Canada B4 E 2001 free printable template

Show details

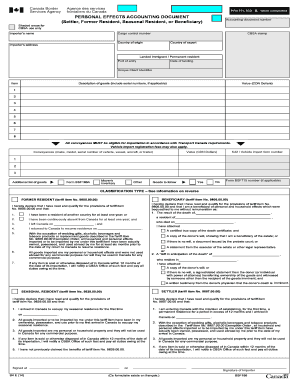

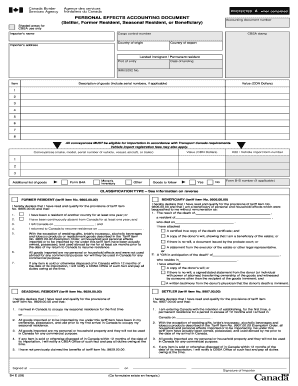

Canada Customs and Revenue Agency DES doubles et Du revenue Du Canada PROTECTED (when completed) PERSONAL EFFECTS ACCOUNTING DOCUMENT (Settler, Former Resident, Seasonal Resident, or Beneficiary)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada B4 E

Edit your Canada B4 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada B4 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada B4 E online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada B4 E. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada B4 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada B4 E

How to fill out Canada B4 E

01

Download the Canada B4 E form from the Canada Border Services Agency (CBSA) website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide details about the goods you are bringing into Canada, including quantity and value.

05

Indicate if any of the goods are for commercial purposes.

06

State your immigration status and the time period of your stay in Canada.

07

Review the completed form for accuracy and completeness.

08

Submit the form at your port of entry into Canada.

Who needs Canada B4 E?

01

Individuals bringing personal goods into Canada duty-free for the first time.

02

Visitors and immigrants who are relocating to Canada.

03

Canadians returning to Canada with personal belongings.

Fill

form

: Try Risk Free

People Also Ask about

What is personal effects accounting document?

When arriving, you'll need to present your list at your first point of arrival in Canada to a CBSA officer. Based on your list, the officer will complete a Form B4, also known as the Personal Effects Accounting Document, assign you a file number and hand you a copy of the completed form as proof/receipt.

What is the form for personal effects shipping?

The U.S. Customs form 3299, Declaration For Free Entry Of Unaccompanied Articles, is used to import personal effects or household items into the United States duty-free.

What is the difference between BSF186 and BSF186A?

What is the difference between BSF186 and BSF186A? ing to the Border Information Service, you can complete the BSF186. The difference between them is that the BSF186A is simply a sheet of lines to be used as an attachment in the event you have more items and they cannot be included on the BSF186 form.

What is the personal effects accounting document bs186 form?

Form BSF186, Personal Effects Accounting Document (also known as Form B4) – used for goods you are bringing to Canada with you. This form is required, even if you have no goods with you at the time of arrival.

What is the form BSF186 personal effects accounting document also known as form B4?

Form BSF186 (or B4): This is used to outline and keep track of the items you are bringing with you at the time of entry into Canada. Items listed on this form are ones that you owned in your home country and intend on using for your household and personal use in Canada.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada B4 E for eSignature?

Canada B4 E is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit Canada B4 E on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share Canada B4 E from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out Canada B4 E on an Android device?

Complete Canada B4 E and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is Canada B4 E?

Canada B4 E is a form used by individuals to report their personal belongings when they are entering Canada, typically after a period of extended absence.

Who is required to file Canada B4 E?

Individuals who are returning to Canada after living outside of the country for more than 1 year are required to file Canada B4 E to declare their personal belongings.

How to fill out Canada B4 E?

To fill out Canada B4 E, individuals must provide details about their personal belongings, including descriptions, values, and any applicable receipts, ensuring all declared items are listed accurately.

What is the purpose of Canada B4 E?

The purpose of Canada B4 E is to inform Canadian customs of the goods an individual is bringing back into the country, which can help determine if any duties or taxes apply.

What information must be reported on Canada B4 E?

The information that must be reported on Canada B4 E includes a detailed description of each item, its value, purchase date, and any related receipts or proof of ownership.

Fill out your Canada B4 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada b4 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.