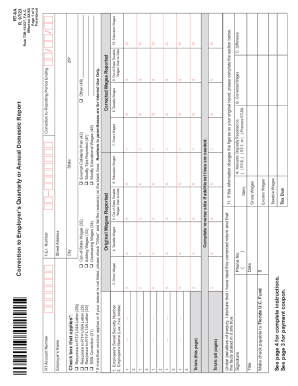

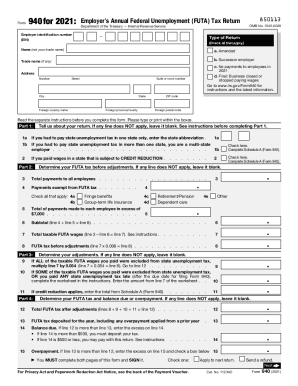

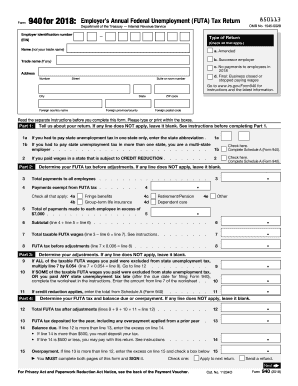

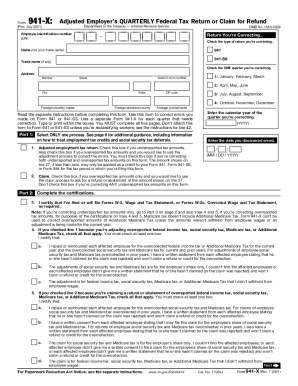

FL DoR RT-8A 2021 free printable template

Get, Create, Make and Sign rt 8a

Editing rt 8a online

Uncompromising security for your PDF editing and eSignature needs

FL DoR RT-8A Form Versions

How to fill out rt 8a

How to fill out FL DoR RT-8A

Who needs FL DoR RT-8A?

Instructions and Help about rt 8a

Election Commission's guidelines for application inform six eight who can file Form six first time applicant on attaining age of eighteen years or more on the first day of January of the year with reference to which the electoral roll is being revised person shifting his or her place of ordinary residence outside the assembly constituency in which he or she is already registered person who is eligible for registration eighteen years and above and ordinarily resident in the area, but the name does not appear in the e role of that assembly constituency who can file form 8a a person whose name is already included in the current electoral roll can file the application in form 8a for transposition of his or her entry from one part to another part within the same assembly constituency that is when a person shifts residence within the same assembly constituency when form six or eight a can be fired during summary revision the application can be filed after draft publication of electoral roll of the constituency for filing claims and objections only one copy of the application is to be filed if submitted during summary revision period during non revision period application must be filed in duplicate where to file form six and eight pain during revision period the application can be filed at the designated locations where the draft electoral roll is displayed mostly polling station locations post offices as well as the offices of the electoral registration officer and assistant electoral registration officer of the constituency during non revision period application can be filed with the electoral registration officer or other offices as may be specified how to fill form 6 camp; 8 the application should be addressed to the electoral registration officer of the constituency in which you seek registration or transposition the name of the constituency should be mentioned in the blank space name with documentary proof the name as it should appear in the electoral roll and the electors photo identity card EP IC should be furnished the full name except the surname should be written in the first box and surname should be written in the second box in case you do not have a surname just write the given name cast should not be mentioned except when a cast name is used as part of the electors name or a surname honorific appellations like Jared pyrimidine Sari Matey Kumar icon Begum pundit etc should not be mentioned age with documentary proof the age of the applicant should be 18 or more on 1st of January of the earth the age should be indicated in years and months that is a person born on or up to 1st January 1991 we'll be eligible for inclusion in the electoral roll which is being revised with reference to first January 2009 persons born on 2nd January 1991 or thereafter up to 1st January 1992 shall be eligible for inclusion during the next revision with reference to 1st January 2010 sex right your sex in full in the space provided for example male/female others...

People Also Ask about

How do I apply for a Florida reemployment tax number?

Where do I file RT 6 in Florida?

What is Florida Department of Revenue reemployment tax?

Is Florida reemployment the same as unemployment?

What is the phone number for Florida reemployment tax?

Who needs to pay reemployment tax in Florida?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rt 8a in Gmail?

How can I get rt 8a?

How do I edit rt 8a on an iOS device?

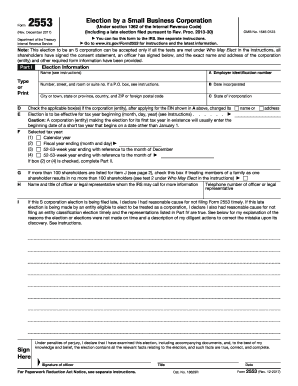

What is FL DoR RT-8A?

Who is required to file FL DoR RT-8A?

How to fill out FL DoR RT-8A?

What is the purpose of FL DoR RT-8A?

What information must be reported on FL DoR RT-8A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.