Get the free 2015 birt ez - phila

Get, Create, Make and Sign 2015 birt ez

How to edit 2015 birt ez online

Uncompromising security for your PDF editing and eSignature needs

Instructions and Help about 2015 birt ez

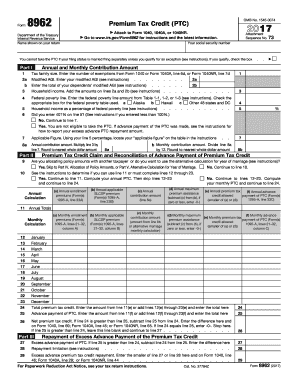

I hi I'm April and here's your tax effect living in the city of Philadelphia comes with some extra taxes to pay that not everyone even City residents know about did you know where the second largest tech city in the nation so who has to pay this tax anyway if you have rental property in the city or if you're self-employed, and you live or work within city limits you have to register and pay the business privilege tax you can do this at the city website Villa gum / revenue there's no fee to pay or to register there are two components to the tax a business income and receipts task called the bird and the net profits tax called not first we'll talk about the bird which comprises two taxes one that's on gross receipts that's point one four one five percent and one that's one profits which is six and a half percent the city requires that you also make a mandatory payment for the next year's task which is calculated by taking the text this year and doubling it now if you filed the Bert before you'll have a credit on your last year's tax return that you'll apply to this year stats do if this is your first year of filing you're going to see a bit of a cash crunch, so I'm going to be pretty the not similar to the city wage tax that you normally are used to paying through your w-2 which is currently 3.92 percent you do get a credit for the taxes you pay on the bird on the not and that will reduce your tax liability there is a distinction if you work outside the city I live in the city you only have to pay the not if you live outside the city and work in the city then you'll pay a slightly reduced tax rate, but you still dependent on now if you forget to file and pay this tax the penalty and interest is pretty steep at a whopping three percent per month that's forty-two percent for the year, so you'll want to pay this tax as soon as you know about it if you're no longer living in the city or working in the city be sure to cancel your account, and you can do this by just filing a change form so there you have it if you work and/or live in the city or have a rental property in the city be sure to register and file for the business privilege task I'm April and this has been your friendly tax fact brought to you by ambrosia counting you

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2015 birt ez?

Can I edit 2015 birt ez on an Android device?

How do I complete 2015 birt ez on an Android device?

What is birt ez?

Who is required to file birt ez?

How to fill out birt ez?

What is the purpose of birt ez?

What information must be reported on birt ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.