Get the free REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES - tiaa-cref

Show details

This document is a request form for individuals seeking to withdraw funds from their after-tax retirement annuities with TIAA, detailing the requirements, tax implications, and instructions for submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for a payment

Edit your request for a payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for a payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request for a payment online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit request for a payment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for a payment

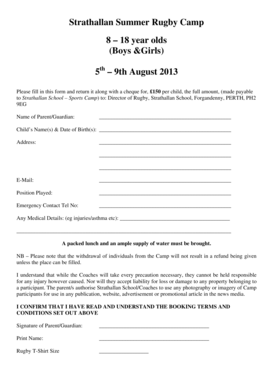

How to fill out REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES

01

Obtain the 'REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES' form from your retirement plan administrator or website.

02

Fill in your personal information as required, including your name, address, and Social Security number.

03

Provide details about your after-tax retirement annuities, including account numbers and amounts.

04

Specify the payment amount you are requesting and the frequency of the payment.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to the designated department or individual, following the submission instructions provided. You're advised to keep a copy for your records.

Who needs REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES?

01

Individuals who have after-tax contributions in their retirement annuities and wish to request withdrawals.

02

Retirees who need access to their after-tax retirement savings.

03

Beneficiaries of a deceased account holder who seek to collect payments from the after-tax retirement annuities.

Fill

form

: Try Risk Free

People Also Ask about

What is an after-tax retirement annuity?

A personal annuity, also called an after-tax annuity, can help you build additional retirement savings and is not subject to income rules or contribution limits like your 401(k), 403(b) or IRA. Another key advantage is that you pay no taxes on any growth until you begin taking income.

What is an after-tax annuity?

What is a personal annuity? A personal annuity, also called an after-tax annuity, can help you build additional retirement savings and is not subject to income rules or contribution limits like your 401(k), 403(b) or IRA. Another key advantage is that you pay no taxes on any growth until you begin taking income.

How much does a $100 000 annuity pay per month?

A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select. That income can be a helpful foundation in retirement, especially when combined with Social Security benefits or other investments.

What are the disadvantages of a retirement annuity?

While annuities offer benefits such as guaranteed income, tax-deferred growth, and protection against outliving savings, they also come with drawbacks like high fees, limited liquidity and potentially lower returns compared to other investments.

What does Suze Orman say about fixed income annuities?

Suze Orman's Preference: The CD-Type Annuity Guaranteed Interest for the Entire Term: Unlike traditional fixed annuities that may have fluctuating interest rates, a CD-type annuity guarantees the same interest rate for the entire length of the surrender period.

Are the payments you receive from an annuity taxed as income?

How are qualified annuities taxed? A qualified annuity is funded with pre-tax money. You generally purchase qualified annuities in a tax-advantaged retirement account like a traditional IRA or 401(k). Once you start payouts, the entire amount—your original contributions and any earnings—is considered taxable income.

What is an annuity retirement payment?

More In Retirement Plans An annuity is a contract that requires regular payments for more than one full year to the person entitled to receive the payments (annuitant). You can buy an annuity contract alone or with the help of your employer.

Do annuity payments count as income?

While the money in an annuity will grow tax-deferred, once you start withdrawing your money, all or a portion of that withdrawal will become taxed as ordinary income. When it comes to taxes on the money you paid into your annuity, the taxation depends on how you funded the annuity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES?

REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES is a formal request you submit to withdraw funds from your retirement annuities that have already been taxed, allowing access to your retirement savings.

Who is required to file REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES?

Individuals who have after-tax retirement annuities and wish to receive a payment from those accounts are required to file this request.

How to fill out REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES?

To fill out the request, you need to provide personal information such as your full name, contact information, the details of your retirement accounts, the amount you wish to withdraw, and any required signatures.

What is the purpose of REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES?

The purpose of this request is to facilitate the withdrawal of funds from your after-tax retirement annuities, ensuring the proper processing of your payment.

What information must be reported on REQUEST FOR A Payment from Your AFTER-TAX RETIREMENT ANNUITIES?

You must report your personal details, the account information pertaining to your retirement annuities, the amount being requested for payment, and your signature.

Fill out your request for a payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For A Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.