NO JGOFS Bank Information Form 2002-2025 free printable template

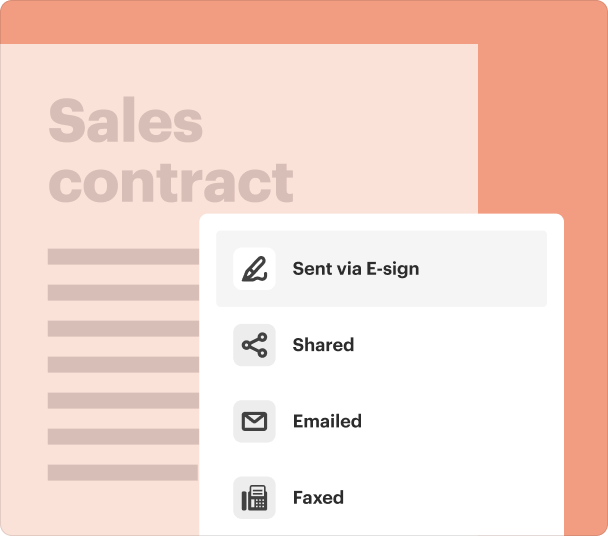

Fill out, sign, and share forms from a single PDF platform

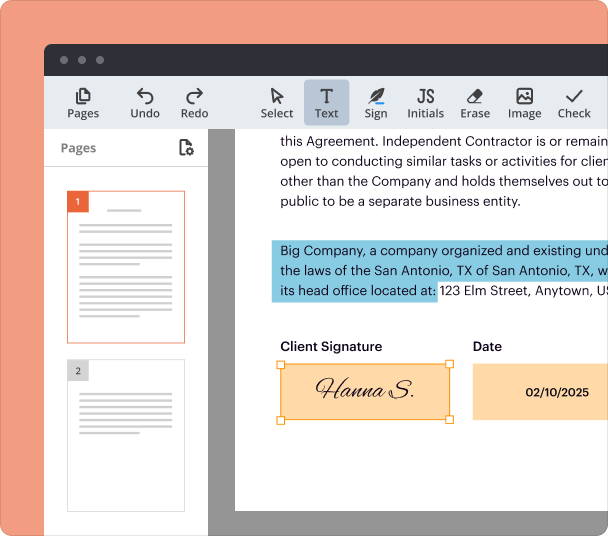

Edit and sign in one place

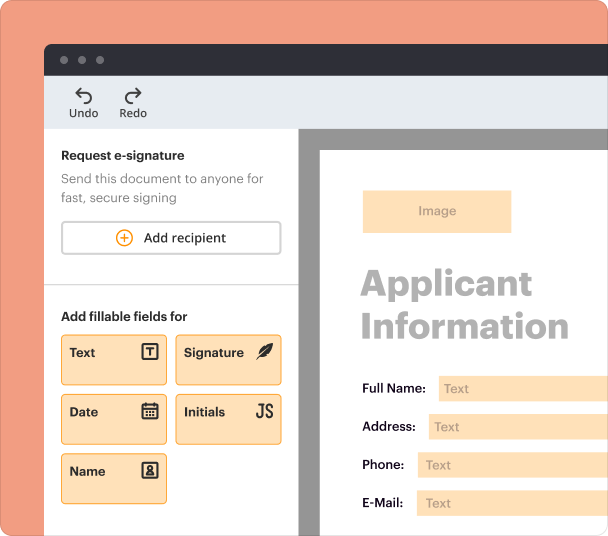

Create professional forms

Simplify data collection

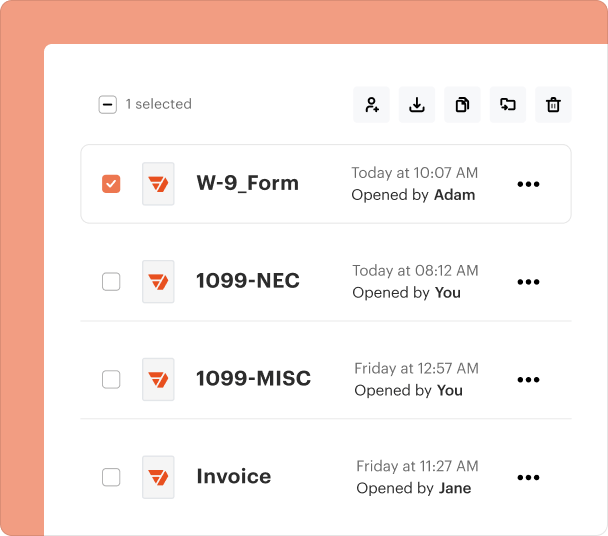

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

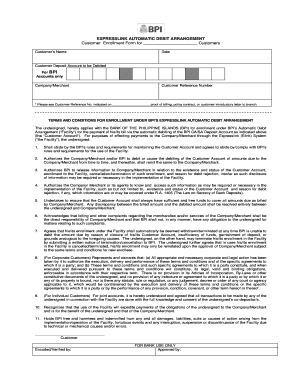

Understanding the No JGOFS Bank Information Form

What is the No JGOFS Bank Information Form?

The No JGOFS Bank Information Form is a document designed to collect essential banking details required for facilitating transactions. This form is significant in ensuring accurate and efficient transfers of funds between banks, particularly for organizations like the Joint Global Ocean Flux Study (JGOFS). The details included typically encompass the recipient's name, bank information, and routing codes, which are crucial for processing electronic payments.

Required Documents and Information

Filling out the No JGOFS Bank Information Form requires specific information to ensure proper handling of transactions. Key details needed include the individual's name for the account, private address, bank name, and position within the organization, if applicable. Additionally, the form requires the bank account number and routing details, such as the SWIFT code, ABA number, or equivalent, depending on the country.

How to Fill the No JGOFS Bank Information Form

Filling out the No JGOFS Bank Information Form is a straightforward process that involves entering specific banking and personal details in designated fields. Users should start with basic information, including their name and private address, followed by their bank details. It is essential to ensure the accuracy of routing codes since mistakes can delay transactions. Users are advised to verify the information with their bank before submission to prevent errors.

Best Practices for Accurate Completion

To ensure the successful submission of the No JGOFS Bank Information Form, adhering to best practices is crucial. Double-check each field for accuracy, particularly account numbers and routing details. It can be beneficial to use clear and legible handwriting or to fill the form out electronically. Additionally, keeping a copy of the completed form for personal records can help in tracking submissions. Users should also consult their bank if uncertain about any details required in the form.

Common Errors and Troubleshooting

Common errors in completing the No JGOFS Bank Information Form include inaccuracies in account numbers, missing required fields, and incorrect routing codes. Such mistakes can lead to delayed payments and financial complications. If users experience issues during submission, reviewing the entries for completeness and confirming all details with the respective bank can often resolve these concerns. Being thorough during the filling process helps in avoiding these pitfalls.

Benefits of Using the No JGOFS Bank Information Form

Using the No JGOFS Bank Information Form presents several advantages. It standardizes the process of requesting and providing bank information, thereby reducing the chances of errors. The form also supports efficient funds transfer, which can save time compared to traditional check methods. Ensuring accuracy through this structured format allows for quicker processing of payments, essential for organizations that require timely fund allocations.

Frequently Asked Questions about Bank Information Document

What is the purpose of the No JGOFS Bank Information Form?

The form is used to gather essential banking details for efficient fund transfers between banks.

How can I ensure that the No JGOFS Bank Information Form is filled out correctly?

Verify all information with your bank and double-check each field for accuracy before submission.

pdfFiller scores top ratings on review platforms