CT DRS OS-114BUT 2014 free printable template

Show details

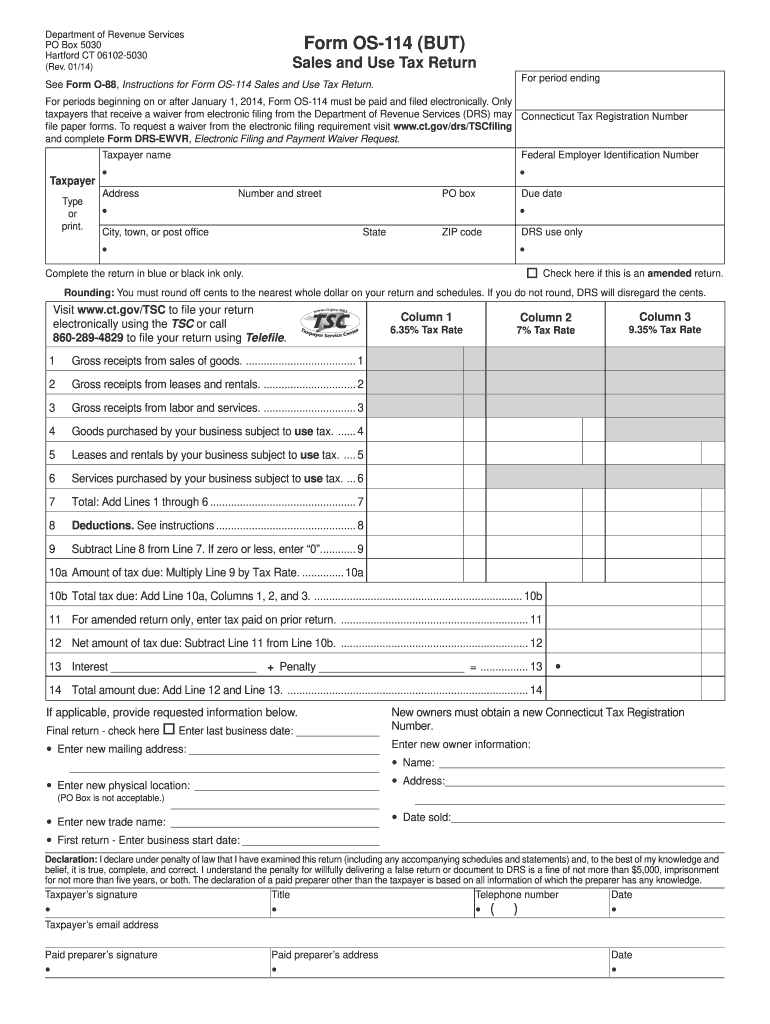

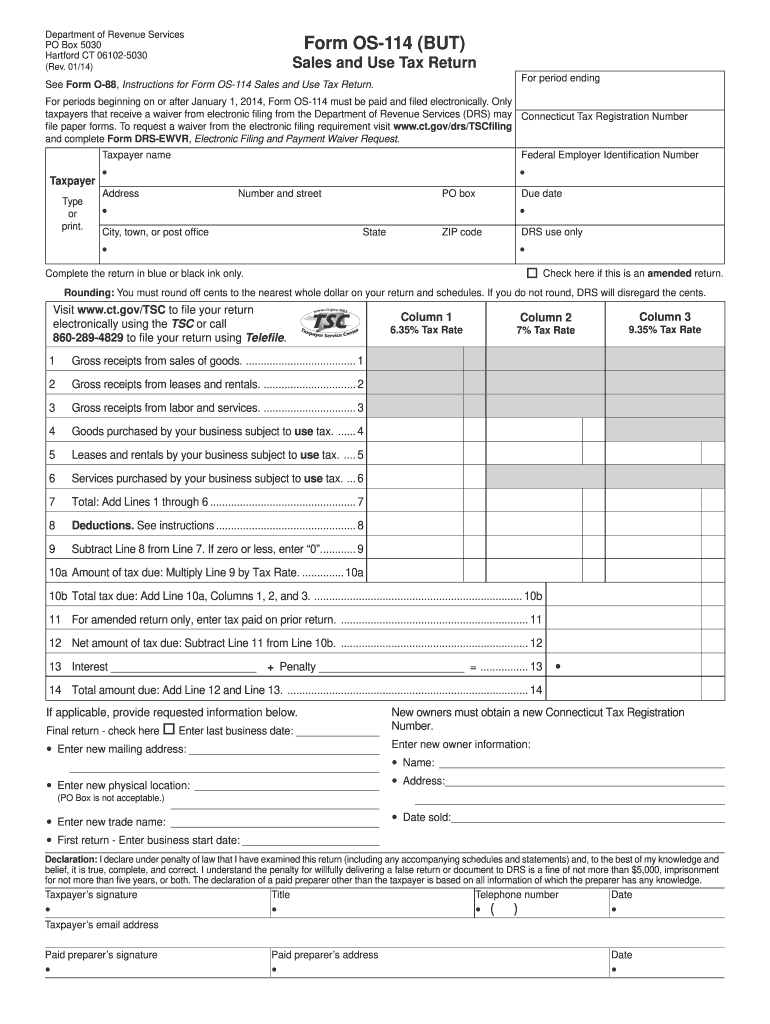

Department of Revenue Services PO Box 5030 Hartford CT 06102-5030 Form OS-114 BUT Sales and Use Tax Return Rev. 01/14 For period ending See Form O-88 Instructions for Form OS-114 Sales and Use Tax Return. For periods beginning on or after January 1 2014 Form OS-114 must be paid and led electronically. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge. Taxpayer s signature Taxpayer s email address Title Paid preparer...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS OS-114BUT

Edit your CT DRS OS-114BUT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS OS-114BUT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS OS-114BUT online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT DRS OS-114BUT. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS OS-114BUT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS OS-114BUT

How to fill out CT DRS OS-114BUT

01

Begin by downloading the CT DRS OS-114BUT form from the Connecticut Department of Revenue Services website.

02

Fill out the identifying information at the top of the form, including your name, address, and contact information.

03

Provide details about the type of income or earnings for which you are reporting.

04

Complete any relevant sections regarding deductions or allowances.

05

Double-check your entries for accuracy, ensuring that all required fields are filled out appropriately.

06

Sign and date the form to certify that the information is correct.

07

Submit the completed form according to the instructions provided, either electronically or via mail.

Who needs CT DRS OS-114BUT?

01

Individuals or businesses who need to report specific types of income or earnings in Connecticut.

02

Tax professionals filing on behalf of clients who are required to complete this form.

03

Anyone seeking to claim deductions or allowances associated with reported income.

Fill

form

: Try Risk Free

People Also Ask about

How do I file taxes with LaTAP?

How do I file a return in LaTAP? Once logged in to LaTAP, select the tax-specific account at the bottom middle of the LaTAP home page. From the account screen, click on the “File Now” link from the “Period List” for the tax period which the return is being filed.

Why would I get a letter from Louisiana Department of Revenue?

If my tax return is audited, how will I be notified? If your tax return is under audit, you will receive written correspondence in the mail from an LDR tax auditor with detailed information concerning your audit. An auditor may call you first to verify contact information.

Who needs a Louisiana Revenue account number?

Any corporation not yet registered with the Louisiana Secretary of State's Office wanting to obtain only a Corporate Income and Fran- chise Tax account, and all businesses registering for any tax type must complete this form to be properly registered.

Are you required to file a Louisiana resident tax return?

Individuals who are domiciled, reside, or have a permanent residence in Louisiana are required to file a Louisiana individual income tax return and report all of their income and pay Louisiana income tax on that income, if applicable.

Who must file a Louisiana income tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

Who must file a Louisiana tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CT DRS OS-114BUT without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your CT DRS OS-114BUT into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out the CT DRS OS-114BUT form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CT DRS OS-114BUT and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit CT DRS OS-114BUT on an Android device?

You can make any changes to PDF files, like CT DRS OS-114BUT, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is CT DRS OS-114BUT?

CT DRS OS-114BUT is a form used in Connecticut for reporting the use of 'butter' or similar products in manufacturing or retail operations, specifically related to the state tax obligations.

Who is required to file CT DRS OS-114BUT?

Businesses that manufacture or sell products containing butter or similar substitutes are required to file CT DRS OS-114BUT to report their sales and tax liabilities.

How to fill out CT DRS OS-114BUT?

To fill out CT DRS OS-114BUT, businesses must provide their identification information, sales figures for the reporting period, and calculate any applicable taxes. Ensure to follow the specific instructions included with the form.

What is the purpose of CT DRS OS-114BUT?

The purpose of CT DRS OS-114BUT is to ensure compliance with state tax regulations regarding the sale and distribution of butter and related products, facilitating proper tax collection.

What information must be reported on CT DRS OS-114BUT?

The information that must be reported on CT DRS OS-114BUT includes the business's contact details, total sales of butter and substitute products, total tax collected, and any deductions that may apply.

Fill out your CT DRS OS-114BUT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS OS-114but is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.