Building On Own Land Calculation Worksheet 2011-2025 free printable template

Show details

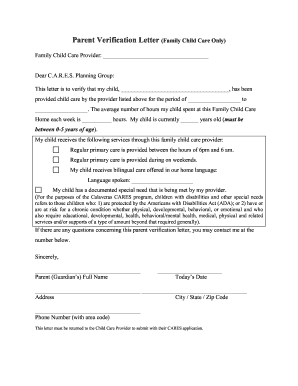

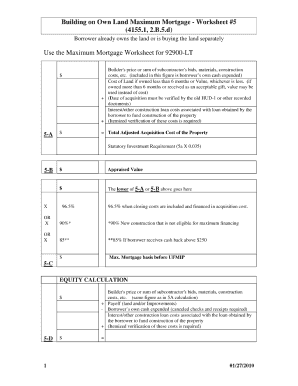

This document provides a calculation worksheet for borrowers who own or are buying land separately for stick-built and manufactured homes, detailing the costs associated with construction loans, acquisition

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign building on own land

Edit your building on own land form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your building on own land form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing building on own land online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit building on own land. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out building on own land

How to fill out FHA build on own:

01

Gather all the necessary documentation: Before filling out the FHA build on own application, make sure you have all the required documents handy. This includes identification proof, income statements, credit history, and a detailed description of the construction project.

02

Understand the eligibility criteria: Familiarize yourself with the eligibility requirements for FHA build on own. This program is designed for individuals who want to construct their own home using an FHA-insured mortgage loan. You should meet the minimum credit score, debt-to-income ratio, and other criteria set by the FHA.

03

Complete the application form: Fill out the FHA build on own application form accurately and completely. Provide all the necessary details about yourself, your income, assets, and the construction project. Double-check the information you input to ensure accuracy.

04

Attach the required documents: Make sure to attach all the required documents along with your application. These may include W-2 forms, tax returns, bank statements, proof of income, construction plans, and permits. Ensure that all documents are up to date and valid.

05

Submit the application: Once you have filled out the application form and attached all the necessary documents, submit your FHA build on own application. You can either submit it online through the FHA's website or submit a hard copy to the appropriate FHA office.

Who needs FHA build on own:

01

Individuals looking to build their own home: FHA build on own is specifically for individuals who want to construct their own home. If you have a specific design or vision for your home and want to be involved in the construction process, this program can be suitable for you.

02

Borrowers who require financing: FHA build on own provides borrowers with the opportunity to obtain financing for their self-built home. If you don't have enough cash on hand to finance the construction, an FHA-insured mortgage loan can help you fund the project.

03

Those who meet the eligibility criteria: To qualify for FHA build on own, you need to meet the FHA's eligibility criteria. This includes having a minimum credit score, a stable source of income, and a debt-to-income ratio that falls within the FHA's guidelines.

In summary, filling out the FHA build on own application involves gathering the required documents, understanding the eligibility criteria, completing the application form accurately, attaching the necessary documents, and submitting the application. This program is suitable for individuals who want to construct their own home and require financing, as long as they meet the FHA's eligibility requirements.

Fill

form

: Try Risk Free

People Also Ask about

How to build a house with FHA?

What are the Requirements for Building a House with an FHA Loan? A down payment of at least 3.5%. A credit score of at least 580. A steady source of documented income and employment history. To meet the FHA debt-to-income ratio limits. To use the home as your primary residence.

What is the FHA 100 mile rule?

Job Relocation and FHA 100 Mile Rule The FHA 100 mile rule allows a buyer to retain their FHA loan on their prior residence and finance another home with another FHA mortgage. In order to obtain another FHA mortgage without selling the other home, the buyer must: Relocate for an employment-related reason.

How many active FHA loans can you have?

So while there's no limit to how many FHA mortgages you can get during your lifetime, you can generally only have one FHA loan at a time because you can only have one primary residence. This restriction helps keep the loan program – and its more lenient requirements – from being used to purchase investment properties.

Can I use FHA if I already own a home?

Since the FHA loan requirements are relaxed, most people find that it's a great way to buy their first home, but it can be used on any home — even a second home if you already own one.

How long do you have to wait to get another FHA loan?

After going through foreclosure, you must wait three years before you can be eligible for another FHA loan. If you've been through bankruptcy, you must wait two years before you can apply for a second FHA loan.

How many FHA loans can one person have?

While you can apply for multiple FHA loans in your lifetime, you can usually only have one at a time. This prevents borrowers from using these loans, designed for people buying a primary residence, to purchase investment properties.

What document must the builder provide to the mortgage company on an FHA new construction?

The builder must provide an appraisal certificate to the mortgage company on an FHA new construction loan prior to closing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my building on own land in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your building on own land and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the building on own land in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your building on own land right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out building on own land on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your building on own land, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is fha building on your?

FHA stands for Federal Housing Administration. FHA building on your refers to the process of assessing and reporting the condition of a building that is financed or insured by the FHA.

Who is required to file fha building on your?

Property owners, property managers, or anyone responsible for the upkeep of a building that is financed or insured by the FHA are required to file FHA building on your.

How to fill out fha building on your?

FHA building on your can be filled out by providing detailed information about the condition of the building, any maintenance or repairs that have been done, and any potential risks or hazards.

What is the purpose of fha building on your?

The purpose of FHA building on your is to ensure that buildings financed or insured by the FHA are maintained in a safe and habitable condition.

What information must be reported on fha building on your?

Information such as the condition of the building, any maintenance or repairs that have been done, any potential risks or hazards, and any other relevant details must be reported on FHA building on your.

Fill out your building on own land online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Building On Own Land is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.