Get the free fmf3cown

Show details

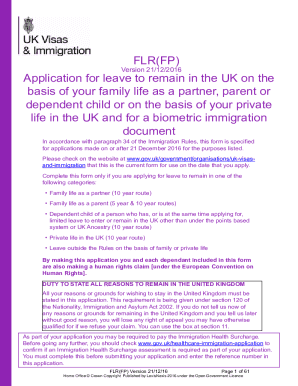

Ownership Change ? Se this form to: U AKE an Ownership Change of a taxable account due to a life M event, such as financial or estate planning, marriage, divorce, death, or minor reaching age of majority.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fmf3cown

Edit your fmf3cown form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fmf3cown form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fmf3cown online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fmf3cown. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fmf3cown

How to fill out T. Rowe Price FMF3COWN

01

Obtain the T. Rowe Price FMF3COWN form from the official website or your broker.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill out your personal information, including your name, address, and Social Security number, in the designated section.

04

Provide your investment details, including the amount you wish to invest and your choice of investment options.

05

Complete the tax information section, ensuring all required details are accurate.

06

Review the form for any errors or missing information before submitting.

07

Submit the form through the recommended method, which may include online submission or mailing it to T. Rowe Price.

Who needs T. Rowe Price FMF3COWN?

01

Investors looking to diversify their portfolio with T. Rowe Price funds.

02

Individuals planning for retirement who want to manage their investments actively.

03

Financial advisors seeking to offer their clients a reputable investment option.

04

People who are saving for specific goals, such as education or a major purchase, and want to use mutual funds.

Fill

form

: Try Risk Free

People Also Ask about

Can I withdraw money from my T Rowe Price 401k?

Generally allows for penalty-free withdrawals if you retire the year you turn 55 or older. Otherwise, penalty-free withdrawals are available after age 59½. Waive early IRS distribution penalties if certain requirements are met, regardless of age.

Who is the beneficiary of an IRA T Rowe Price?

Beneficiary designations must be consistent for all identically registered accounts. If there are no beneficiaries on your account, your surviving spouse will be considered your sole beneficiary. If you do not have a surviving spouse, your estate will be considered your sole beneficiary.

How do I withdraw my RMD?

How to Take Required Minimum Distributions Start RMDs after age 73. Avoid two distributions in the same year. Delay 401(k) withdrawals if you are still working. Withdraw the correct amount. Take distributions from the worst-performing account. Consider converting to a Roth IRA.

How do I withdraw my RMD from T Rowe Price?

How can I take my distributions? You can satisfy your RMD through a one-time transaction or automatic withdrawals from eligible accounts. As a T. Rowe Price client, you can log in and set up your RMD with our Auto-RMD tool.

Can I take my RMD as cash?

It's usually easiest to take your required minimum distribution (RMD) in cash since there is no tax advantage. You can take just the dollar amount you need to, which you can't necessarily do otherwise.

Can you withdraw from your T Rowe Price account?

Rowe Price does not charge fees when you withdraw money or close your account. You may incur third-party processing or account transfer fees. Check the Brokerage Account Agreement, Fee Schedule and Important Disclosures for details. Your withdrawal may be subject to taxes if you take the proceeds as a distribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fmf3cown to be eSigned by others?

fmf3cown is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find fmf3cown?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fmf3cown and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my fmf3cown in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your fmf3cown directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is T. Rowe Price FMF3COWN?

T. Rowe Price FMF3COWN is a financial document or form related to investment management, typically used in the context of mutual funds or other investment products managed by T. Rowe Price.

Who is required to file T. Rowe Price FMF3COWN?

Individuals or entities that invest in T. Rowe Price funds or are involved in specific financial reporting activities related to those investments may be required to file T. Rowe Price FMF3COWN.

How to fill out T. Rowe Price FMF3COWN?

To fill out T. Rowe Price FMF3COWN, you should follow the instructions provided with the form, which typically include providing personal or business information, investment details, and potentially financial metrics associated with your investments.

What is the purpose of T. Rowe Price FMF3COWN?

The purpose of T. Rowe Price FMF3COWN is to collect necessary information for compliance, reporting, and investment management processes specific to T. Rowe Price funds.

What information must be reported on T. Rowe Price FMF3COWN?

Information that must be reported on T. Rowe Price FMF3COWN typically includes investor identification details, investment amounts, transaction dates, and any applicable financial disclosures relevant to T. Rowe Price products.

Fill out your fmf3cown online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

fmf3cown is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.