Get the free 8 Blind If you (or your spouseRDP) are visually impaired, enter 1 - ftb ca

Show details

Get instructions for 540 Form

“What's New” for 540 Form

For Privacy Notice, get FT 1131 ENG/SP.

FORM

California Resident Income Tax Return 2013

540 C1 Side 1

Fiscal year filers only: Enter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8 blind if you

Edit your 8 blind if you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8 blind if you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

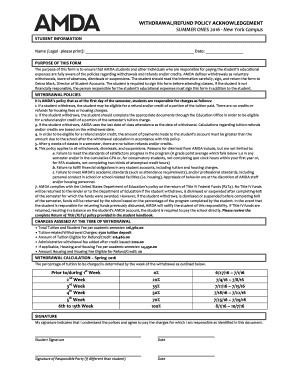

How to edit 8 blind if you online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 8 blind if you. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 8 blind if you

How to fill out 8 blind if you:

01

Start by measuring the width and height of your window where you plan to install the blind.

02

Choose the type of 8 blind that suits your needs, such as roller blinds, Venetian blinds, or Roman blinds.

03

Determine whether you want the blind to be mounted inside the window frame or outside.

04

Select the material and color of the blind that complements your interior décor.

05

Consider the level of privacy and light control you require, and choose the appropriate opacity of the blind.

06

Follow the manufacturer's instructions to assemble any necessary components and attach the blind to the brackets or mounting hardware.

07

Test the blind by raising and lowering it to ensure it operates smoothly.

08

Adjust the blind's length if necessary by removing any excess material.

Who needs 8 blind if you:

01

Homeowners who prioritize privacy and light control may opt for 8 blind to regulate the amount of sunlight entering their living spaces.

02

Those seeking to update their home's interior design often choose 8 blind as a stylish window treatment option.

03

Individuals living in apartments or houses with large windows might benefit from using 8 blind to maintain privacy while still allowing natural light into their spaces.

04

Office spaces can also benefit from the use of 8 blind, as they provide glare reduction on computer screens and promote a focused working environment.

05

People who are sensitive to external noise may find that 8 blind offer an additional layer of sound insulation when closed.

It is important to note that the specific need for 8 blind may vary depending on individual preferences and requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8 blind if you?

8 blind if you refers to the form 8880, also known as the Credit for Qualified Retirement Savings Contributions form.

Who is required to file 8 blind if you?

Individuals who make eligible contributions to a retirement account such as a 401(k) or IRA may need to file form 8880 to claim the retirement savings credit.

How to fill out 8 blind if you?

To fill out form 8880, individuals need to provide information about their retirement account contributions and calculate the credit amount based on their income.

What is the purpose of 8 blind if you?

The purpose of form 8880 is to allow individuals to claim a tax credit for contributions made to a retirement account, encouraging saving for retirement.

What information must be reported on 8 blind if you?

Information such as the amount of contributions made to a retirement account, adjusted gross income, and the credit amount calculated based on income limits must be reported on form 8880.

How can I send 8 blind if you to be eSigned by others?

When you're ready to share your 8 blind if you, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute 8 blind if you online?

pdfFiller makes it easy to finish and sign 8 blind if you online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in 8 blind if you?

With pdfFiller, it's easy to make changes. Open your 8 blind if you in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your 8 blind if you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8 Blind If You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.