Get the free Executive Choice Fiduciary Liability Coverage Application

Show details

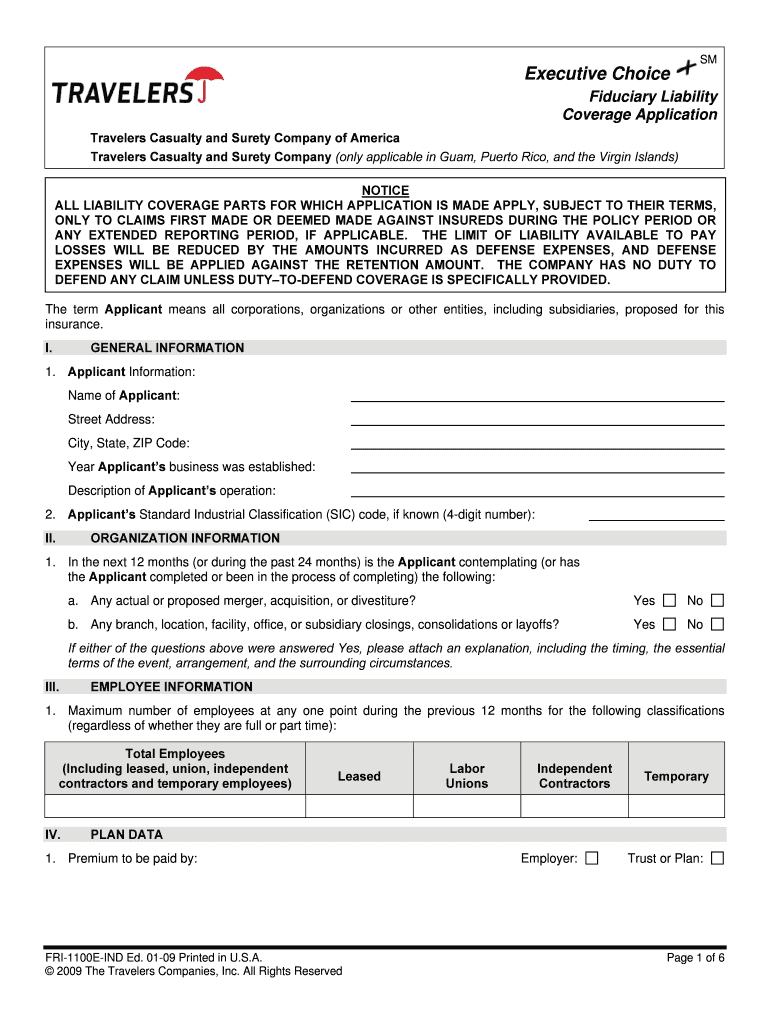

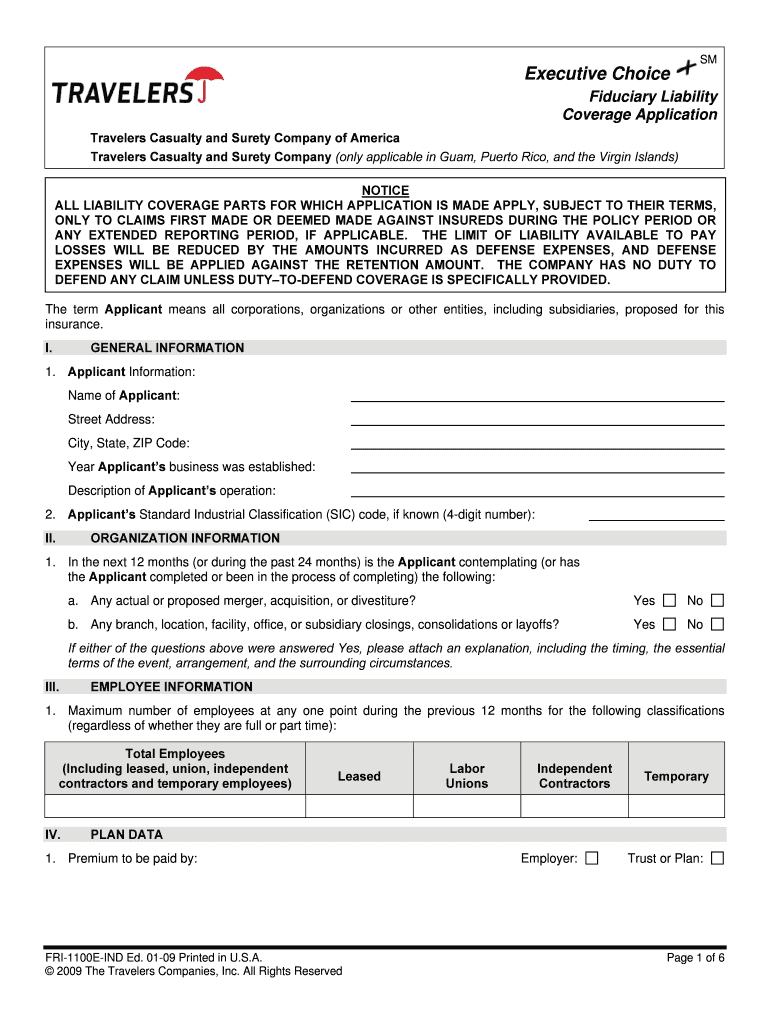

This document is an application for fiduciary liability coverage insurance provided by Travelers Casualty and Surety Company. It collects information regarding the applicant's organization, employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign executive choice fiduciary liability

Edit your executive choice fiduciary liability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your executive choice fiduciary liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit executive choice fiduciary liability online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit executive choice fiduciary liability. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out executive choice fiduciary liability

How to fill out Executive Choice Fiduciary Liability Coverage Application

01

Gather all necessary company information, including legal name, address, and contact details.

02

Identify the fiduciary roles within your organization, such as board members and trustees.

03

Provide details about your employee benefit plans, including types and number of plans offered.

04

Outline any previous liabilities or claims related to fiduciary duties.

05

Disclose any regulatory investigations or audits pertaining to your fiduciary responsibilities.

06

Review and ensure all information is accurate and complete before submission.

07

Submit the completed application to your insurance provider.

Who needs Executive Choice Fiduciary Liability Coverage Application?

01

Organizations that offer employee benefit plans, such as retirement plans and health insurance.

02

Trustees and fiduciaries of employee benefit plans.

03

Non-profit organizations managing funds for beneficiaries.

04

Companies with a board of directors making fiduciary decisions regarding employee benefits.

Fill

form

: Try Risk Free

People Also Ask about

Is fiduciary coverage the same as ERISA?

Highlights of Discussion No, an ERISA fidelity bond and fiduciary liability insurance are not the same. An ERISA fidelity bond is required by law to cover plan losses as a result of fraud. Fiduciary liability insurance is not required, but it may be a good idea to help protect plan fiduciaries.

Are ERISA and fiduciary the same thing?

As you may be aware, Employee Retirement Income Security Act (ERISA) fidelity bonds and fiduciary liability insurance are not the same. Both serve to mitigate risk for fiduciaries, and are critical aspects of an employee benefits plan. The difference between the two lies in the risks that they cover.

What is another name for fiduciary insurance?

Fiduciary liability insurance (and management liability insurance) is targeted at protecting businesses' and employers' assets against fiduciary-related claims of mismanagement of a company's employee benefit plans.

Does ERISA require fiduciary requirements?

Even if your plan is not subject to ERISA, there may be advantages to following certain ERISA requirements. For example, ERISA generally requires a plan fiduciary to offer a plan with a diversified menu of investment options. Non- ERISA plans generally follow this practice as well.

Is fiduciary liability coverage the same as a fidelity bond?

As you may be aware, Employee Retirement Income Security Act (ERISA) fidelity bonds and fiduciary liability insurance are not the same. Both serve to mitigate risk for fiduciaries, and are critical aspects of an employee benefits plan. The difference between the two lies in the risks that they cover.

What is another name for fiduciary liability insurance?

Fiduciary liability insurance (and management liability insurance) is targeted at protecting businesses' and employers' assets against fiduciary-related claims of mismanagement of a company's employee benefit plans. It is not required by the Employee Retirement Income Security Act (ERISA) or any federal statute.

What is the difference between a fidelity bond and fiduciary insurance?

An ERISA fidelity bond is required by law to cover plan losses as a result of fraud. Fiduciary liability insurance is not required, but it may be a good idea to help protect plan fiduciaries. The Department of Labor (DOL), under ERISA Sec.

Is fiduciary liability the same as crime coverage?

Fiduciary liability insurance provides coverage for risk or loss resulting from negligence, mismanagement, or errors. Intentional acts like fraud or theft causing loss to a benefits plan or its assets are not covered; that is the domain of a specific crime coverage policy.

How much does fiduciary liability insurance cost?

What does fiduciary liability insurance cost? Fiduciary liability insurance costs vary by company size, plan assets and more. Most companies can get a fiduciary liability plan for $500 to $2,500 per year, with up to $10 million in coverage.

What is another name for crime insurance?

Crime insurance is often referred to as fidelity insurance since crime policies cover losses caused by employee theft.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Executive Choice Fiduciary Liability Coverage Application?

Executive Choice Fiduciary Liability Coverage Application is a document used by organizations to apply for insurance protection against fiduciary liability claims, which arise from the management of employee benefit plans.

Who is required to file Executive Choice Fiduciary Liability Coverage Application?

Typically, it's the responsibility of the organization's executives, such as the CFO or human resources director, to file the Executive Choice Fiduciary Liability Coverage Application.

How to fill out Executive Choice Fiduciary Liability Coverage Application?

To fill out the application, the organization must provide accurate information regarding its employee benefit plans, governance structure, and any prior claims history related to fiduciary duties.

What is the purpose of Executive Choice Fiduciary Liability Coverage Application?

The purpose of the application is to secure coverage that protects fiduciaries from personal liability arising from claims made against them for breaches of fiduciary duty.

What information must be reported on Executive Choice Fiduciary Liability Coverage Application?

Information that must be reported includes details about the organization's benefit plans, the fiduciaries involved, any previous claims or inquiries, and the financial condition of the organization.

Fill out your executive choice fiduciary liability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Executive Choice Fiduciary Liability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.