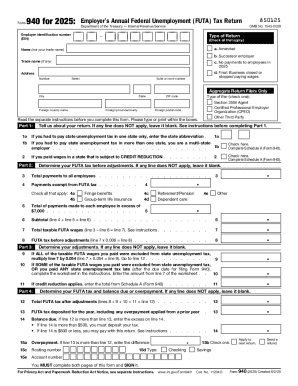

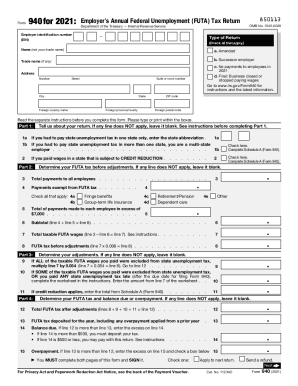

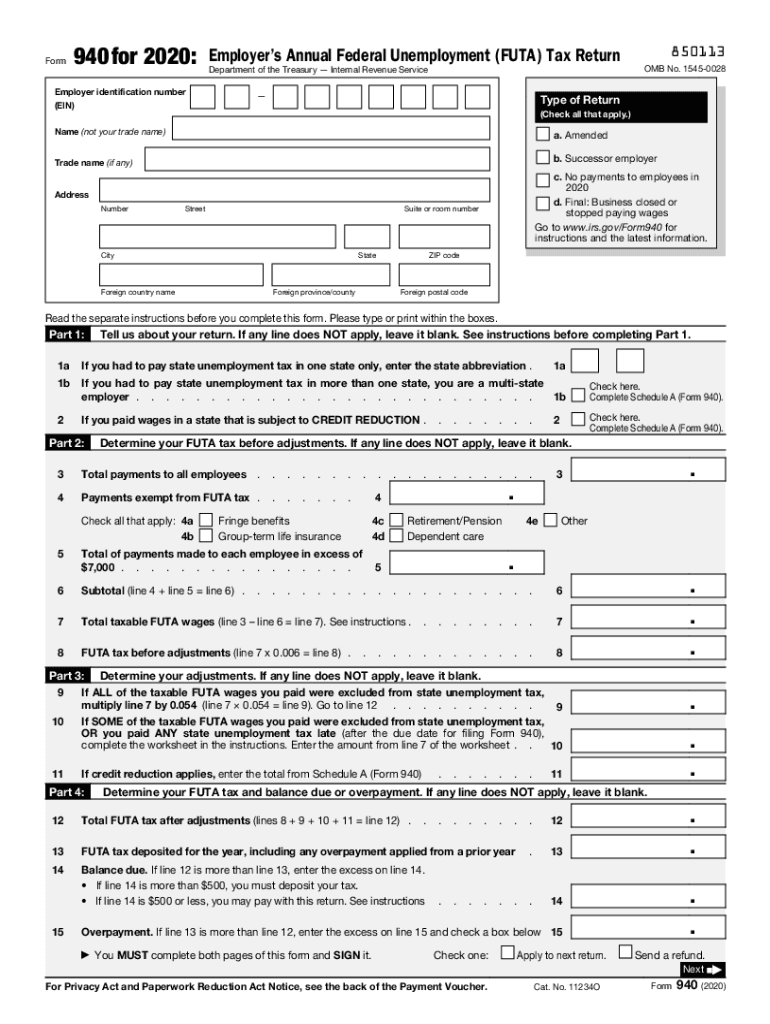

IRS 940 2020 free printable template

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

About IRS previous version

What is IRS 940?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 940

What should I do if I realize I've made a mistake on my IRS 940 after submitting it?

If you find an error on your IRS 940 after submission, you need to file an amended return using Form 940-X. This allows you to correct previous mistakes and ensure accurate reporting. Make sure to clearly indicate the corrections made in the appropriate sections.

How can I track the status of my IRS 940 after I have filed it?

To track the status of your IRS 940, you can use the IRS 'Where's My Refund?' tool if you filed an amended return. Regular returns can be verified through the IRS Customer Service. Keep an eye out for any e-file rejection codes if applicable, as these require immediate attention.

Are there any penalties for e-filing my IRS 940 incorrectly?

Yes, if you submit your IRS 940 electronically and it is rejected or contains errors, you may face penalties. It's critical to verify that all information is accurate before submission to avoid these costs. Consult IRS guidelines for specific details on service fees and potential penalties.

Can I use someone else's information to file an IRS 940 on their behalf?

Yes, if you are authorized through a power of attorney (POA), you can file an IRS 940 for someone else. Ensure all necessary permissions and documentation are in place to avoid any complications during the filing process.

See what our users say