Get the free VAT newsletter - Issue No. 1, 2014 - Ernst & Young

Show details

Issue No. 1, 2014 VAT newsletter Introduction Welcome to the first issue of Ernst & Young LLP s 2014 VAT Newsletter for the US. These newsletters cover a variety of topics, as VAT can impact businesses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat newsletter - issue

Edit your vat newsletter - issue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat newsletter - issue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat newsletter - issue online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vat newsletter - issue. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

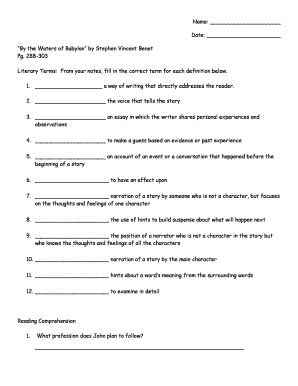

How to fill out vat newsletter - issue

How to fill out VAT newsletter - issue?

01

Begin by gathering all necessary information and documents related to the VAT. This may include sales and purchase invoices, receipts, bank statements, and any other relevant financial records.

02

Review the previous VAT newsletter - issue and identify any changes or updates that need to be made. This could include new regulations, tax rate changes, or any other important updates that should be communicated to recipients.

03

Create a template for the VAT newsletter - issue that is visually appealing and easy to read. Include a header with the issue number and date, as well as any other relevant information such as contact details or a brief introduction.

04

Organize the content of the newsletter in a logical manner. Start with any important announcements or updates, followed by a summary of recent VAT developments. Include any new guidance or resources that might be relevant to recipients.

05

Provide clear instructions on how to calculate VAT, complete VAT returns, and any other important reporting requirements. Use simple language and include any helpful examples or step-by-step guides.

06

Include any common questions or challenges that recipients may encounter when completing VAT returns or complying with VAT regulations. Offer solutions or tips to help address these issues and ensure accurate reporting.

Who needs VAT newsletter - issue?

01

Small business owners: VAT newsletters are particularly valuable for small business owners who may not have access to dedicated accounting or tax professionals. These newsletters provide up-to-date information and guidance on VAT regulations and reporting requirements, helping them stay compliant and avoid penalties.

02

Accountants and tax professionals: Even for professionals in the field, VAT regulations are constantly evolving and can be complex. VAT newsletters provide a concise summary of changes and updates, keeping accountants and tax professionals informed and enabling them to provide accurate advice to their clients.

03

Individuals or companies that deal with international transactions: VAT rules and regulations can vary significantly between countries. VAT newsletters provide valuable information on cross-border transactions, import/export rules, and relevant VAT exemptions or concessions, helping individuals and companies navigate these complexities more effectively.

Remember, it's important to consult with a tax or accounting professional for specific advice tailored to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vat newsletter - issue?

VAT newsletter - issue is a periodic publication that provides updates and information related to VAT (Value Added Tax) regulations, guidelines, and changes.

Who is required to file vat newsletter - issue?

Businesses and individuals who are registered for VAT are required to file VAT newsletter - issue.

How to fill out vat newsletter - issue?

To fill out VAT newsletter - issue, one must provide accurate information about their VAT activities, transactions, and any changes in VAT regulations.

What is the purpose of vat newsletter - issue?

The purpose of VAT newsletter - issue is to keep VAT-registered entities informed about the latest updates and changes in VAT regulations to ensure compliance.

What information must be reported on vat newsletter - issue?

Information that must be reported on VAT newsletter - issue includes details of VAT transactions, input and output taxes, any changes in VAT rates, and other relevant information.

How do I modify my vat newsletter - issue in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign vat newsletter - issue and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in vat newsletter - issue?

The editing procedure is simple with pdfFiller. Open your vat newsletter - issue in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit vat newsletter - issue on an Android device?

The pdfFiller app for Android allows you to edit PDF files like vat newsletter - issue. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your vat newsletter - issue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat Newsletter - Issue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.