Get the free NC 457b DEFERRED COMPENSATION PLAN Change of Employer

Show details

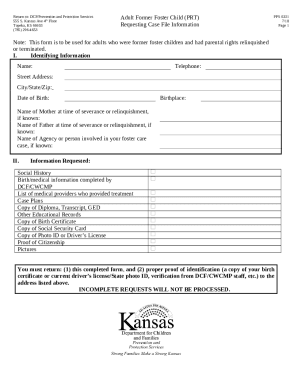

This form is used for employees changing employers to transfer their NC 457b deferred compensation plan and update contribution details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nc 457b deferred compensation

Edit your nc 457b deferred compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nc 457b deferred compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nc 457b deferred compensation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nc 457b deferred compensation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nc 457b deferred compensation

How to fill out NC 457b DEFERRED COMPENSATION PLAN Change of Employer

01

Obtain a copy of the NC 457b DEFERRED COMPENSATION PLAN Change of Employer form.

02

Read through the form instructions carefully before filling it out.

03

Provide your personal information, including full name, social security number, and contact details.

04

Fill in the details of your current employer, including their name and address.

05

Enter the details of your new employer, including their name and address.

06

Specify the effective date of the change in employer.

07

If applicable, include any additional information required by the form.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form where indicated.

10

Submit the form to the designated office or person as indicated in the instructions.

Who needs NC 457b DEFERRED COMPENSATION PLAN Change of Employer?

01

Participants in the NC 457b DEFERRED COMPENSATION PLAN who are changing their employer.

02

Individuals who want to transfer their deferred compensation benefits to a new employer.

Fill

form

: Try Risk Free

People Also Ask about

What should I do with my 457 B when I retire?

Assets in a 457(b) plan can be rolled over into most other retirement accounts, including into a traditional IRA, a Roth IRA, another 457(b) plan, a 403(b), a 401(a) or a 401(k) plan. See the table below for IRS rules on which plans a 457(b) can be rolled into.

What are the disadvantages of a 457 B plan?

The UNC System 457(b) Plan is a defined contribution plan. This means the value of your retirement benefit is based on the contributions you make to the plan, how you invest them and how your investments perform. See the UNC System Supplemental Retirement Plan Decision Guide for more information.

At what age can I withdraw from my 457 B without penalty?

Special 457(b) catch-up contributions, if permitted by the plan, allow a participant for 3 years prior to the normal retirement age (as specified in the plan) to contribute the lesser of: the elective deferral limit ($23,000 in 2024; $22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and in 2021).

What is a 457b deferred compensation plan?

To learn more about the NC 401(k) and Roth Savings Plans and NC 457 Plans, visit the Supplemental Retirement Savings page on the North Caroling Retirement Systems' Website. The State matches contributions made by State employees. Retirement, disability, monthly income and medical benefits are also available.

What are the downsides to a 457 B?

Cons of 457(b) plans: Fewer investing options than 401(k)s (Not as common today) Only available to certain employees employed by state or local governments or qualifying nonprofits. Employer contributions count toward the annual limit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NC 457b DEFERRED COMPENSATION PLAN Change of Employer?

The NC 457b DEFERRED COMPENSATION PLAN Change of Employer refers to the process and documentation required when an employee transitions from one employer to another while participating in the NC 457b Deferred Compensation Plan.

Who is required to file NC 457b DEFERRED COMPENSATION PLAN Change of Employer?

Employees who are switching employers and are participants in the NC 457b Deferred Compensation Plan are required to file the Change of Employer form.

How to fill out NC 457b DEFERRED COMPENSATION PLAN Change of Employer?

To fill out the NC 457b DEFERRED COMPENSATION PLAN Change of Employer form, employees should provide details such as their name, old and new employer information, account number, and any other required personal data, ensuring that all information is accurate and up-to-date.

What is the purpose of NC 457b DEFERRED COMPENSATION PLAN Change of Employer?

The purpose of filing the NC 457b DEFERRED COMPENSATION PLAN Change of Employer is to ensure that the participant's deferred compensation accounts are properly transferred and managed under the new employer, maintaining the benefits of the plan.

What information must be reported on NC 457b DEFERRED COMPENSATION PLAN Change of Employer?

The information that must be reported includes the participant's personal details, previous employer's information, new employer's information, the participant's account number, and any applicable changes in contribution amounts or investment options.

Fill out your nc 457b deferred compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nc 457b Deferred Compensation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.