Get the free dssr 240 fillable - aoprals state

Show details

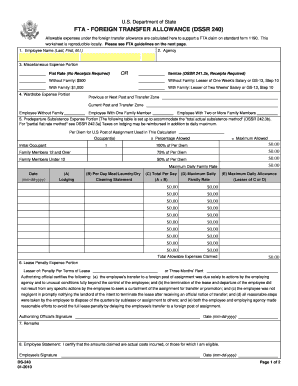

FTA Foreign Transfer Allowance Worksheet (USSR 240). Allowable expenses under the Foreign Transfer Allowance are calculated here to process a claim on ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dssr 240 - aoprals

Edit your dssr 240 - aoprals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dssr 240 - aoprals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dssr 240 - aoprals online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dssr 240 - aoprals. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for post allowance?

Definition of Post Allowance Post allowance is a non-taxable cost of living allowance granted to employees stationed at a post or foreign area where the cost of living, exclusive of quarters costs, is substantially higher than in Washington, DC.

What DSSR 240?

FTA - Foreign Transfer Allowance Worksheet (DSSR 240) Allowable expenses under the Foreign Transfer Allowance are calculated here to process a claim on the SF-1190. This worksheet is reproducible locally. See guidelines on the reverse side of this page.

What is foreign transfer allowance?

Foreign Transfer Allowance (FTA): The purpose of the FTA is to help defray an employee's extraordinary but necessary and reasonable costs when he/she transfers to a post in a foreign area.

What is the DSSR subsistence expense allowance?

(3) The Predeparture Subsistence Expense Portion is granted to assist employees with the costs of temporary lodging, meals, laundry, and dry cleaning that are incurred when an employee transfers to a foreign post from a post in the U.S. This allowance may be granted for up to 10 days before final departure from a post

What is home service transfer allowance?

Home Service Transfer Allowance (HSTA): The purpose of the HSTA is to help defray an employee's extraordinary but necessary and reasonable costs when s/he transfers from a foreign post to a post in the United States.

What is DSSR Home Service Transfer allowance?

"Home service transfer allowance" means an allowance for extraordinary, necessary, and reasonable expenses, not otherwise compensated for, incurred by an employee incident to establishing him/herself at a post of assignment in the United States as authorized by 5 U.S.C. 5924(2)(B).

What is the State Department foreign transfer allowance?

For those employees who qualify, the flat amounts (no itemization; no receipts required) for a two-zone transfer are: $700 for an employee without family; $1,150 for an employee with one family member; and $1,500 for an employee with two or more family members. For more information, see DSSR 242.2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my dssr 240 - aoprals in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your dssr 240 - aoprals along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I modify dssr 240 - aoprals without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including dssr 240 - aoprals, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in dssr 240 - aoprals without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your dssr 240 - aoprals, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is dssr 240?

DSSR 240 is a reporting form used by certain organizations to submit data regarding their structure and operations, often related to compliance with regulations or for statistical purposes.

Who is required to file dssr 240?

Organizations that meet specific criteria set by the governing body or agency requiring the form are obligated to file DSSR 240. This typically includes businesses and non-profits involved in regulated activities.

How to fill out dssr 240?

To fill out DSSR 240, organizations should gather the required data, carefully complete each section of the form following the provided guidelines, and ensure accuracy before submission.

What is the purpose of dssr 240?

The purpose of DSSR 240 is to collect standardized information from organizations for statistical analysis, compliance monitoring, and regulatory oversight.

What information must be reported on dssr 240?

The information required on DSSR 240 typically includes organizational details, operational metrics, compliance status, and any other data specified by the reporting guidelines.

Fill out your dssr 240 - aoprals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dssr 240 - Aoprals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.