NE DoR 20 2014 free printable template

Show details

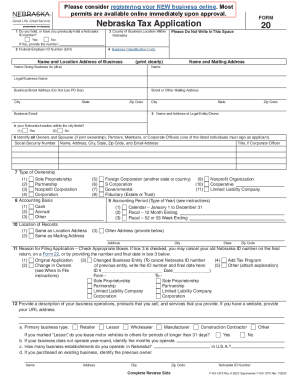

Instructions to Complete Form 20 Line 2. Generally you should have your federal employer ID number EIN prior to applying for a Nebraska tax program license. Important Message Nebraska Tax Application 1 Do you hold or have you previously held a Nebraska ID number c Yes c No If Yes provide the number 2 Federal Employer ID Number EIN Form 3 County of Business Location Within Please Do Not Write In This Space Nebraska Name and Location Address of Business print clearly Name Doing Business As dba...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE DoR 20

Edit your NE DoR 20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE DoR 20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE DoR 20 online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NE DoR 20. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE DoR 20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE DoR 20

How to fill out NE DoR 20

01

Obtain the NE DoR 20 form from the official Nebraska Department of Revenue website or local office.

02

Fill in your personal information including your name, address, and Social Security number.

03

Specify the type of return you are submitting (individual, business, etc.).

04

Provide details of your income, deductions, and any applicable credits.

05

Review the instructions for any additional schedules or documents required for your specific situation.

06

Double-check all entries for accuracy before signing the form.

07

Submit the completed form either electronically or by mail to the appropriate Nebraska Department of Revenue address.

Who needs NE DoR 20?

01

Individuals or businesses who need to report their income and pay taxes to the state of Nebraska.

02

Taxpayers who have earned income in Nebraska or have other tax obligations in the state.

03

Any entity requiring a formal record of tax liability for compliance or audit purposes.

Instructions and Help about NE DoR 20

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay inheritance tax in Nebraska?

Nebraska imposes an inheritance tax on a beneficiary's right to receive property from a deceased individual (a “decedent”). With certain exceptions discussed below, Nebraska's inheritance tax applies to all the assets owned by a decedent who is a Nebraska resident at the time of his or her death.

How do I see all tax forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do I avoid inheritance tax in Nebraska?

Nebraska Inheritance and Gift Tax If you leave money to your spouse, there is no inheritance tax. For other relationships, the following rates apply: Class 1: Parents, siblings, children, grandparents and any spouses/descendants of these relatives. These individuals pay 1% on any value over $40,000.

What are the 3 tax forms?

Three of them — the W-2, 1098 and 1099 — are IRS forms that may be sent to you with information you'll need in order to file your taxes. The others are IRS forms that you might need to fill out as part of preparing your tax return.

What is a Form 706N in Nebraska?

Nebraska Form 706N PDF Details This document allows for all associated individuals to agree on how assets should be divided after someone dies and offers detailed instructions on determining inheritance taxes in the state of Nebraska.

What is a Form 20 in Nebraska?

If you need to add sales and use tax collection to your existing Nebraska ID Number you will need to submit a Form 20, Nebraska Tax Application to the Nebraska Department of Revenue by mail or fax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NE DoR 20?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the NE DoR 20 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete NE DoR 20 online?

Filling out and eSigning NE DoR 20 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I complete NE DoR 20 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NE DoR 20. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NE DoR 20?

NE DoR 20 is a document or form used for reporting specific information required by the state of Nebraska, typically related to tax obligations or regulatory compliance.

Who is required to file NE DoR 20?

Entities or individuals who have certain tax obligations or who engage in specific business activities in Nebraska are required to file NE DoR 20.

How to fill out NE DoR 20?

To fill out NE DoR 20, provide the requested information regarding your business operations or tax obligations, ensuring accuracy and completeness before submission.

What is the purpose of NE DoR 20?

The purpose of NE DoR 20 is to collect information necessary for tax assessment and compliance monitoring within the state of Nebraska.

What information must be reported on NE DoR 20?

NE DoR 20 requires reporting information such as business income, expenses, tax identification numbers, and other relevant financial data as mandated by the state.

Fill out your NE DoR 20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE DoR 20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.