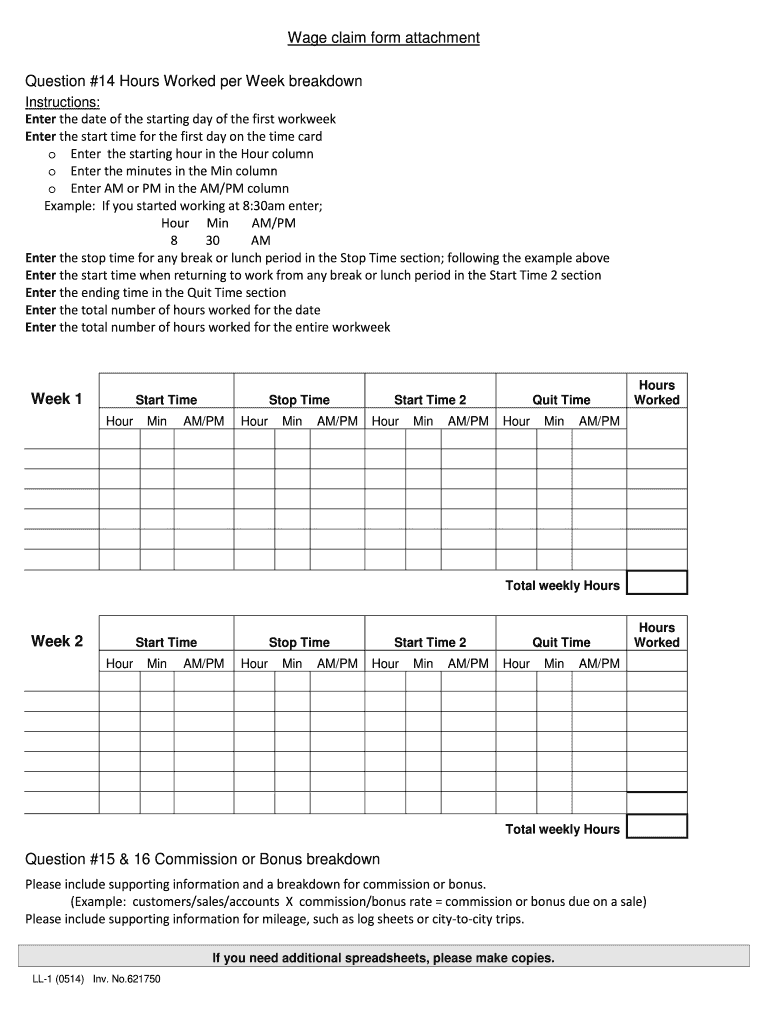

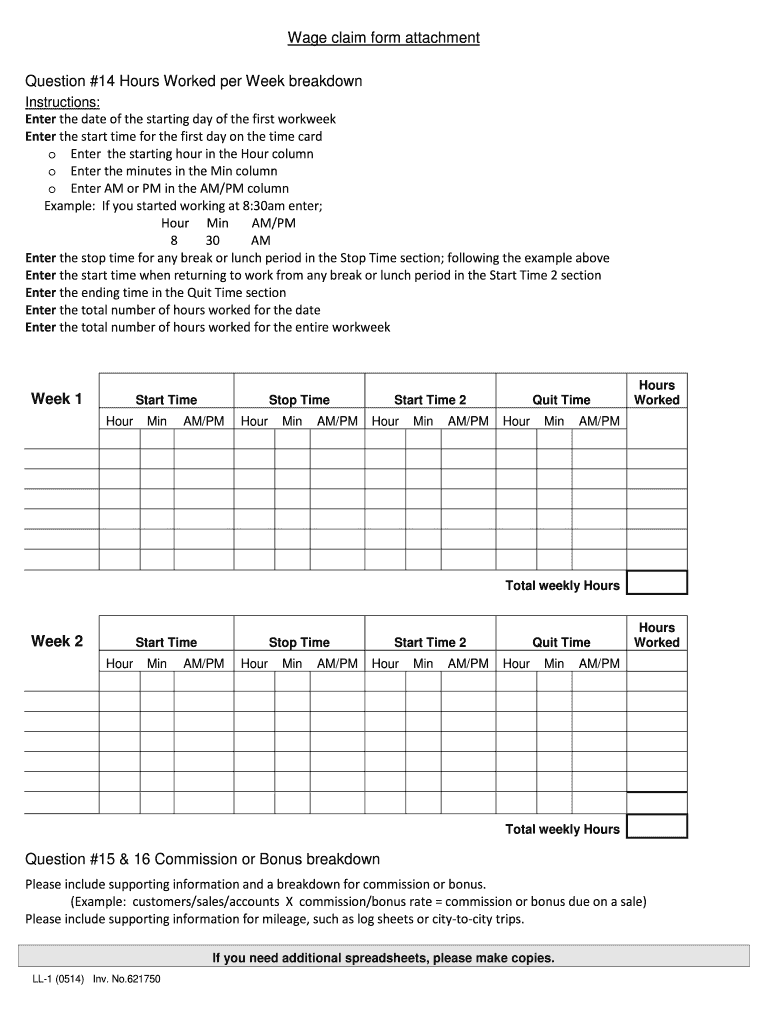

YOU MUST FILL OUT THE FORM COMPLETELY. INFORMATION YOU SHOULD CONSIDER BEFORE FILING A WAGE CLAIM Wage problems can often be cleared up by discussing them with your employer. Your employer filed for bankruptcy. within 180 days file only for that part. You file against more than one employer on one claim form. Use separate wage claim forms for filing against each employer. To be considered valid your Wage Claim must be completed below and signed as true under penalty of perjury. My name is and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX LL-1

Edit your TX LL-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX LL-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX LL-1 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX LL-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX LL-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX LL-1

How to fill out TX LL-1

01

Obtain a copy of the TX LL-1 form from the Texas Secretary of State's website or local office.

02

Fill in the applicant's name and address at the top of the form.

03

Provide the legal name of the entity and its Texas File Number or Federal Employer Identification Number (EIN).

04

Indicate the type of entity (e.g. corporation, LLC, etc.).

05

Specify the reason for requesting the form (e.g. to apply for an assumed name).

06

Provide the assumed name you wish to use, ensuring it complies with Texas naming regulations.

07

Include information about the entity's registered agent and registered office address.

08

Sign and date the form in the designated area.

09

Submit the completed form to the Texas Secretary of State along with any required fees.

Who needs TX LL-1?

01

Any business entity in Texas that wishes to operate under an assumed name.

02

Individuals or groups forming a partnership or LLC under a name different from their legal names.

03

Corporations looking to register a name that is not its legal name for branding or marketing purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a claim for unpaid wages in Texas?

Get a Wage Claim Form You can file a wage claim using TWC's online system or by using a paper form that you print and mail or fax to the Wage and Hour Department. TWC encourages you to file online.

Can I sue my employer for not paying me correctly in Texas?

Yes, you can sue your employer for other unpaid or improperly paid wages by filing a state or federal claim. In some cases, an employer might classify you as an “independent contractor” to avoid providing you with required employee benefits.

How do I withdraw a wage claim in Texas?

If collections have started, you must have this form notarized or witnessed by a TWC Workforce Solutions Representative and send the original form (no FAX or photocopy). You may call Wage and Hour Department at 800-832-9243 to find out if TWC has started collection actions.

How do I check my wage claim in Texas?

Wage claimants who have questions should call 512-475-2670 or toll-free at 800-832-9243 for assistance.

How far back can you claim pay?

How Far Back Can An Employer Collect Overpayment? It will depend on where and how the employer is trying to recover the money. Generally, you can only pursue a claim to recover a monetary amount for up to six years from when the overpayment occurred.

How long does it take TWC to review a claim?

It takes about four weeks from the date you apply for benefits to know if you are eligible for benefits. We use this time to gather information on your past wages, job separation, and general eligibility. You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321.

How do you work out if you have been underpaid?

Check you're getting the minimum wage Your average hourly rate (before tax, National Insurance and pension contributions) in each pay reference period must be no less than the minimum wage. So, if you're paid monthly, your average hourly rate will be your monthly pay divided by the number of hours worked in that month.

How far back can you claim underpayment of wages UK?

You can claim up to 2 years back as long as there is not a gap of 3 months or more between deductions.

How far back can you claim underpayment of wages Australia?

You can make a claim for wages or entitlements owed to you within 6 years of when you were underpaid. For further information about the wages recovery process visit the website or call the Registry on 1300 592 987.

What happens if my employer doesn't pay me on time in Texas?

If an employee is not paid on payday, then the employer must pay the employee on another business chosen by the employee. Thus, an employer who fails to pay its employee on payday and fails to fulfill its employee's request to get paid the next business day violates the Texas Payday Law.

How do I file a complaint against unpaid wages in Texas?

Submit a wage claim with the Texas Workforce Commission within 180 days of the date the claimed wages originally became due for payment. File a complaint with the U.S. Department of Labor's Wage and Hour Division within two years of the date the claimed wages originally became due for payment.

How far back can an employee claim underpayment of wages?

In most cases, you cannot claim any deductions that took place more than two years before you start your claim, unless you are claiming statutory sick pay, statutory maternity pay and other statutory payments.

How do I check my wage claim in Texas?

If you have questions or need assistance completing your wage claim, call the TWC Wage and Hour Department at 800-832-9243 or 512-475-2670.

Who do I contact if my employer doesn't pay me Texas?

Submit a wage claim with the Texas Workforce Commission within 180 days of the date the claimed wages originally became due for payment. File a complaint with the U.S. Department of Labor's Wage and Hour Division within two years of the date the claimed wages originally became due for payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX LL-1 for eSignature?

To distribute your TX LL-1, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the TX LL-1 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your TX LL-1 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete TX LL-1 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your TX LL-1. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is TX LL-1?

TX LL-1 is a form required by the state of Texas for reporting specific information related to certain entities, commonly used in the context of local business taxes.

Who is required to file TX LL-1?

Entities that are subject to local business taxes in Texas, including corporations and partnerships that operate within the state, are required to file TX LL-1.

How to fill out TX LL-1?

To fill out TX LL-1, you must provide the required information about your business, including business name, address, federal tax identification number, and other relevant financial details as specified in the form.

What is the purpose of TX LL-1?

The purpose of TX LL-1 is to collect data from businesses for tax assessment, ensuring compliance with local tax laws and regulations in Texas.

What information must be reported on TX LL-1?

TX LL-1 requires you to report information such as the name and address of the entity, the type of business, the federal tax identification number, and income or revenue figures for the reporting period.

Fill out your TX LL-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX LL-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.