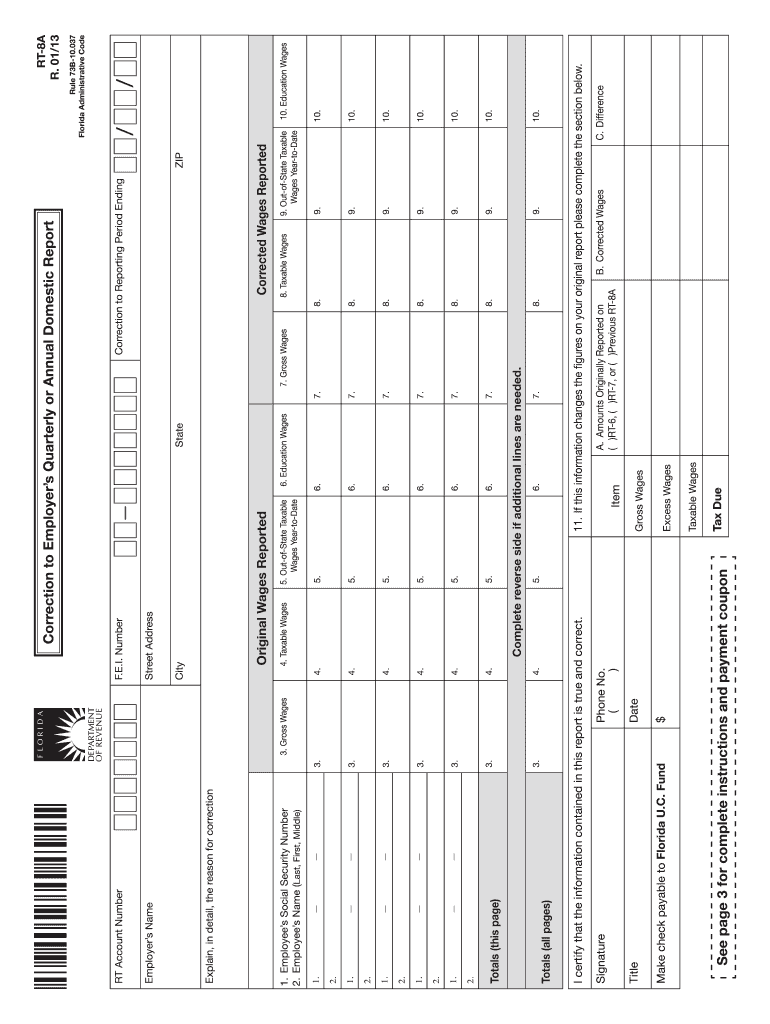

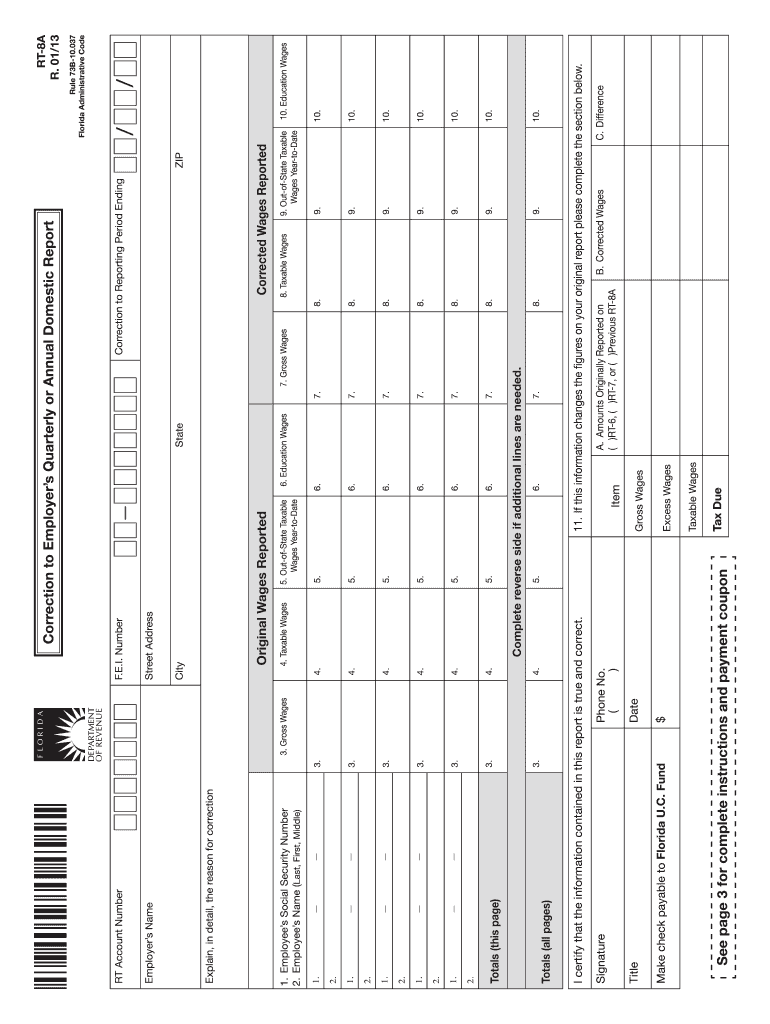

FL DoR RT-8A 2013 free printable template

Show details

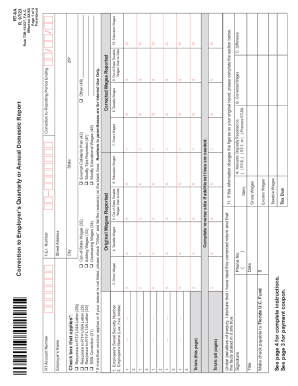

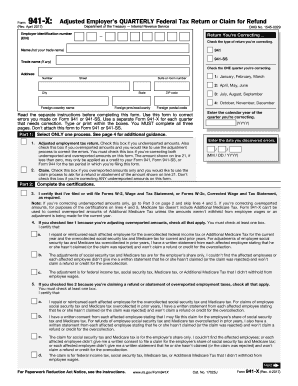

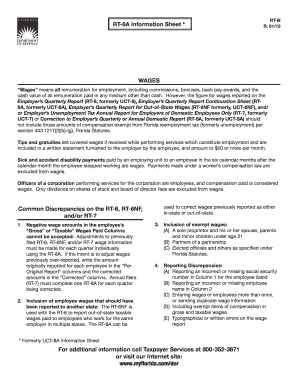

Nonprofit Educational Institutions Form RT-6EW formerly UCT-6EW. Annual filers will need to complete one RT-8A for each quarter being corrected. Payment Coupon Completion Instructions You do not need to complete the Payment Coupon if you owe no additional tax. The column will also indicate either the amount of the credit or the amount of additional tax due. This form RT-8A formerly UCT-8A is used to correct errors made on the originally submitted Employer s Quarterly Report RT-6 formerly...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR RT-8A

Edit your FL DoR RT-8A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR RT-8A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DoR RT-8A online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL DoR RT-8A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR RT-8A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR RT-8A

How to fill out FL DoR RT-8A

01

Download the FL DoR RT-8A form from the official Florida Department of Revenue website.

02

Begin filling out the identification section with your name, address, and taxpayer identification number.

03

Indicate the type of tax you are filing for by selecting the appropriate options on the form.

04

Complete the income and/or deduction sections as applicable to your situation.

05

Review the instructions provided on the form carefully to ensure all required fields are filled out.

06

Sign and date the form before submission.

Who needs FL DoR RT-8A?

01

Businesses or individuals who are required to report and remit specific tax obligations to the Florida Department of Revenue.

02

Tax preparers or accountants who manage tax filings for clients in Florida.

03

New businesses that need to register for tax identification and reporting.

Fill

form

: Try Risk Free

People Also Ask about

How to get full custody of a child without going to court Ontario?

You can try negotiation, collaborative family law, mediation or arbitration to come up with a plan you both agree on. If you can't agree on who should have decision-making responsibility of your children or on parenting time arrangements, you can go to court to have a judge decide and issue a parenting order.

What forms do I need to file for child custody in Ontario?

To start a new court case, you always have to fill out Form 8: Application (general) in addition to the form that your case is about. For example, if you have to go to court to start a case about child custody and access, you would fill out Form 8 and Form 35.1 Affidavit in Support of Claim for Custody or Access.

What is the cheapest way to get a divorce in Ontario?

Note: There is a fee of $224 to start a simple divorce. This fee can be paid by cash, cheque or money order payable to the Minister of Finance. If you can't afford to pay for this court fee, you can ask the court to waive your fees so you don't have to pay. You can do this by completing a Fee Waiver Request Form.

What is a Form 14 Ontario?

Form 14: Notice of Motion, where you list the orders you want the court to make if you want something other than to have the motion dismissed; or a Form 14B: Notice of Motion if you're asking for a procedural order such as more time to file your documents.

Do I need a lawyer to get a divorce in Ontario?

No you don't need a lawyer to divorce in Ontario, but wisdom would dictate that you do. Saying this, you are not required to use a lawyer or other professionals to Divorce in Ontario. Instead, consider how you can best use professionals to assist you in your process.

What forms do I need to fill out for divorce in Ontario?

Form 8A: Application (Divorce): The person filing the application is referred to as the applicant and your spouse is the respondent. Bring 3 copies of this completed form for filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my FL DoR RT-8A directly from Gmail?

FL DoR RT-8A and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send FL DoR RT-8A to be eSigned by others?

Once you are ready to share your FL DoR RT-8A, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the FL DoR RT-8A in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your FL DoR RT-8A in seconds.

What is FL DoR RT-8A?

FL DoR RT-8A is a form used by the Florida Department of Revenue for reporting certain tax information, specifically related to transient rentals.

Who is required to file FL DoR RT-8A?

Individuals or businesses that collect and remit Florida's transient rental taxes are required to file FL DoR RT-8A.

How to fill out FL DoR RT-8A?

To fill out FL DoR RT-8A, you need to provide accurate information regarding rental income, calculate the taxes owed, and submit the form to the Florida Department of Revenue, ensuring that all required sections are completed.

What is the purpose of FL DoR RT-8A?

The purpose of FL DoR RT-8A is to collect information and taxes related to transient rentals in Florida, helping the state enforce tax compliance among rental operators.

What information must be reported on FL DoR RT-8A?

The information that must be reported on FL DoR RT-8A includes rental income amounts, taxes collected, the number of rental days, and details about the property being rented.

Fill out your FL DoR RT-8A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR RT-8a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.