Get the free Fiduciary Liability Coverage Application

Show details

This document serves as an application for fiduciary liability coverage, collecting information about the applicant organization, its operations, employee details, and current insurance requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary liability coverage application

Edit your fiduciary liability coverage application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary liability coverage application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiduciary liability coverage application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiduciary liability coverage application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

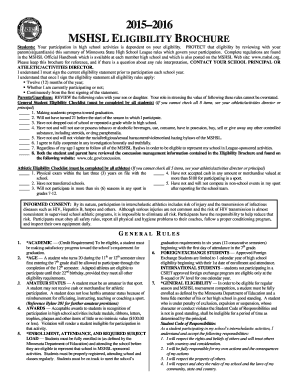

How to fill out fiduciary liability coverage application

How to fill out Fiduciary Liability Coverage Application

01

Gather necessary information about the organization and its fiduciaries.

02

Provide details about the types of employee benefit plans maintained by the organization.

03

List all fiduciaries and their respective roles within the organization.

04

Include any past claims or incidents related to fiduciary duties.

05

Review and confirm the accuracy of all information provided before submission.

06

Submit the application to the insurance provider for evaluation.

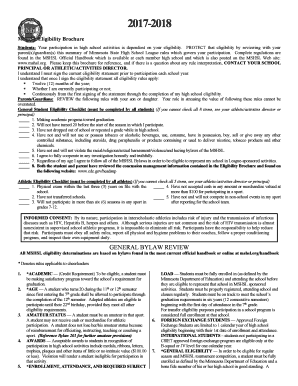

Who needs Fiduciary Liability Coverage Application?

01

Organizations managing employee benefit plans.

02

Corporations with retirement plans and health benefits.

03

Nonprofits offering benefit plans to their employees.

04

Trustees and fiduciaries overseeing pension and health plans.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a fidelity bond and fiduciary insurance?

An ERISA fidelity bond is required by law to cover plan losses as a result of fraud. Fiduciary liability insurance is not required, but it may be a good idea to help protect plan fiduciaries. The Department of Labor (DOL), under ERISA Sec.

What is fiduciary liability coverage?

As you may be aware, Employee Retirement Income Security Act (ERISA) fidelity bonds and fiduciary liability insurance are not the same. Both serve to mitigate risk for fiduciaries, and are critical aspects of an employee benefits plan. The difference between the two lies in the risks that they cover.

What is another name for fidelity bond insurance?

In addition to being referred to as a fidelity bond, Employee Dishonesty Insurance is sometimes also referred to as: Financial Institution Bond. Commercial Crime Policy.

Is liability insurance the same as a bond?

Both surety bonds and liability insurance are critical tools for managing risk and ensuring financial stability. While surety bonds guarantee that your business will meet its contractual obligations, liability insurance protects it from the unpredictable nature of accidents, lawsuits, and claims.

What is another name for fiduciary liability insurance?

Fiduciary liability insurance (and management liability insurance) is targeted at protecting businesses' and employers' assets against fiduciary-related claims of mismanagement of a company's employee benefit plans. It is not required by the Employee Retirement Income Security Act (ERISA) or any federal statute.

How much does fiduciary liability insurance cost?

A fiduciary insurance policy protects employers and their plan fiduciaries from fiduciary-related claims for the alleged mismanagement of plan assets or failure to follow ERISA rules in the control or management of plan assets and payment of benefits. The coverage is not required but is highly recommended.

Is fiduciary liability coverage the same as a fidelity bond?

What does fiduciary liability insurance cost? Fiduciary liability insurance costs vary by company size, plan assets and more. Most companies can get a fiduciary liability plan for $500 to $2,500 per year, with up to $10 million in coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fiduciary Liability Coverage Application?

Fiduciary Liability Coverage Application is a document that organizations use to apply for insurance coverage that protects fiduciaries against claims resulting from the management of employee benefit plans.

Who is required to file Fiduciary Liability Coverage Application?

Organizations that manage employee benefit plans, such as retirement plans or health insurance plans, are typically required to file a Fiduciary Liability Coverage Application to secure appropriate insurance coverage.

How to fill out Fiduciary Liability Coverage Application?

To fill out the Fiduciary Liability Coverage Application, provide accurate information about the organization, the fiduciaries, the employee benefit plans being managed, and any previous claims or liabilities related to fiduciary duties.

What is the purpose of Fiduciary Liability Coverage Application?

The purpose of the Fiduciary Liability Coverage Application is to seek insurance coverage that protects fiduciaries from legal liabilities and claims arising from their roles in managing employee benefit plans.

What information must be reported on Fiduciary Liability Coverage Application?

The information that must be reported includes details about the fiduciaries, descriptions of the employee benefit plans, any past claims or lawsuits, the financial health of the organization, and risk management practices in place.

Fill out your fiduciary liability coverage application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Liability Coverage Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.