2656-1 2002-2026 free printable template

Show details

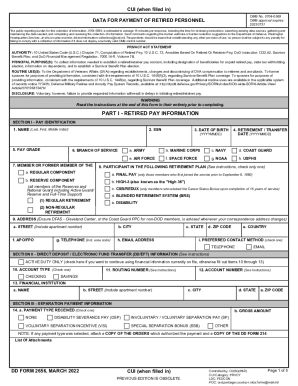

SURVIVOR BENEFIT PLAN (SVP) ELECTION STATEMENT FOR FORMER SPOUSE COVERAGE (Please read Privacy Act Statement and Instructions on back BEFORE completing form.) SECTION I ELECTION OF COVERAGE — RETIRED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2656-1

Edit your 2656-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2656-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2656-1 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2656-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2656-1

How to fill out 2656-1

01

Obtain the form 2656-1 from the official website or the relevant office.

02

Read the instructions carefully to understand the requirements.

03

Fill out Section 1 with your personal information, including your name, address, and contact details.

04

Complete Section 2 by providing the necessary details regarding the purpose of the form.

05

In Section 3, specify any additional information or comments as required.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the form either electronically or by mailing it to the designated office.

Who needs 2656-1?

01

Individuals applying for a specific permit or service related to the subject of form 2656-1.

02

Organizations or businesses that require formal documentation pertaining to their operations.

03

Any stakeholder seeking to comply with regulatory or administrative requirements associated with the form.

Fill

form

: Try Risk Free

People Also Ask about

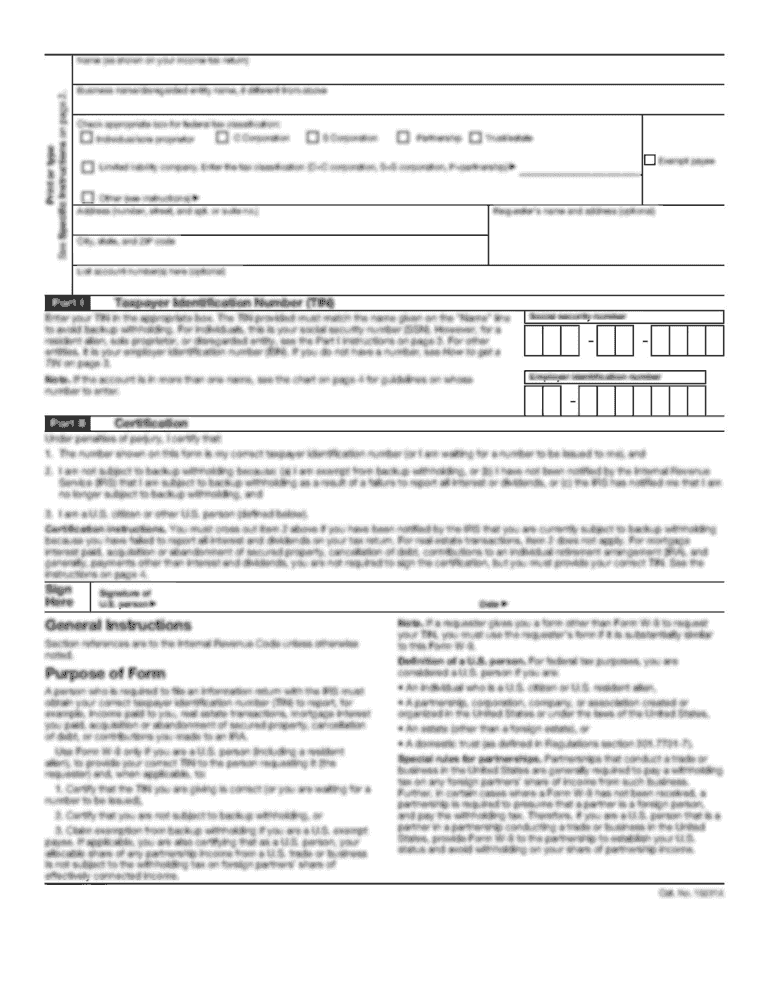

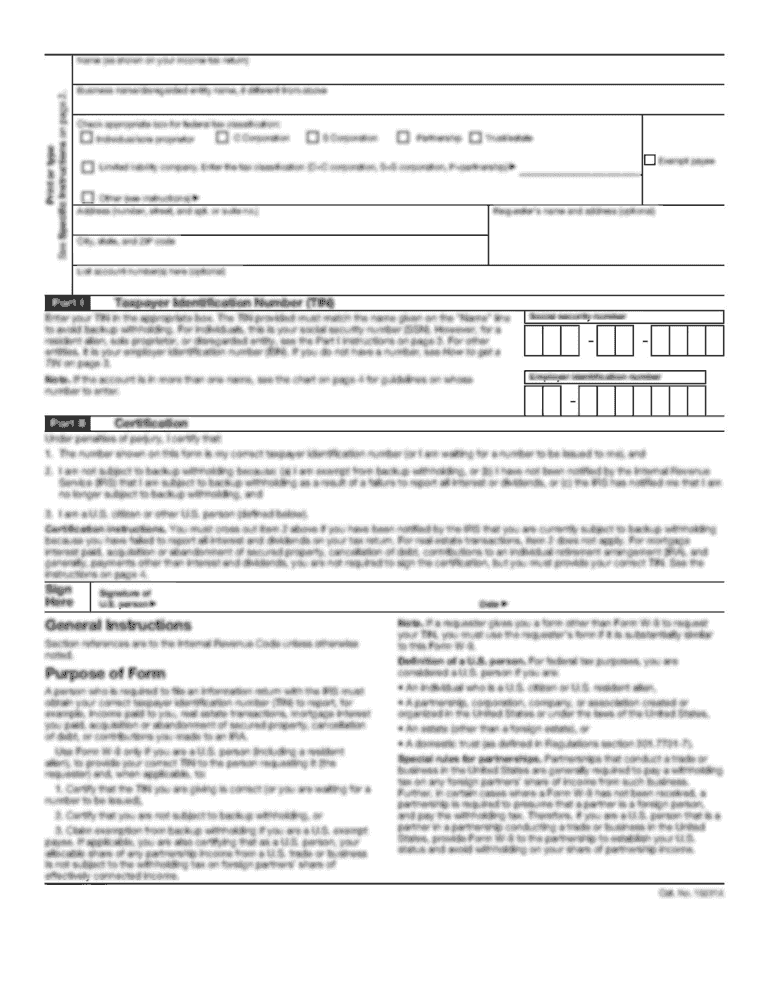

Do you have to pay federal income tax after age 70?

There is no age at which you no longer have to submit a tax return and most senior citizens do need to file taxes every year. However if Social Security is your only form of income then it is not taxable. In the case of a married couple who file jointly, this must be true of both spouses.

What does 1040sr mean?

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

Does a 75 year old have to file taxes?

In short, senior citizens are largely subject to the same tax requirements as other adults. There is no age at which you no longer have to submit a tax return and most senior citizens do need to file taxes every year. However if Social Security is your only form of income then it is not taxable.

How much money can a 70 year old make without paying taxes?

Basically, if you're 65 or older, you have to file a tax return in 2022 if your gross income is $14,700 or higher. If you're married filing jointly and both 65 or older, that amount is $28,700. If you're married filing jointly and only one of you is 65 or older, that amount is $27,300.

What is the new tax return for seniors?

What Is the Additional Standard Deduction for Seniors? For the 2022 tax year (filed in 2023), taxpayers age 65 and older can take an additional standard deduction of $1,750 for single or head of household, or $1,400 for married filing jointly or qualifying widow(er).

What is the IRS income limit for seniors?

Table 1-1. 2022 Filing Requirements Chart for Most Taxpayers IF your filing status is. . .AND at the end of 2022 you were . . .*THEN file a return if your gross income** was at least. . .Single65 or older$14,700Head of householdunder 65$19,40065 or older$21,150Married filing jointly***under 65 (both spouses)$25,9006 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2656-1?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2656-1 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit 2656-1 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 2656-1 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit 2656-1 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 2656-1 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is 2656-1?

2656-1 refers to a specific tax form used for certain reporting requirements, often related to federal taxation.

Who is required to file 2656-1?

Individuals or entities that meet certain criteria established by the IRS, typically relating to specific tax situations or transactions.

How to fill out 2656-1?

To fill out 2656-1, you must provide the required information accurately, following the instructions provided by the IRS for the specific form.

What is the purpose of 2656-1?

The purpose of 2656-1 is to report specific information to the IRS regarding financial transactions or situations that fall under the reporting requirements.

What information must be reported on 2656-1?

Information required on 2656-1 typically includes identification details of the filer, transaction details, and any other pertinent data as instructed by the IRS.

Fill out your 2656-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2656-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.