CNMI Non-Profit Annual Corporation Report free printable template

Get, Create, Make and Sign cnmi annual corporation report form

Editing non corporation report form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non corporation report form

How to fill out CNMI Non-Profit Annual Corporation Report

Who needs CNMI Non-Profit Annual Corporation Report?

Video instructions and help with filling out and completing non corporation report

Instructions and Help about non corporation report form

Music half a day done buenas Dias was he her birthday worse re-sign Quinta de Northern Marianas college Olympia Tavor her Memorial Library arriving in Rico he shyster and Marianas put the Anatole fennyman many agreement in pogey you been not a pro you comunidades and ye man been no she said he thought altered on blue contribution Yankee rope and an hoods and we need odd for a slot Pacheco Marianas Milano Juna we're pushing Takeda hamju see some Pablo nagito Danzig wanna stand on and Ito get a tan out back I'm a mysterious Nostradamus near when our garden hoe million egg we need certain topic can I told you from a goonie ominous again if you've seen on the Aggies at an OPEC on Pablo don't crew experience Sunday were not gonna been to my animal fan of war I mean ever since it was you know same suspect us yes I am no one to whom a good measles and on it is anyone here but the secret third Selena she page editor we'll see Sabino mr Appaji to Nancy stable she should not he the net then she Antonia masseuse then she ate that be then she from the detergent a Music Japanese - Anya I'm a good super nice sang it's a mall no wanna come push a Dylan toy but good NEMA locked in a squalor Grandma Connie Music Govinda Menton happiness no swap a surgery no oh I had those nah categora gay escuela Japanese aluminum Honka coma killing Anna a regular curriculum and my phonology a regular course gamma phenomenal Asuka to me killing a zos who shook on apparel whom practica Hamas niyama asana Mahakala prom exact most indical an advanced force around 1939 in my implemented room of Nannan quinoa hooptie para la la Hanuman Manuel de FEV no tobira de Honka tres owns a gay artist not a tuma prosthetic Anna me a MANET reasons ma consider and its abolitionists are sufficiently par including the profanity comunidad de jamon Malaga advanced course maana Masuka No waha Bosnian okosan lagina module estimates advances in tournament play of sinners and manda Catalina regard whisper totally screen and Japanese curricular Shinkansen attempt to conquer reasons for cicadas owns this place in 1939 on a cozy September enemy's name implemented imagine a Nintendo occupied Aquino Hakata Mahadi Parata greenest arena tempo Judy Garin a mondo dos de anima fattiness a no-cut para roofin mana Judah amon tobin Tamura Lala is the shattered applaud ALPHAN manager dengue a sultan come inna da no dolphin ahadith an accompaniment to Japanese indie game animal ironic in Robocop a little totally natty woman so morose Anna Karenina curliness ya wanna sue Manama noggin attempt on Japanese escuela gun she was through clearly Nagisa ms rpido go get em Pocoyo semester tomorrow oh joon-ha suita tota new Yamaha oportunidad cinnamon guidance on mana loss of bonds is Bella Mia Yasu Cunha she monopoly terminate adorning to give - Caprice Milano pericana Philippine police she building she mr Reyes she Henry looked human opponent penguin army and pop on a companion human honor in America bashyam and scalability...

People Also Ask about

What is a 1040 tax form?

Do you have to file an annual report in Texas?

Does MA require an annual report?

Are nonprofits required to disclose financial statements?

What financial statements are nonprofits required to issue?

Who is required to file Maryland Annual Report?

Is there a yearly fee for LLC in Virginia?

Do I need to renew my LLC every year in VA?

Does a Virginia LLC have to file an annual report?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non corporation report form in Gmail?

How can I send non corporation report form for eSignature?

Can I create an eSignature for the non corporation report form in Gmail?

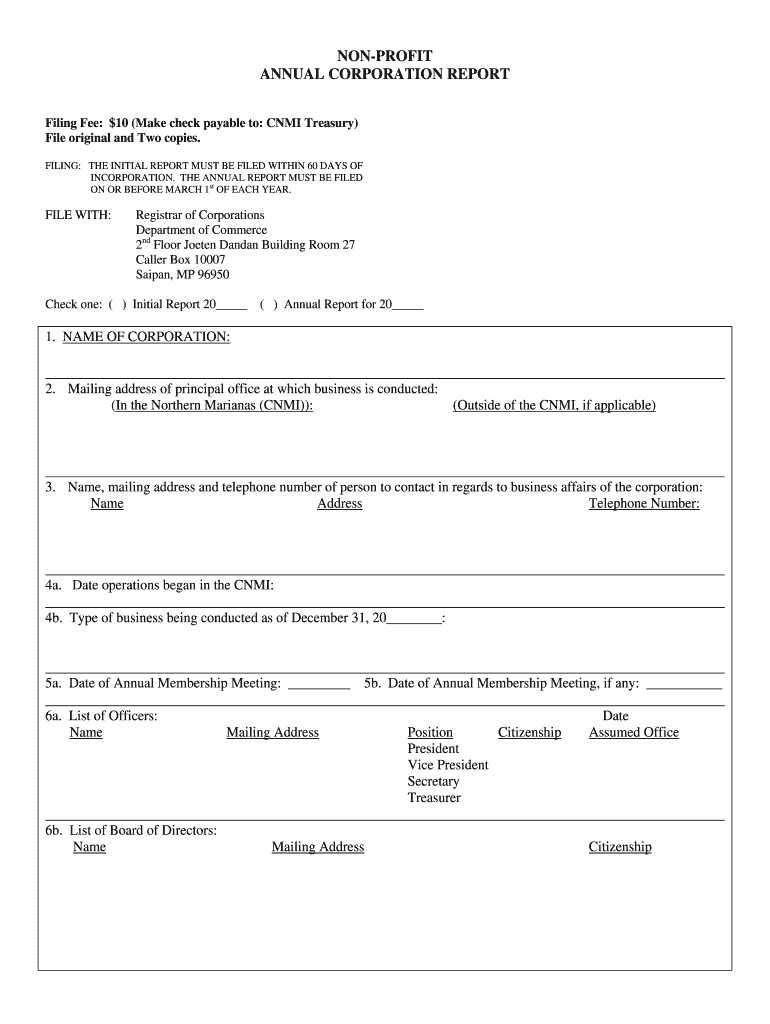

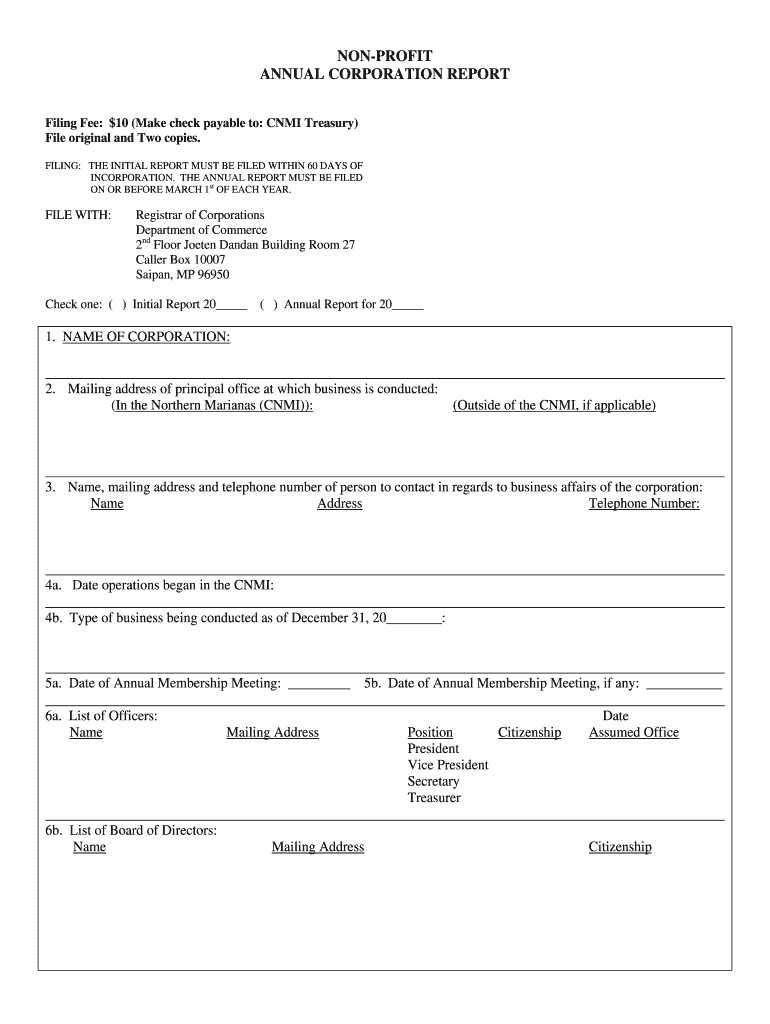

What is CNMI Non-Profit Annual Corporation Report?

Who is required to file CNMI Non-Profit Annual Corporation Report?

How to fill out CNMI Non-Profit Annual Corporation Report?

What is the purpose of CNMI Non-Profit Annual Corporation Report?

What information must be reported on CNMI Non-Profit Annual Corporation Report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.