Get the free Agreement for Salary Deferral - under Section 403(b) - tiaa-cref

Show details

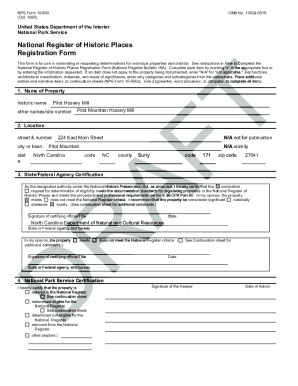

This document serves as an agreement between an employee and The New York Blood Center regarding the deferral of salary into a 403(b) retirement plan, outlining contributions, catch-up provisions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agreement for salary deferral

Edit your agreement for salary deferral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agreement for salary deferral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit agreement for salary deferral online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit agreement for salary deferral. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agreement for salary deferral

How to fill out Agreement for Salary Deferral - under Section 403(b)

01

Obtain the Agreement for Salary Deferral form from your employer or plan administrator.

02

Read the instructions thoroughly to understand the terms and implications of the agreement.

03

Fill in your personal information, including your name, Social Security number, and employment details.

04

Specify the percentage or dollar amount you wish to defer from your salary into your 403(b) account.

05

Review the contribution limits to ensure your deferral complies with IRS regulations.

06

Sign and date the agreement to confirm your consent and understanding.

07

Submit the completed form to your employer's human resources or payroll department.

Who needs Agreement for Salary Deferral - under Section 403(b)?

01

Employees of eligible educational institutions and certain tax-exempt organizations who want to save for retirement through a 403(b) plan.

02

Individuals looking to reduce their taxable income by contributing to a retirement account.

03

Employees wishing to take advantage of employer matching contributions if offered.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a 403b plan?

Putting money into the 403(b) reduces your taxable income for that year. For example, if you put $5,000 into your 403(b) account and your federal income tax rate was 10%, by deferring that income you just saved $500 in federal taxes. Plus, $765.00 is exempt from social security tax.

What is a salary reduction agreement for 403b?

Pros and cons of a 403(b) ProsCons Tax advantages Few investment choices High contribution limits High fees Employer matching Penalties on early withdrawals Shorter vesting schedules Not always subject to ERISA1 more row • Nov 25, 2024

What is a 403 B salary reduction agreement?

Your Salary Deferral Agreement is a written, legally binding agreement between you and your employer. It is an agreement whereby you direct your employer to reduce compensation not yet currently available by a specific percentage. Your employer then sends this amount to your account in the Retirement Savings Plan.

What is the salary deferral for 403b?

Limit on employee elective salary deferrals The limit on elective salary deferrals - the most an employee can contribute to a 403(b) account out of salary - is $23,000 in 2024, ($22,500 in 2023; $20,500 in 2022; $19,500 in 2021 and 2020).

What is a salary deferral agreement?

Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salary into individual accounts. The deferred salary is generally not subject to federal or state income tax until it's distributed. However, a 403(b) plan may also offer designated Roth accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Agreement for Salary Deferral - under Section 403(b)?

An Agreement for Salary Deferral under Section 403(b) is a legal document that allows eligible employees of certain tax-exempt organizations to defer a portion of their salary into a retirement plan.

Who is required to file Agreement for Salary Deferral - under Section 403(b)?

Employees of eligible 403(b) plan sponsors, such as public schools and tax-exempt organizations, who wish to defer a portion of their salary into a retirement account must file the Agreement for Salary Deferral.

How to fill out Agreement for Salary Deferral - under Section 403(b)?

To fill out the Agreement for Salary Deferral, employees typically need to provide their personal information, the amount or percentage of salary they wish to defer, and their signature, indicating their agreement to the terms.

What is the purpose of Agreement for Salary Deferral - under Section 403(b)?

The purpose of the Agreement for Salary Deferral is to enable employees to save for retirement in a tax-advantaged manner by allowing them to defer income into a 403(b) retirement plan.

What information must be reported on Agreement for Salary Deferral - under Section 403(b)?

The Agreement must report information such as the employee's name, address, the deferral amount or percentage, the effective date of the agreement, and any other conditions set by the employer.

Fill out your agreement for salary deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agreement For Salary Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.