Get the free CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIV...

Show details

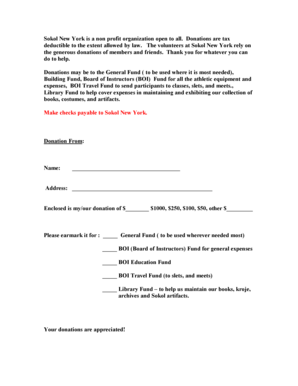

This document allows participants to request a withdrawal or rollover from their group/supplemental retirement annuity for private employer plans, providing necessary details and instructions for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash withdrawal or rollover

Edit your cash withdrawal or rollover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash withdrawal or rollover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash withdrawal or rollover online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cash withdrawal or rollover. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash withdrawal or rollover

How to fill out CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS

01

Obtain the CASH WITHDRAWAL OR ROLLOVER form from your retirement plan provider.

02

Read the instructions carefully to understand the options available for withdrawal or rollover.

03

Complete your personal information section including your name, account number, and contact details.

04

Indicate your choice of payment method: either direct cash withdrawal or rollover to another retirement account.

05

If choosing a rollover, provide the details of the receiving account, including account number and institution name.

06

Sign and date the form to certify that all information is accurate.

07

Submit the completed form to your retirement plan provider as instructed.

Who needs CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS?

01

Employees who wish to withdraw funds from their retirement accounts.

02

Individuals seeking to rollover their retirement savings to another account.

03

Former employees who want to access their retirement funds after leaving a job.

04

Anyone who has a group or supplemental retirement annuity plan and needs to manage their funds.

Fill

form

: Try Risk Free

People Also Ask about

How do I cash out my retirement annuity?

8 steps to withdrawing your retirement annuity from South Africa Notify SARS. Calculate your deemed capital gains tax. Submit to an audit by SARS. Apply for emigration tax clearance status. Follow the three-year rule. Submit your retirement annuity withdrawal request. Wait for SARS' tax directive. Withdraw your funds.

How can I get my money out of TIAa?

If your plan allows it, you can withdraw money online. If an online withdrawal is not an option, call us at 800-842-2252. Please be sure to contact us two to three months before you must receive your withdrawal to ensure you receive funds by the required deadline.

Can I take money out of my TIAA account?

Lump sum withdrawals are available within 120 days after termination of employment with a 2.5% surrender charge. All other transfers and withdrawals must be paid in 10 annual installments (not subject to a surrender charge). Lump sum transfers and withdrawals are available at any time with no surrender charges.

What is a group supplemental retirement annuity?

Group Supplemental Retirement Annuities (403-b) This plan permits you to set aside tax deferred funds over and above the amounts you are accumulating in your retirement plan. As with the TDA described above, this is a salary reduction program, and amounts contributed will not be taxed until you withdraw them.

Can you cash out an individual retirement annuity?

If you find yourself in a situation where you need cash, your annuity contract provides you with an option. But pulling money from your annuity before you reach age 59½ does come with a cost. If you take out money early, be aware that income taxes may not be the only consequence you'll have to face.

What are the rules for withdrawing from TIAA traditional?

If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. The tool assumes that you will incur this 10% penalty if you are currently under 59 ½.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS?

CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY refers to the process by which participants in private employer retirement plans can take out funds from their retirement accounts either by cashing them out or transferring them to another qualified retirement account.

Who is required to file CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS?

Individuals who are withdrawing funds from their group or supplemental retirement annuity plans or rolling over their retirement savings to another qualified account are required to file for CASH WITHDRAWAL OR ROLLOVER.

How to fill out CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS?

To fill out the form for CASH WITHDRAWAL OR ROLLOVER, you need to provide personal identification information, specify the amount to withdraw or rollover, and choose the destination account for the rollover, if applicable.

What is the purpose of CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS?

The purpose is to allow individuals to access their retirement savings either by withdrawing cash for personal use or by rolling over funds to maintain their tax-advantaged status in another retirement account.

What information must be reported on CASH WITHDRAWAL OR ROLLOVER FROM YOUR GROUP/SUPPLEMENTAL RETIREMENT ANNUITY FOR PRIVATE EMPLOYER PLANS?

The information that must be reported includes the participant's identification details, the total amount being withdrawn or rolled over, the purpose of the withdrawal, and any relevant account numbers for the rollover.

Fill out your cash withdrawal or rollover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Withdrawal Or Rollover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.