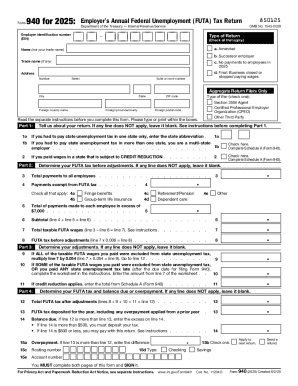

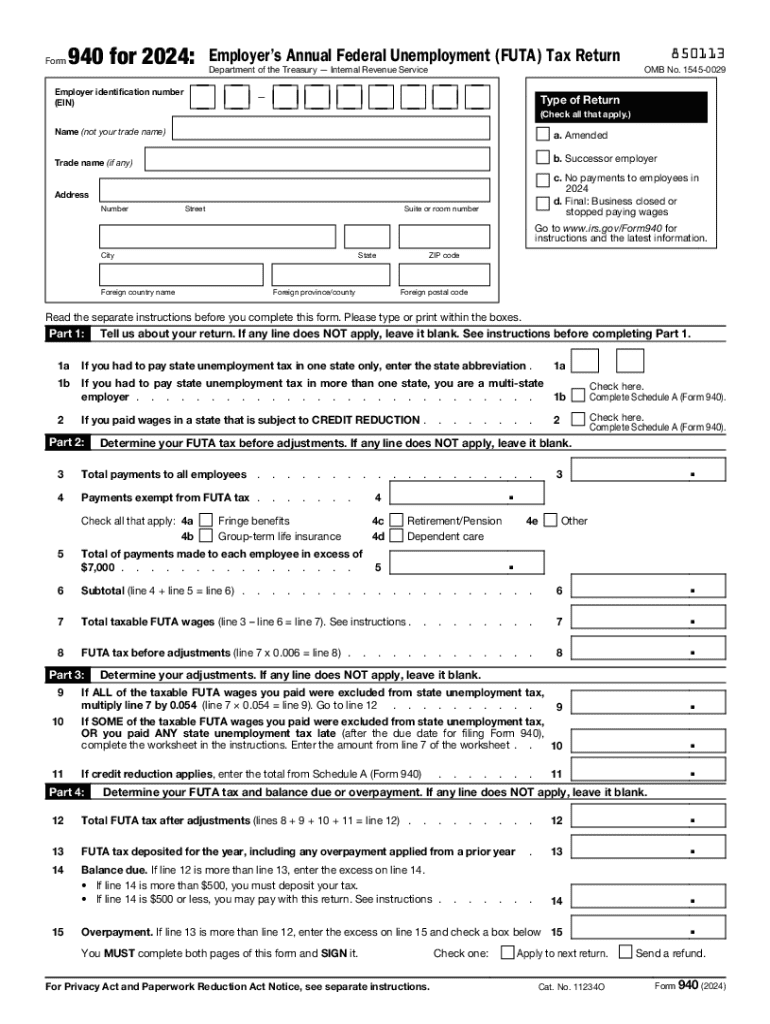

IRS 940 2024 free printable template

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

Latest updates to IRS 940

About IRS previous version

What is IRS 940?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 940

What should I do if I discover an error after filing my IRS 940?

If you discover an error on your IRS 940 after submission, you should file an amended return using Form 940-X. This form allows you to correct mistakes in taxable wages, tax liability, or other details. Ensure you explain the nature of the changes and retain documentation to support your corrections.

How can I track the status of my filed IRS 940?

To track the status of your submitted IRS 940, you can use the IRS e-File Status tool available on their website. This tool helps verify if your filing was received and processed. Keep in mind you'll need the details of your submission to access the status effectively.

Are there any specific legal requirements for filing an IRS 940 on behalf of someone else?

When filing an IRS 940 on behalf of another person or entity, you must include a Power of Attorney (POA) document that authorizes you to act on their behalf. Ensure that you comply with all applicable laws regarding data protection and privacy when handling their information.

What common mistakes should I watch out for when submitting IRS 940?

Some common mistakes when submitting IRS 940 include incorrect reporting of employee wages, failing to use the correct tax rates, and overlooking state unemployment contributions. To avoid these errors, double-check your calculations and ensure all information aligns with your payroll records.

What are the technical requirements for e-filing the IRS 940?

E-filing the IRS 940 requires compliant tax preparation software that supports e-filing and is compatible with current IRS standards. Ensure your software is updated to the latest version and that your internet connection is stable to avoid submission issues.

See what our users say