Get the free 2013 Nebraska Tax Calculation Schedule for Individual Income Tax

Show details

2013 Nebraska Tax Calculation Schedule for Individual Income Tax This calculation represents tax before any credits are applied. (Enter on line 15, Form 1040 N). Single Taxpayers If taxable income

We are not affiliated with any brand or entity on this form

Instructions and Help about 2013 nebraska tax calculation

How to edit 2013 nebraska tax calculation

How to fill out 2013 nebraska tax calculation

Instructions and Help about 2013 nebraska tax calculation

How to edit 2013 nebraska tax calculation

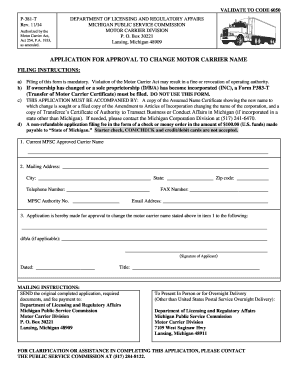

To edit the 2013 Nebraska tax calculation form, start by accessing the form through the pdfFiller platform. The editing tools available allow users to fill in personal information, adjust financial figures, and include appropriate signatures. Using pdfFiller ensures that changes are saved and that the form can be easily submitted once completed.

How to fill out 2013 nebraska tax calculation

Filling out the 2013 Nebraska tax calculation form requires accurate financial data and personal identification information. Begin by gathering all necessary documents, including income statements and previous tax returns. Enter this information into the specified fields, ensuring data is accurate to avoid penalties.

Latest updates to 2013 nebraska tax calculation

Latest updates to 2013 nebraska tax calculation

No recent significant updates have been reported for the 2013 Nebraska tax calculation form. Always verify with the Nebraska Department of Revenue for the most current information and future changes regarding tax forms and regulations.

All You Need to Know About 2013 nebraska tax calculation

What is 2013 nebraska tax calculation?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2013 nebraska tax calculation

What is 2013 nebraska tax calculation?

The 2013 Nebraska tax calculation form is used to determine the state income tax obligations of residents and some non-residents who earn income in Nebraska. This form collects detailed information about income, deductions, and credits, ensuring that the correct tax amount is calculated.

What is the purpose of this form?

The primary purpose of the 2013 Nebraska tax calculation form is to accurately assess the tax owed by the filer. It facilitates compliance with state tax laws by allowing individuals to report their income and claim any applicable deductions or credits. Proper completion helps avoid discrepancies that could lead to audits or legal complications.

Who needs the form?

Individuals who are residents of Nebraska or earned income within the state during the tax year must complete the 2013 Nebraska tax calculation form. If you have job income, self-employment income, or other taxable earnings, this form is necessary for accurate tax reporting.

When am I exempt from filling out this form?

You may be exempt from filing the 2013 Nebraska tax calculation form if your total income is below the minimum threshold set by the state. Specific exemptions also apply to recipients of certain benefits and low-income taxpayers, so it's essential to review the details provided by the Nebraska Department of Revenue.

Components of the form

The 2013 Nebraska tax calculation form includes multiple sections, such as personal identification information, income details, deductions, credits, and tax calculations. Each component is designed to ensure all relevant financial data is considered in determining overall tax liability.

Due date

The due date for filing the 2013 Nebraska tax calculation form is typically April 15 of the following year. However, it's advisable to confirm any changes or extensions on filing deadlines by checking with the Nebraska Department of Revenue, especially in case of unforeseen circumstances.

What are the penalties for not issuing the form?

Failing to file the 2013 Nebraska tax calculation form can result in significant penalties, including fines and interest on unpaid taxes. The state may also impose additional fees for late submissions, and repeated failures can lead to more severe actions, including garnishment of wages or liens on property.

What information do you need when you file the form?

When filing the 2013 Nebraska tax calculation form, have the following information ready: Social Security number, income statements (W-2s, 1099s), details of any deductions or credits, and other relevant financial documents. Ensuring this information is accurate is critical to a successful filing.

Is the form accompanied by other forms?

The 2013 Nebraska tax calculation form may require supplementary forms, such as schedules for itemized deductions or additional credits. Assess your individual situation to determine if these additional forms are necessary when submitting your tax return.

Where do I send the form?

Completed 2013 Nebraska tax calculation forms should be sent to the Nebraska Department of Revenue. It is advisable to use certified mail or a reliable delivery service to ensure the form reaches the appropriate office by the due date. Consult the Nebraska Department of Revenue's website for the correct mailing address.

See what our users say