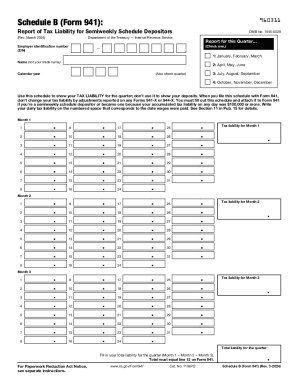

What is Form 941 Schedule B?

It is an attachment to Form 941 and used to report how much an employer is withholding from employees’ pay for taxes, specifically federal income tax, social security tax, and Medicare tax, during each quarter.

Who should file Form 941 Schedule B?

Form 941 Schedule B must be filed by semiweekly schedule depositors. This includes employers that have an accumulated tax liability of $100,000 or more on a particular day during this or the prior calendar year, or that reported more than $50,000 of employment taxes. Employers that qualify as semiweekly schedule depositors for at least one month must prepare the document for the entire quarter.

What information do you need to file Form 941 Schedule B?

To prepare Form 941 Schedule B, you need to have the following information at hand:

- Employer Identification Number

- Tax liability for every month in a quarter.

How do I fill out Form 941 Schedule B in 2018?

Schedule B tax form doesn't include requirements for a filer to provide significant information about themselves. The information needed includes an EIN, name, as well as the tax liabilities per month and quarter. However, there are more than 90 fields for inserting data about tax liability for every day in a month during a quarter. Still, a filer is required to provide information only for days they are paying employees. Consider filling the template out online:

- Click Get Form.

- Provide the employer information at the top of the template.

- Start filling in data about your tax liability.

- Calculate the liability for every month separately and fill this amount in fields on the right side of the template.

- Calculate the sum of the liability for three months and insert it in the last Total liability for the quarter field.

- Double-check the correctness of data added to the document.

- Click Done and export the file using the options in the right sidebar.

Is Form 941 Schedule B accompanied by other forms?

There are no documents that accompany the Schedule B tax form. It accompanies Form 941.

When is Form 941 Schedule B due?

Schedule B tax form does not have any particular deadlines. However, it must be filed as an attachment to Form 941 that is submitted quarterly: April 30, July 31, October 31, and January 31.

Where do I send Form 941 Schedule B?

Schedule B tax form, as an accompaniment of Form 941, must be sent to the regional Internal Revenue Service office. Visit the IRS website to determin what regional office is responsible for processing your tax records.