Get the free Principal Executive Bonus Plus Proposal

Show details

This document outlines the Principal Executive Bonus Plus plan, detailing its benefits, design considerations, tax implications, and administrative services aimed at employers looking to enhance their

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign principal executive bonus plus

Edit your principal executive bonus plus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your principal executive bonus plus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

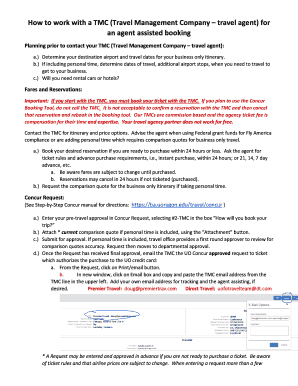

Editing principal executive bonus plus online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit principal executive bonus plus. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out principal executive bonus plus

How to fill out Principal Executive Bonus Plus Proposal

01

Begin by collecting all necessary information about the executive's performance metrics.

02

Outline the goals and objectives that the executive is expected to meet.

03

Specify the bonus structure, including any targets and thresholds that must be achieved.

04

Include a detailed breakdown of the performance review process.

05

Ensure all calculations for potential bonuses are clear and transparent.

06

Provide a section for the executive to acknowledge and sign the proposal.

07

Review the proposal with HR and legal teams before final submission.

Who needs Principal Executive Bonus Plus Proposal?

01

Executives who are eligible for performance-based bonuses.

02

HR professionals involved in compensation and benefits management.

03

Company executives looking to establish clear bonus criteria.

04

Financial teams tasked with overseeing compensation frameworks.

Fill

form

: Try Risk Free

People Also Ask about

Are executive bonus plans tax deductible?

Executive bonus plans are typically offered to C-suite employees such as chief executives, chief operations executives, and chief financial officers. Premium payments are usually tax deductible for the employer and considered additional taxable compensation for the employee.

What is the executive bonus plan?

A Section 162 executive bonus plan is a way to attract, reward, and retain key employees using life insurance. The employer takes out a life insurance policy on a key employee. The employee is the owner of the policy, and gets to determine the beneficiaries and manage the funds within the policy.

Who is the beneficiary of an executive bonus plan?

The business can selectively choose the key employees they wish to reward. The bonus payments may be considered a fully deductible expense to the company. The key employee is able to name the beneficiary of the entire death benefit of the life insurance policy.

How do you write a bonus structure?

Considerations for Designing a Bonus Structure Plan Alignment with company goals: The bonus structure should be aligned with the overall goals and objectives of the company. Fairness and equity: The bonus structure should be fair and equitable, with clear and transparent criteria for determining eligibility and payouts.

What is a typical executive bonus?

In many cases, an annual bonus is nothing more than a base salary in disguise. A CEO with a $1 million salary may also receive a $700,000 bonus. If any of that bonus, say $500,000, does not vary with performance, then the CEO's salary is really $1.5 million. Bonuses that vary with performance are another matter.

What is the golden executive bonus arrangement?

How can a golden executive bonus arrangement help protect your family and fund your retirement? You and your employer enter into an employment agreement that lays out a vesting schedule. You take out a personally owned life insurance policy. Your employer pays the premiums as a bonus to you.

How does an executive bonus plan work?

This plan is a type of life insurance where the employer pays the premiums as a bonus. It serves as an incentive for employees to perform at their best, contributing to the company's success.

What is a typical executive bonus?

In many cases, an annual bonus is nothing more than a base salary in disguise. A CEO with a $1 million salary may also receive a $700,000 bonus. If any of that bonus, say $500,000, does not vary with performance, then the CEO's salary is really $1.5 million. Bonuses that vary with performance are another matter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Principal Executive Bonus Plus Proposal?

The Principal Executive Bonus Plus Proposal is a compensation plan designed for executives, outlining the criteria and structure for performance bonuses.

Who is required to file Principal Executive Bonus Plus Proposal?

Typically, the top executives of an organization, such as the CEO and other senior leaders, are required to file the Principal Executive Bonus Plus Proposal.

How to fill out Principal Executive Bonus Plus Proposal?

To fill out the Principal Executive Bonus Plus Proposal, one must provide detailed information on performance metrics, bonus structure, and any relevant executive compensation details as per the established guidelines.

What is the purpose of Principal Executive Bonus Plus Proposal?

The purpose of the Principal Executive Bonus Plus Proposal is to align executive compensation with company performance, ensuring accountability and encouraging achievement of organizational goals.

What information must be reported on Principal Executive Bonus Plus Proposal?

The information that must be reported includes executive names, performance targets, bonus calculations, and any conditions that might affect performance-based bonuses.

Fill out your principal executive bonus plus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Principal Executive Bonus Plus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.