CT CT-3911 2013 free printable template

Show details

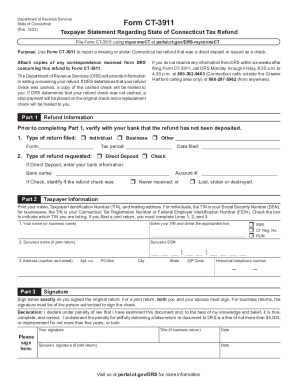

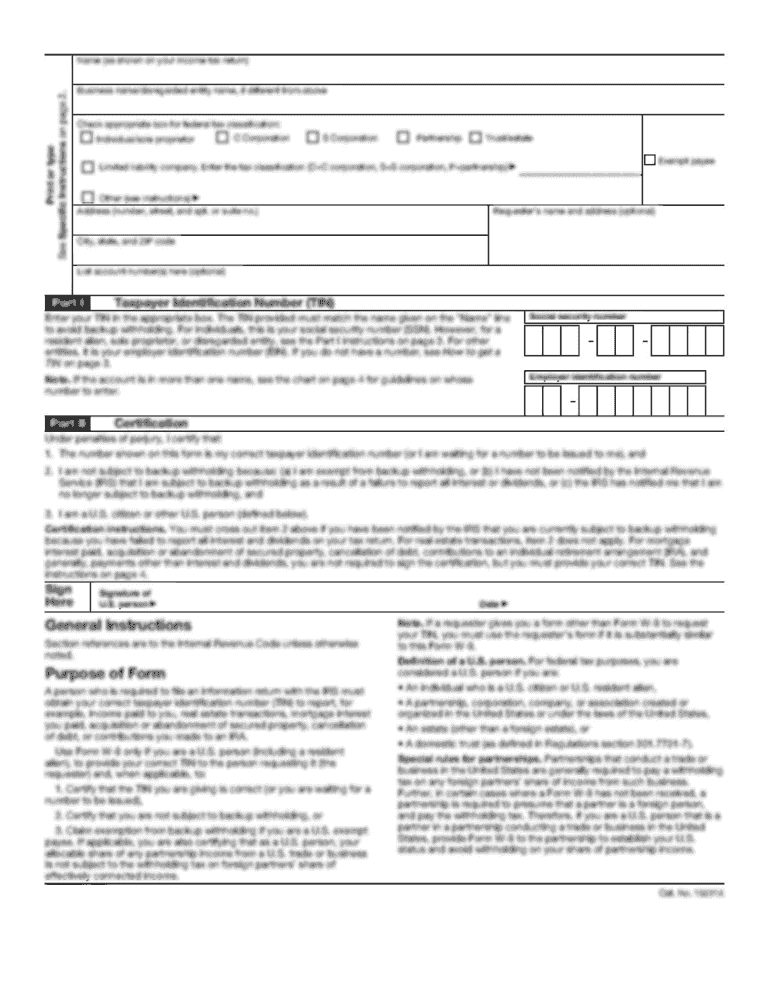

Form CT-3911. Taxpayer Statement Regarding State of Connecticut Tax Refund ... weeks after filing Form CT-3911, contact DRS at 800-382-9463. (Connecticut ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct3911 2013 form

Edit your ct3911 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct3911 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct3911 2013 form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ct3911 2013 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT CT-3911 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct3911 2013 form

How to fill out CT CT-3911

01

Obtain a copy of the CT CT-3911 form.

02

Provide your name and Social Security number in the designated fields.

03

Indicate the year for which you are claiming a refund.

04

Specify the type of tax return you filed (e.g., 1040, 1040A).

05

Complete the section regarding your refund amount.

06

Fill out any additional required information about your tax situation.

07

Review the form for accuracy.

08

Submit the completed form to the appropriate tax authority.

Who needs CT CT-3911?

01

Individuals who believe they are entitled to a refund from the State of Connecticut and have not received it.

02

People who filed their taxes electronically or by mail and need to claim their refund.

03

Taxpayers who submitted a CT tax return and have questions about their refund status.

Instructions and Help about ct3911 2013 form

Fill

form

: Try Risk Free

People Also Ask about

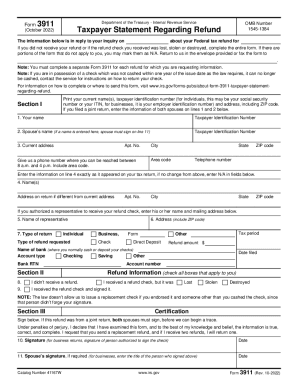

How long does it take for IRS to trace stimulus check?

If your refund was direct deposited, the financial institution will get a letter within six weeks from the Bureau of the Fiscal Service in the Treasury Department, to verify where the deposit went. If the check hasn't been cashed, you'll get a replacement refund check in about six weeks.

How long does it take IRS to respond to form 3911?

How soon can I expect a response from the IRS after filing Form 3911? You can expect a response within 6-8 weeks of filing Form 3911.

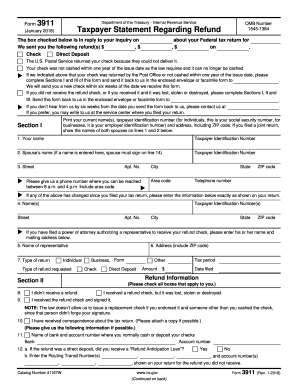

What is the form 3911 for tax refund?

Form 3911 is completed by the taxpayer to provide the Service with information needed to trace the nonreceipt or loss of the already issued refund check.

What is a 1310 form in CT?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

Where do I send my form 3911?

What address do I send my 3911 tax form? If you live in any other state, mail to the Department of the Treasury, Internal Revenue Service Center, Fresno CA 93888-0002.

How long does it take to get a reply from the IRS?

Allow at least 30 days for a response. Usually, you don't have to call or visit an IRS office to handle this correspondence. However, if you have questions, call the telephone number in the upper right corner of the notice. Have a copy of your tax return and the correspondence available when you call.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ct3911 2013 form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific ct3911 2013 form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out ct3911 2013 form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign ct3911 2013 form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit ct3911 2013 form on an Android device?

You can make any changes to PDF files, like ct3911 2013 form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is CT CT-3911?

CT CT-3911 is a tax form used in Connecticut for claiming a credit for taxes paid to another state.

Who is required to file CT CT-3911?

Individuals and businesses that have paid income taxes to another state while also being subject to Connecticut state income tax are required to file CT CT-3911.

How to fill out CT CT-3911?

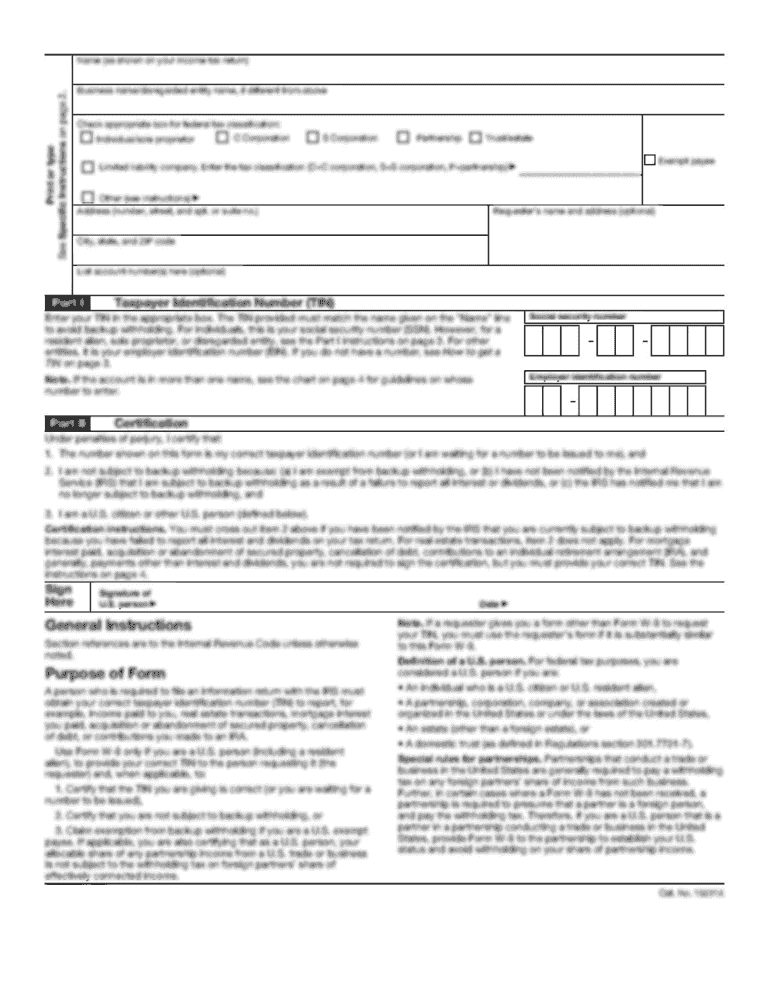

To fill out CT CT-3911, you need to provide your personal or business information, details of the taxes paid to another state, and the credit amount being claimed.

What is the purpose of CT CT-3911?

The purpose of CT CT-3911 is to allow taxpayers to claim a credit for taxes that were already paid to another state, thus preventing double taxation.

What information must be reported on CT CT-3911?

The information that must be reported on CT CT-3911 includes your name, address, Social Security Number or business ID, the amount of tax paid to the other state, and the state to which the taxes were paid.

Fill out your ct3911 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ct3911 2013 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.