Get the free Sales in interstate commerce (from Schedule B) - tax ohio

Show details

OTP 2 Rev. 9/14 P.O. Box 530 Columbus, OH 43216-0530 Other Tobacco Products Tax Return Print or Type Tobacco Products 1. 2. 3. 4. 5. 6. 7. Total purchases (from Schedule A) ...........................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales in interstate commerce

Edit your sales in interstate commerce form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales in interstate commerce form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales in interstate commerce online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sales in interstate commerce. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales in interstate commerce

How to fill out sales in interstate commerce?

01

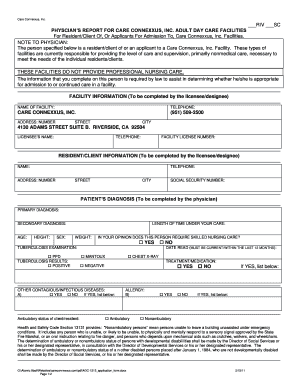

Identify the items or services being sold: Before filling out the sales form, you need to have a clear understanding of the items or services that are being sold across state lines. This includes gathering all relevant information such as descriptions, quantities, and prices.

02

Determine the applicable legal requirements: interstate commerce involves transactions that cross state lines, so it is essential to be aware of the legal requirements that apply. Research and familiarize yourself with any specific laws or regulations that must be followed while conducting interstate sales.

03

Complete the necessary paperwork: Fill out the sales form accurately and completely. Include all required information such as the names and addresses of both the buyer and seller, the date of the transaction, a detailed description of the items or services, quantities, prices, and any applicable taxes or fees.

04

Calculate and record the costs: If there are any taxes or fees associated with the transaction, make sure to calculate them correctly and include them in the total cost. This will ensure that the sales form is accurate and compliant with interstate commerce regulations.

05

Keep copies of all documentation: It is important to keep copies of all documentation related to interstate sales, including the completed sales form, invoices, receipts, and any other relevant paperwork. These records will serve as proof of the transaction and can be useful for future reference or audits.

Who needs sales in interstate commerce?

01

Businesses operating across state lines: Any business that engages in the sale of goods or services across state lines needs to be aware of and comply with the requirements of sales in interstate commerce. This includes online retailers, manufacturers, wholesalers, and distributors.

02

Individuals selling goods or services across state lines: Even individuals who engage in occasional sales across state lines, such as selling products on online platforms or through direct marketing, need to be familiar with the regulations around interstate commerce sales.

03

Service providers operating in multiple states: Service-based businesses that provide services in different states, such as consulting services or transportation services, are also subject to the rules and regulations of sales in interstate commerce.

In summary, anyone involved in the sale of goods or services that cross state lines, whether it's a business or an individual, needs to understand how to fill out sales forms accurately and ensure compliance with interstate commerce regulations. Keeping copies of all documentation is essential for record-keeping purposes, audits, and ensuring transparency in the sale of goods or services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sales in interstate commerce?

Sales in interstate commerce refers to the buying and selling of goods or services between different states within the United States.

Who is required to file sales in interstate commerce?

Businesses engaged in selling products or services across state lines are required to file sales in interstate commerce.

How to fill out sales in interstate commerce?

To fill out sales in interstate commerce, businesses need to accurately report the total sales revenue generated from interstate transactions.

What is the purpose of sales in interstate commerce?

The purpose of sales in interstate commerce is to track and regulate the flow of goods and services between states for taxation and regulatory purposes.

What information must be reported on sales in interstate commerce?

Businesses must report detailed information on the nature of the products or services sold, the states involved in the transaction, and the total revenue generated.

How can I send sales in interstate commerce for eSignature?

When your sales in interstate commerce is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out the sales in interstate commerce form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign sales in interstate commerce. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit sales in interstate commerce on an Android device?

With the pdfFiller Android app, you can edit, sign, and share sales in interstate commerce on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your sales in interstate commerce online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales In Interstate Commerce is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.