Get the free USAA TOTAL RETURN STRATEGY FUND

Show details

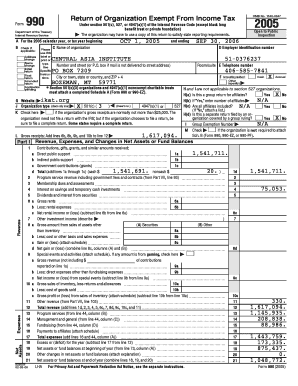

PORTFOLIO OF INVESTMENTS 1ST QUARTER USA TOTAL RETURN STRATEGY FUND MARCH 31, 2015 (Form N-Q) 48701-0515 2015, USA. All rights reserved. PORTFOLIO OF INVESTMENTS USA Total Return Strategy Fund March

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usaa total return strategy

Edit your usaa total return strategy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usaa total return strategy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing usaa total return strategy online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit usaa total return strategy. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out usaa total return strategy

How to fill out usaa total return strategy:

01

Gather your financial information, including current income, expenses, and investments.

02

Analyze your risk tolerance and investment goals to determine the appropriate allocation of your portfolio.

03

Consider your time horizon for investing and any specific objectives you have, such as saving for retirement or education expenses.

04

Identify the asset classes that align with your investment goals, such as stocks, bonds, or real estate.

05

Determine the specific investments within each asset class that best fit your strategy, considering factors like diversification, historical performance, and expense ratios.

06

Implement your chosen investments by purchasing them through a brokerage account or investment platform.

07

Monitor and regularly review your usaa total return strategy to ensure it remains aligned with your financial goals and market conditions.

Who needs usaa total return strategy:

01

Individuals seeking a comprehensive investment approach that combines income and capital appreciation.

02

Those who are looking to diversify their investment portfolio across different asset classes.

03

Investors who have a long-term investment horizon and are willing to accept a certain level of risk for potential higher returns.

04

Individuals interested in actively managing their investments and regularly reviewing their strategy to make necessary adjustments.

05

Those who value professional guidance and expertise in creating and managing an investment strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my usaa total return strategy directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign usaa total return strategy and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find usaa total return strategy?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific usaa total return strategy and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my usaa total return strategy in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your usaa total return strategy right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is usaa total return strategy?

The USAA Total Return Strategy is a investment approach that aims to provide investors with both income and capital appreciation by investing in a diversified portfolio of fixed income securities. It focuses on generating a combination of interest income and price appreciation from bond investments.

Who is required to file usaa total return strategy?

Individual investors or institutional investors who choose to invest in the USAA Total Return Strategy are required to file the necessary investment documents and provide any required information to the USAA Investment Management Company, as per their guidelines and regulations.

How to fill out usaa total return strategy?

To fill out the USAA Total Return Strategy, one needs to open an account with the USAA Investment Management Company, complete the necessary investment forms, provide accurate and up-to-date personal and financial information, and make the required investment transactions as per the guidelines and instructions provided by the company.

What is the purpose of usaa total return strategy?

The purpose of the USAA Total Return Strategy is to provide investors with a balanced investment approach that aims to generate income and capital appreciation. It seeks to achieve this by investing in a diversified portfolio of fixed income securities, aiming for consistent returns over the long term.

What information must be reported on usaa total return strategy?

The USAA Total Return Strategy requires investors to report their personal and financial information, including their legal name, contact information, Social Security number or Tax Identification number, investment amount, source of funds, and any other relevant information required by the USAA Investment Management Company.

Fill out your usaa total return strategy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usaa Total Return Strategy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.