India DCB Bank Request for Remittance through NEFT/RTGS 2011 free printable template

Show details

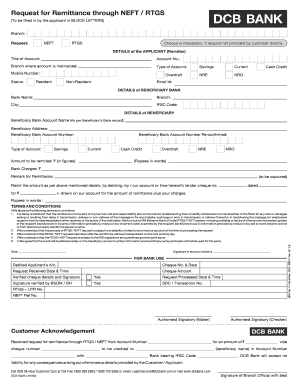

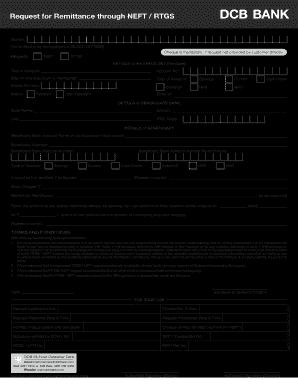

Request for Remittance through NEFT / RTGS Branch: (To be filled in by the applicant in BLOCK LETTERS) DETAILS of the APPLICANT (Remitter) (1) Title of Account: (2) Account No.: (3) Branch where account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India DCB Bank Request for Remittance through NEFTRTGS

Edit your India DCB Bank Request for Remittance through NEFTRTGS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India DCB Bank Request for Remittance through NEFTRTGS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India DCB Bank Request for Remittance through NEFTRTGS online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit India DCB Bank Request for Remittance through NEFTRTGS. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India DCB Bank Request for Remittance through NEFT/RTGS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India DCB Bank Request for Remittance through NEFTRTGS

How to fill out India DCB Bank Request for Remittance through NEFT/RTGS

01

Obtain the India DCB Bank Request for Remittance form from the bank's website or branch.

02

Fill in the date at the top of the form.

03

Enter your account number in the designated field.

04

Provide the beneficiary details, including name, account number, and bank details.

05

Specify the amount to be remitted.

06

Choose the mode of transfer: NEFT or RTGS.

07

Fill in the purpose of remittance in the given box.

08

Sign the form to authorize the transfer.

09

Submit the completed form to the bank along with any required identification documents.

Who needs India DCB Bank Request for Remittance through NEFT/RTGS?

01

Individuals and businesses looking to send money to other bank accounts in India.

02

Customers of India DCB Bank who wish to make electronic fund transfers.

03

Anyone needing to remit money for purposes such as payments, loans, or personal transfers.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum amount for NEFT transfer?

There is no minimum limit on the amount to be transferred through NEFT. Users can transfer funds as low as Re. 1 through NEFT.

What is NEFT application form?

NEFT: National Electronic Funds Transfer It was introduced by Reserve Bank of India. It is an electronic fund transfer system that is based on Deferred Net Settlement (DNS) which settles transaction in batches.

What should I fill in NEFT form?

What are the details required in Bank of India NEFT Form? Name of the branch. Date of transaction. Details of the remitter or the applicant: Title of the account. Account number. Beneficiary details. Name of the beneficiary. Mobile number of the applicant or the remitter. Signature of the remitter.

What is a NEFT form?

Ans: National Electronic Funds Transfer (NEFT) is a nation-wide centralised payment system owned and operated by the Reserve Bank of India (RBI).

What is the format of NEFT letter?

Dear Sir/ Madam, Please remit a sum of Rs. __ (Rupees __) only as per details given below and debit the amount with your charges to my/our account with you. DETAILS OF APPLICANT DETAILS OF BENEFICIARY NAME : IFSC CODE: ACCOUNT NO.

What is the full form of NEFT Central bank of India?

NATIONAL ELECTRONIC FUNDS TRANSFER (NEFT) NEFT is an electronic payment system developed by RBI to facilitate transfer of funds by customers from one bank to another bank in India. It is a secured, economical, reliable and efficient system of funds transfer between banks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit India DCB Bank Request for Remittance through NEFTRTGS from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your India DCB Bank Request for Remittance through NEFTRTGS into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the India DCB Bank Request for Remittance through NEFTRTGS in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your India DCB Bank Request for Remittance through NEFTRTGS and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete India DCB Bank Request for Remittance through NEFTRTGS on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your India DCB Bank Request for Remittance through NEFTRTGS. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is India DCB Bank Request for Remittance through NEFT/RTGS?

The India DCB Bank Request for Remittance through NEFT/RTGS is a formal request submitted by an individual or organization to transfer funds electronically to another bank account using the National Electronic Funds Transfer (NEFT) or Real Time Gross Settlement (RTGS) systems. This allows for secure and efficient money transfers across banks in India.

Who is required to file India DCB Bank Request for Remittance through NEFT/RTGS?

Any individual or business entity wishing to transfer funds from their DCB Bank account to another bank account, either within India or to select international locations, is required to file the India DCB Bank Request for Remittance through NEFT/RTGS.

How to fill out India DCB Bank Request for Remittance through NEFT/RTGS?

To fill out the India DCB Bank Request for Remittance through NEFT/RTGS, one must provide the following details: sender's account number, recipient's name, recipient's account number, recipient's bank name, IFSC code of the recipient's bank, amount to be transferred, transaction date, and purpose of the remittance. After filling in these details, it should be submitted to the bank for processing.

What is the purpose of India DCB Bank Request for Remittance through NEFT/RTGS?

The purpose of the India DCB Bank Request for Remittance through NEFT/RTGS is to facilitate the transfer of funds from one bank account to another in a secure and systematic manner. This service allows individuals and businesses to make payments, settle dues, or transfer money for personal and business-related transactions.

What information must be reported on India DCB Bank Request for Remittance through NEFT/RTGS?

The following information must be reported on the India DCB Bank Request for Remittance through NEFT/RTGS: sender's account number, sender's name, recipient's account number, recipient's name, IFSC code of the recipient's bank, recipient's bank name, amount to be remitted, transaction type (NEFT/RTGS), and the purpose of remittance.

Fill out your India DCB Bank Request for Remittance through NEFTRTGS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India DCB Bank Request For Remittance Through NEFTRTGS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.